CXO intersects high grade lithium

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

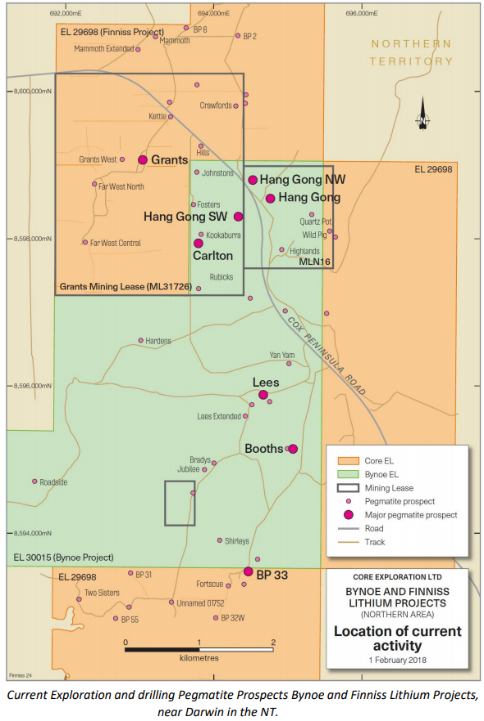

Core Exploration Ltd (ASX:CXO) today announced that its newly acquired Bynoe Lithium Project near Darwin in the Northern Territory is continuing to deliver immediate positive results, reporting high grade lithium assay results at a number of the project’s prospects.

A stand-alone Reverse Circulation (RC) drilling campaign was carried out during December at Hang Gong, Lees, Carlton and Booths Prospects, all within the Bynoe Lithium Project, designed to investigate preliminary low-grade results obtained by the previous owner.

These prospects all very close to CXO’s planned development of the Grant’s deposit, which is approximately five kilometres away.

Today’s news follows CXO’s recent announcements that CXO had recommenced resource drilling at the high-grade BP33 and Grants Prospects.

It should be noted that CXO is an early stage play and anything can happen, so seek professional financial advice if considering this stock for your portfolio.

Data from RC and Rotary Air Blast (RAB) drilling at the Hang Gong, Booths and Lees prospects indicates multiple, shallow dipping, and high grade spodumene pegmatites. High-grade lithium drill assays received from all four historic pegmatite mines in CXO’s first drilling on the newly acquired project, include:

- 10m at 1.6% Li2O from 83m in NRC006 at Carlton prospect

- 5m at 2.2% Li2O from 70m in NRC004 at Hang Gong prospect

- Including 1m at 3.0% lithium oxide from 70m in NRC004

- 4m at 1.4% lithium oxide from 72m in NRC008 at Lees prospect

- 3m at 1.6% lithium oxide from 87m in NRC011 at Booths prospect

These high-grade lithium intersections are very significant, and this first drilling demonstrates the strong potential for Hang Gong and other historic prospects.

The results indicate an improved grade, within spodumene pegmatites up to 20 metres true width, the higher grades intercepted by CXO’s drilling are the result of successful targeting of drill holes to intercept the pegmatites below the effects of surficial weathering.

The pegmatites at three of these prospects (Hang Gong, Booth and Lees) comprise multiple pegmatites bodies that dip at a shallow angle.

A similar high grade of mineralised intervals was observed across all four spodumene rich pegmatite prospects (approx. 1.5% Li2O at a 0.4% Li2O cutoff is consistent with the Grants Deposit). Additionally, individual metre-width grades of more than 2.0% lithium oxide have been recognised at all four prospects, and the maximum metre-width grade being 3.0% lithium oxide (from 70m in NRC004 at Hang Gong).

The results of the targeted shallow Rotary Airblast (RAB) drilling program at these prospects are still being assessed, but the geological data has proven invaluable in the interpretation of pegmatite geometry and fine-tuning of the RC drill plan.

For example, it has enabled the subsurface extrapolation of pegmatite bodies from surface workings to more distant, deeper drilling intersections. Based on these result, CXO plan to drill further down-dip with the aim of defining larger footprint pegmatites that have robust mining attributes.

CXO Managing Director, Stephen Biggins said: “The acquisition of the Bynoe Lithium Project is continuing to deliver immediate positive results for Core. These high-grade lithium intersections are very significant and our first drilling demonstrates the potential of Hang Gong and other historic prospects. The success of these results has given us the encouragement to drill further down-dip with the aim of defining larger footprint pegmatites with robust mining attributes.”

The newly drilled prospects will be followed up by RC and RAB drilling, both down-dip and along strike, as soon as access is possible following the wet season.

Already, the acquisition of the Bynoe Lithium Project is delivering immediate positive results for CXO and the company has shown that it can move rapidly from first drill discovery to a JORC Resource in as little as six months.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.