Creso up 70% in less than a week

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Creso Pharma (ASX: CPH) have continued to be well supported since listing on the ASX last week, and have traded as high as 34.5 cents on Monday morning, up circa 17% on Friday’s closing price of 29.5 cents.

However, the real indicator of how well the company has been received can be gauged by the premium to its IPO price of 20 cents. This morning’s high represents an increase of more than 70% in less than a week since listing.

Next Investor highlighted the merits of the stock on the day it listed, suggesting the company’s strong management team would provide the necessary direction and strategic manoeuvrability to take advantage of its leverage to the burgeoning medical cannabis industry through the development of cannabis and hemp derived therapeutic products targeted at a range of end markets including veterinary related applications.

However, it should be noted that Cresp Pharma is an early stage biotech company so anything can happen. It is highly recommended so seek professional financial advice if considering this stock for your portfolio.

While the company released an investor presentation on Monday morning, for the best part it reaffirmed news that was already in the market. However, because CPH is a microcap stock that arguably flew under the radar pre-IPO, investors are still getting to know it and there is now a rush to get set before its share price climbs further.

Investors considering this stock should note that historical trading patterns may not be replicated and investment decisions should not be based on the group’s share price performance to date. Given the speculative nature of this stock, independent professional financial advice should be sought.

Leadership, IP and diversification key points of difference

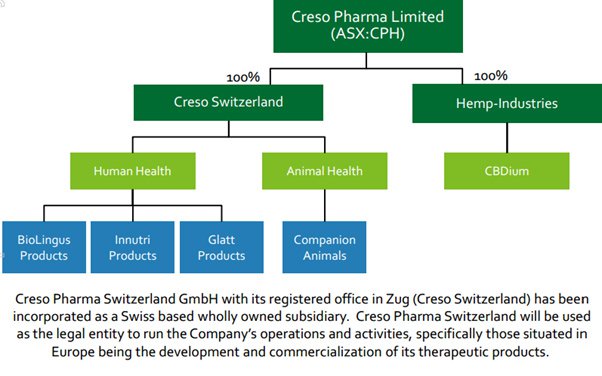

The following highlights the company’s corporate structure, as well as providing a guide as to the end markets that it will be targeting.

Management highlighted several key points of difference between CPH and a number of other newcomers in the industry, both in Australia and overseas. The company believes it fills the void in the current market where there is a growing need for trusted products that meet the highest global pharmaceutical standards.

Indeed, CPH’s high profile management team provides credibility in itself and would fit just as comfortably on the board of CSL as CPH.

Another important issue to take into account with CPH is the fact that it is commercially ready with near-term revenue from its first product. There is also reasonably strong visibility with three other products in the pipeline targeting human and animal nutraceutical markets.

CPH also has access to various drug delivery technologies through multiple licensing deals.

Distribution agreement may be on the horizon

While all these factors suggest the company is a compelling investment proposition, there could be a significant near-term development and share price catalyst should the company be successful in securing a distribution agreement and/or binding letters of intent with European and North American partners to progress the development and commercialisation of its products across both the human and animal health care markets.

Supporting the company’s progress is an industry that is forecast to grow exponentially in coming years.

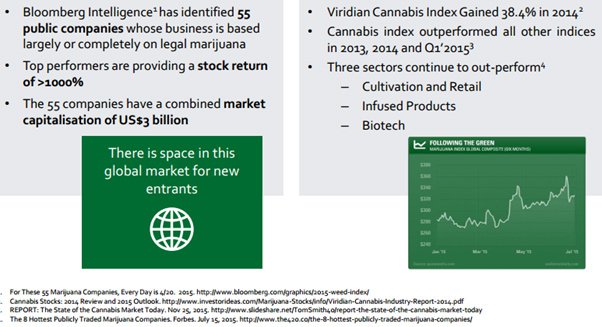

The following demonstrates that investors are no longer shy of the sector with significant inroads made in recent years by the medical profession in terms of endorsing the merits and dispensing with the myths of cannabis applications.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.