Cobalt grades exceed Celsius Resources’ expectations

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

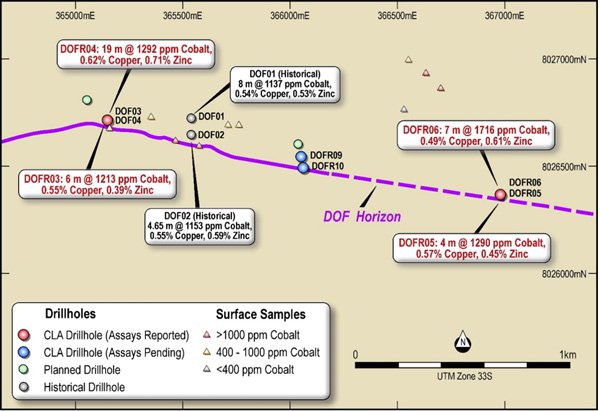

Celsius Resources (ASX:CLA) has released promising initial assay results from drilling at the Opuwo Cobalt Project in Namibia. Assays from samples from the first four holes confirmed strong cobalt-copper-zinc mineralisation at locations approximately 400 metres west and 1,500 metres east of the two historical holes drilled in 2015.

As indicated below this has extended the strike length of mineralisation confirmed by drilling assays to 1.9 kilometres.

Importantly, mineralisation extends to surface and outcrops in many places, and while the company has only limited assay data to draw on, grades appear to increase with depth.

Of significance is the fact that CLA’s Managing Director, Brendan Borg who has extensive ‘on the ground’ experience, having developed and managed projects for majors such as Rio Tinto, indicated further positive news flow may be imminent.

Although, CLA is at an early stage and anything can so investors should seek professional financial advice before considering this stock for their portfolio.

Both grades and thicknesses exceed expectations

More specifically, Borg said, “These first results exceed our expectations in terms of grade and thickness, and we are very pleased that we have now intersected the target unit over a distance of some 11 kilometres”.

Borg has had significant experience in mining for battery material metals (graphite, lithium and cobalt), and comments suggesting the prospect of further near-term positive news are likely to resonate with investors.

On this note, Borg said, “The presence of high grade zones of cobalt and copper within the mineralised zone identified to date provides confidence that there is significant upside still to be uncovered at Opuwo and we look forward to progressing our rapid evaluation of the project”.

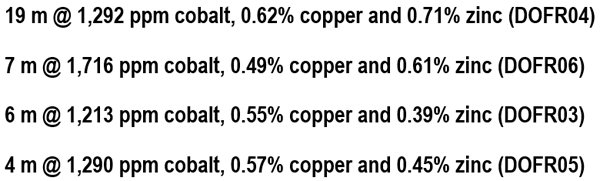

Impressive cobalt-copper-zinc mineralisation identified in assays from the first four holes are shown below.

Notable high grade zones within these intersections included 7 metres grading 1321 ppm cobalt and 2 metres grading 3075 ppm cobalt.

Early exploration results support management’s confidence in Opuwo project

From a strategic perspective, the exploration results are extremely encouraging given that the underlying focus on this area was to a significant degree based on two discovery holes drilled in 2015. Current drilling has yielded average grades and thicknesses in excess of what was recorded from the holes drilled in 2015.

It is also important to note that some drill holes were designed to intersect the mineralised zone at right angles and provide an approximate true thickness while other holes were drilled oblique to mineralisation. Consequently, further investigation at depth of angular holes could provide confirmation of higher grades at depth.

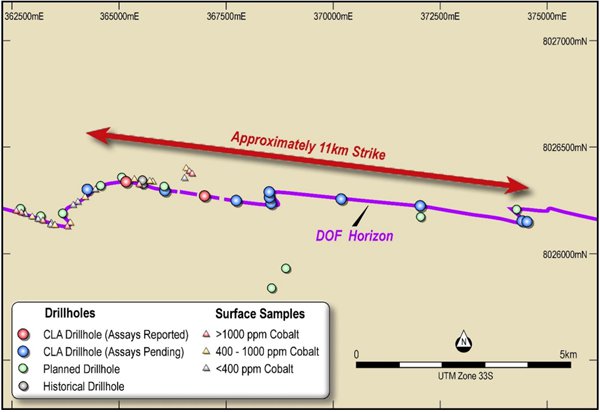

With regards to ongoing drilling, 20 shallow holes have been completed for 1627 metres. This initial phase is designed to test a 20 kilometre strike length of the cobalt copper mineralised Dolomite Ore Formation (DOF) horizon and the mineralisation hosted within it.

Wide spaced drilling has been completed across 11 kilometres of strike as shown below with the mineralised horizon intersected in each drill ‘fence’ to date. Diamond drilling will commence in early May, providing samples for first-pass metallurgical testing.

The planned metallurgical studies, along with preliminary mining studies and resource definition drilling are expected to contribute to a scoping study for the project, planned for completion before the end of 2017.

Opuwo earn-in agreement provides relatively risk-free exposure to cobalt

As a backdrop, the Opuwo Cobalt Project is located in north-western Namibia, approximately 800 km by road from the capital, Windhoek, and approximately 750 km from the port at Walvis Bay.

CLA is gaining exposure to the project via a staged investment in exploration activities. This involves the earning of an initial 30% interest through the expenditure of $500,000 within 6 months of exercising the option to proceed.

A further 30% will be earnt following expenditure of a further $1,000,000 within 12 months of completing the stage 1 earn in, and a final 16% can be earnt following expenditure of a further $1,000,000 within 6 months of completing the stage 3 earn in.

Following the earning of the 76% interest, all parties will be required to contribute to exploration.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.