CCZ discovers high-grade ore at copper-cobalt mine

Published 07-AUG-2017 16:12 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

ASX explorer, Castillo Copper Limited (ASX:CCZ), has announced today that high-grade supergene ore, with copper up to 35%, has been discovered at the historic Cangai Copper Cobalt Mine.

This discovery was made during the due diligence process on the company’s current acquisition of Total Minerals Pty Ltd. The process has verified that Total’s three complementary project areas in NSW and QLD are highly prospective for high-grade cobalt, copper and zinc.

Mine records confirm that supergene ore occurred with azurite and amalachite ore, grading at 20% to 35% copper – this occurred close to the surface and passed into chalcocite ore, of similar grade, below surface. Crucially, supergene ore was present in both sediments and dykes.

In addition, historic drill core from the mine (held by the NSW Resources and Energy department) has been inspected by Total Minerals’ consultant, ROM Resources, and is now being prepared to be assayed.

These new assays, which are currently being analysed, will target high-grade cobalt, copper and zinc, and will assist materially with JORC Resource modelling.

With this in mind, CCZ’s share sale agreement has been executed, and conditions are expected to be satisfied within five days. With due process now finalised, CCZ’s primary objective is to prove up three JORC compliant Inferred Resources as quickly as possible.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

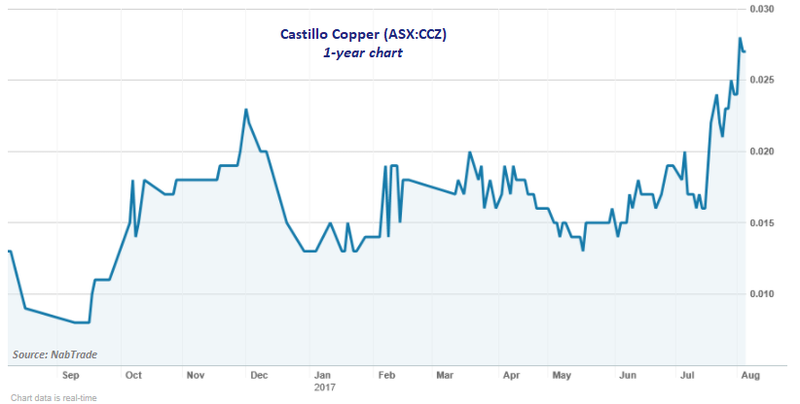

Shares have been trading strongly for CCZ, up 93% in the last 12 months. In the wake of today’s development, the share price has surged 15%.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Three JORC-compliant Resources confirmed

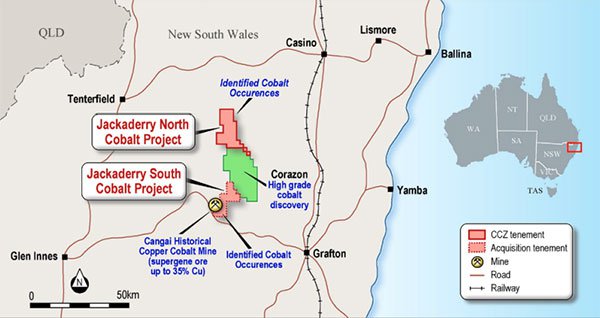

CCZ’s strategic and timely acquisition doubles its mineralised footprint across NSW and QLD. Importantly, ROM Resources has confirmed that two JORC Resources for cobalt, copper and zinc can be modelled from legacy data at the Jackaderry South project area (which includes the historic Cangai Copper Cobalt Mine) and the contiguous Peak Hill/Total prospects.

The map below shows CCZ’s tenements, including the recent acquisitions.

Particularly significant is the historic Cangai Copper Cobalt Mine (within the renamed Jackaderry South prospect), which resides in a region with known cobalt-copper systems.

During the desktop review process, ROM uncovered historical analyses undertaken by CRA Exploration between 1990 and 1992 on samples of massive ore around Cangai, which indicates promising exploration upside to the Jackaderry South project.

The key results recorded include:

- Copper values ranging from 5% to 15% in primary ore, rising to nearly 35% in samples of supergene ore;

- Zinc values ranging from less than 1% to nearly 10%, while lead values were typically in the range of 0.05% to 1%;

- The presence of cobaltite in primary ore which explains materially elevated cobalt values in relation to other trace elements.

As part of its drilled down due diligence to generate a JORC Resource from Jackaderry South, ROM will thoroughly test legacy core samples from Cangai for high-grade cobalt, copper and zinc.

These new assays, expected in the coming weeks, will importantly assist the process to model a JORC compliant Inferred Resource for the Jackaderry South project area.

Larger JORC Resources likely

Desktop reviews have also highlighted contiguous mineralisation at the Peak Hill/Total and Big Oxide North/Hill of Grace prospects.

Significantly, this is likely to translate into a higher JORC-compliant Resource for cobalt, copper and zinc than originally anticipated, as the initial assessment was based only on the Peak Hill prospect area.

The addition of Total’s project area effectively doubles CCZ’s mineralised footprint in the prime Broken Hill region. Additionally, ROM Resources has identified priority drilling targets for the Big Oxide North and Hill of Grace project areas in QLD, which show contiguous mineralisation.

Upon completion of the inaugural drilling program, which will commence in spring, ROM believes a third JORC Resource for cobalt-copper-zinc can be generated. This means that CCZ will potentially have three JORC Inferred Resources across its project areas, which bodes highly favourably for the company.

It’s also important to note that from a cost perspective, generating these will be relatively inexpensive, given two are from legacy data and only one is from a drilling campaign.

Castillo Copper’s new management team, Alan Armstrong and Neil Hutchison, said: “We are delighted to have joined Castillo Copper at an exciting time, with cobalt demand remaining robust and copper/zinc on a cyclical uptick.”

They added that the closure of the Total acquisition is extremely timely, providing CCZ with a sizeable mineralised footprint across NSW and QLD, and presenting “realistic prospects of generating three scalable JORC compliant Inferred Resources for cobalt, copper and zinc.”

Given the sturdy global outlook for all three commodities, CCZ’s immediate focus now is to review all geological studies for the six project areas, prioritise the exploration plan, progress JORC modelling for the NSW prospects, and speedily execute its business plan.

The finalised acquisition terms stipulate that CCZ will issue the vendors 55,000,000 CCZ shares in consideration for all Total’s issued equity, and formalise an agreement for the vendors to receive a 3% net smelter return royalty in respect of the project areas.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.