Castillo Copper’s recent assays ‘infer mineralisation extension’ at Cangai

Published 10-SEP-2018 11:21 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Castillo Copper Limited’s (CCZ:ASX) Board has provided an update on the geology team’s findings from the soil and rockchip sampling undertaken to the east of the line of lode at Cangai.

CCZ Chairman Peter Meagher commented: “After the recent impressive assay results, which confirmed an eleven-metre massive sulphide intersection grading close to 6% copper, the positive news flow continues.

“Clearly, the Board’s core objective is to expand the known mineralised footprint and rock-chips grading up to 23.9% copper & 55.5g/t gold certainly verify there is a potential north-east extension to the line of lode.

“While significant incremental work needs to be undertaken, the Board’s strategic objective remains re-opening Cangai Copper Mine.”

North-east mineralised extension

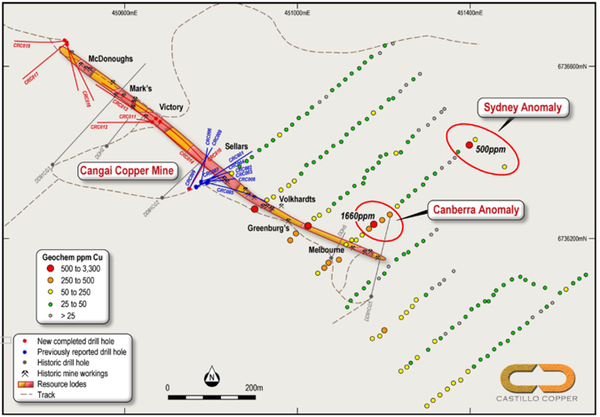

CCZ advised that the significant soil and rock-chip sampling work by the geology team has uncovered a potential high-grade extension to known mineralisation at the eastern end of the line of lode.

The team discovered two anomalies, named Canberra and Sydney, which had assay results from surface soil sampling at 1,660ppm copper and 500ppm copper respectively.

Of these, the reading from the Canberra anomaly is a significant potential indicator of sub-surface mineralisation and will be prioritised for the next broader infill sampling program.

Incrementally, while mapping historic workings — including shafts, adits and trenches across the eastern portion of Cangai — several rock-chip samples were collected from mine tailings that were mineralised or gossanous.

These were assayed and returned excellent readings up to 23.9% copper and 55.5g/t gold, which provides further supporting evidence there is a potential extension to the known mineralised footprint.

Yet it remains a speculative stock and investors and investors should take a cautious approach to any investment decision made with regard to this stock.

Exploration upside across Cangai Copper tenure

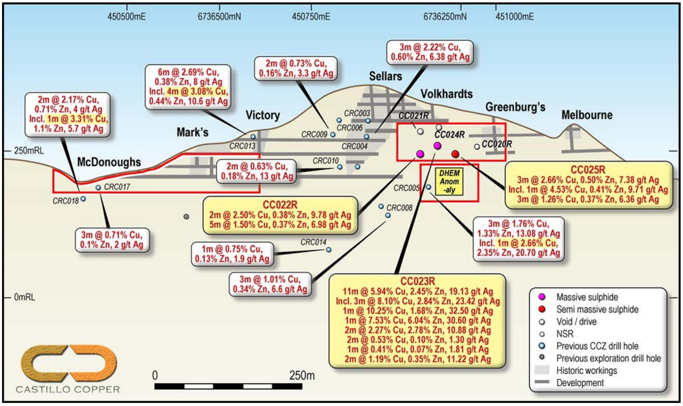

Following the discovery of high-grade massive sulphides in drill-hole CC0023R, which returned assay results of 11m @ 5.94% copper, 2.45% zinc and 19.13 g/t gold — the Board’s focus has switched towards expanding the known orebodies.

Utilising DHEM surveys will aid optimising the remainder of the current drilling campaign, which should potentially deliver extensions to known orebodies. The below graphic bundles all significant intersections recorded so far from the two drilling campaigns undertaken.

The company advised that broadening the soil sampling program may potentially unearth new areas extending from the line of lode, that warrant closer scrutiny.

Of note is the fact that since mining operations ceased early last century there has been negligible exploration activity, which clearly underscores the upside potential across the Cangai copper tenure.

East field report

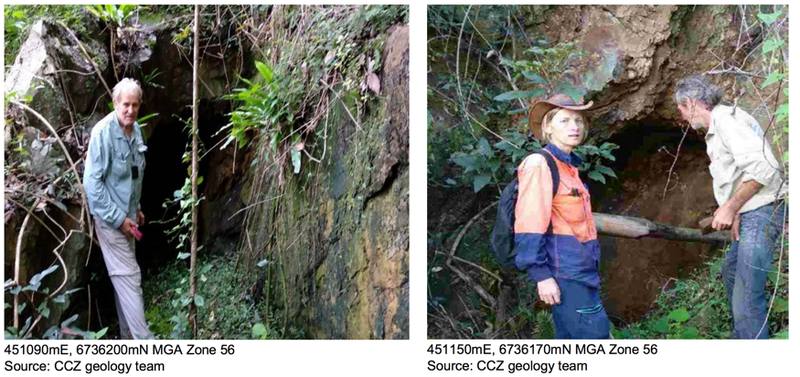

Several members of the geology team visited the Cangai east area, including Volkhardts, in late April 2018 and discovered historic workings that are not fully documented.

The terrain is quite steep and canopy think, which prevented using a drone to find workings. The team made several observations, including:

- There appears to have been more activity on the eastern end of the Cangai line of lode than western end;

- There potentially is not one simple lode, more likely two and possibly cross cutting; and

- Fresh observations contrast significantly with what has been previously reported.

What’s next for CCZ at Cangai

Recommence DHEM surveys and drilling program (including diamond drill rig) should deliver metallurgical samples. CCZ will look to provide an update on its Broken Hill project.

The Board is progressing with its strategic objective of monetising legacy stockpiles, after metallurgical test-work confirmed copper concentrate recoveries >80% and grade up to 22% copper.

CCZ now intends to request official guidance from the regulator on the pathway to remove the historic stockpiles for processing by third parties.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.