Canopy Growth Founder Joins a Refreshed, Re-Set and Re-Funded CPH

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is no doubt Creso Pharma (ASX: CPH) shareholders have had a rough ride in the last 12 months – however the company looks to have finally turned over a new page.

The company is now largely debt free, after completing a A$8.992M funding round priced at $0.0291 per share.

CPH appears to be generating more consistent revenue via its Canadian cannabis cultivation facility, has substantially trimmed is operating costs, and brought on a high-profile medical cannabis maverick as a strategic advisor.

Back in June 2019, Creso Pharma was set to be acquired for A$122M by a TSX listed cannabis company PhamaCielo. Unfortunately for shareholders, the acquisition did not proceed, and this came at the same time as a widespread downturn in cannabis stocks in general.

Following the failed acquisition, the company was forced to seek dilutive funding arrangements including convertible notes, which whilst the arrangement allowed the company to survive, it was destructive to long term holders.

We have invested in CPH a few times over the years and, like many, have been badly burnt.

However, we have decided to participate in the most recent capital raise at 2.91c, a raise which appears to have largely cleared those convertible note holders out of the company.

At the current share price levels this looks like the bottom for CPH, given what looks to have been a very high turnover of shares in recent days.

Based on those high trading volumes, it’s reasonable to assume the large convertible note holders have finally exited the company – and from here we think the company’s capital structure might have finally been re-set.

We have been watching and waiting until after the new shares have been issued, to bring you an update on CPH.

Creso is a highly speculative investment, and our intent is to hold over the coming months to see how the company’s strategy plays out.

We are looking for significant share price appreciation from here – However this is an ASX small cap stock, and there is no guarantee this investment will be successful. Remember at this end of the market, only invest what you can afford to lose.

Three key aspects have piqued our interest in CPH again.

- CPH is now largely debt free – the recent placement has extinguished debt including the convertible notes that hampered the share price.

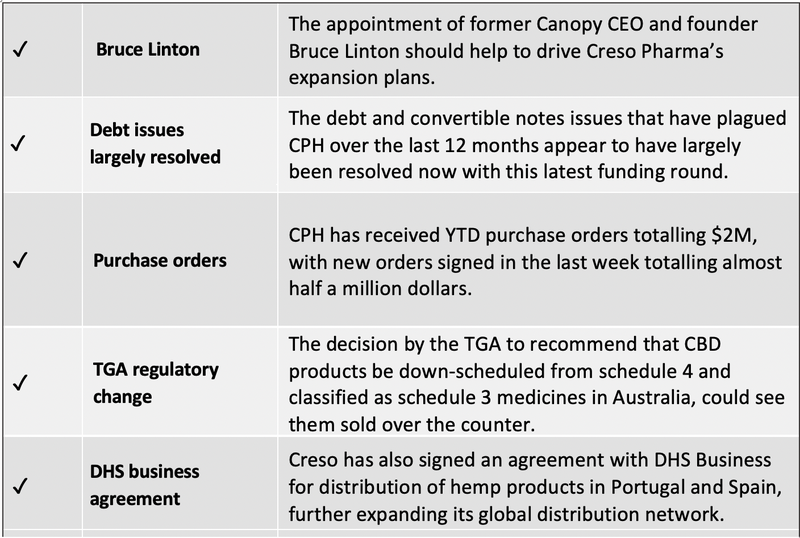

- Canopy Growth Corp (TSX: WEED, NYSE: CGC) founder and former CEO Bruce Linton is now a Strategic Advisor to CPH. Linton took Canopy from a start up to a peak US$15BN market cap.

- The company is generating consistent revenues from its subsidiary, Canadian Licensed Producer Mernova, which has received purchase orders YTD totalling over A$2M. In fact, in the last 3 days alone, the company has received a total of A$442,390 in orders.

We will go into more details on each point now.

CPH emerges debt free with strong balance sheet

Last week, CPH received commitments of A$8.92M by way of issuing new shares at 2.91c/ share.

If the share price is currently trading at around this level, investors buying on market would be coming in at the same price as the sophisticated investors that participated in the placement.

Whilst this placement of new shares is dilutive, the company has finally gotten rid of the convertible notes and debt that had been hanging over it over the last 12 months.

This means CPH is emerging largely debt free, and after significantly trimming operational costs over the past 12 months, and revenue coming in to support operations, should have some runway to execute on growth plans.

Based on the 2.91c share price, the company is valued at ~ $19.9M.

As the convertible note holders look to have largely exited the company over recent days, at a current 2.91c share price we would hope the company has some fresh air to run higher on material news.

Other things to look out for are the future conversion of options – placement participants received 1:4 options with a strike price of 5c. So, we would expect the company would certainly be trying to grow company value such that that strike price is surpassed.

Continued revenue and purchase orders certainly helps maintain confidence the company is heading in the right direction.

Cannabis Purchase Orders YTD total over A$2M

Key to CPH’s growth moving forward is its 100% ownership of Mernova Medical Inc. located in Nova Scotia, Canada – owner of a 24,000 square foot world-class, cannabis growing, revenue generating, Cultivation and Production Facility, that continues to win significant Purchase Orders for CPH.

Mernova’s Managing Director is run by ex-Canopy Growth executive and Production Manager, Jack Yu, who brings expert-level knowledge of cannabis cultivation and production from 25 years of practical experience growing cannabis, including nine years of consulting for licensed Canadian medicinal cannabis growers.

The facility is actively working to secure European Union GMP certification, which will allow the export of its GMP medicinal cannabis products to Europe.

The facility commenced production midway through 2019 and has been scaling up ever since.

Through Mernova, CPH sees scope for expansion into new markets, and part of the funds raised have been earmarked for such initiatives.

It has also been a big couple of weeks for Mernova on the back of two purchase orders totalling A$442,390.

Mernova Medicinal received its initial purchase order from Nova Scotia Liquor Corporation (NSLC) for the purchase of two of the group’s premium strains, HPG 13 and Lemon Haze.

The initial purchase order from Nova Scotia’s sole distributor of recreational cannabis had a value of C$180,000 (A$189,000), and the second purchase order had a value of circa $253,000.

The significance is broader than just the dollar value, as these orders from Nova Scotia signalled the group’s entry into Canada’s retail markets. This has effectively diversified Mernova’s revenue streams and builds on an established and growing wholesale product sales pipeline.

On a year-to-date basis, Mernova has generated revenues and received purchase orders totalling more than $2 million for CPH.

The second purchase order announced this week from CPH’s European operations for Creso’s Cannamics (cannaQIX® regular) product, follows the product’s successful launch of Cannamics in South Africa in May 2020.

Behind the order is from South Africa’s Pharma Dynamics.

Pharma Dynamics, a subsidiary of the $472.3BN capped Lupin Limited (NSE: LUPIN), currently ranks as the third fastest growing pharmaceutical company in South Africa and is a leading supplier of generic medicines in the country.

Pharma Dynamics successfully launched the cannaQIX® regular product under the brand name Cannamics during Q2 in South Africa.

Pharma Dynamics distributes Creso Pharma’s hemp-based products across South Africa, with plans to extend the distribution to Namibia, Botswana, Zimbabwe, Swaziland, Lesotho, Angola, Mozambique and Uganda.

CPH is not yet profitable, but certainly if it keeps posting solid, growing revenue numbers, we would expect investors to increase their confidence that CPH is on a stable pathway.

Aside from all important revenue that supports operations, perhaps the bigger news was the addition of an influential strategic advisor to CPH.

Canopy Growth Founder now a Strategic Advisor to CPH

Those who know anything about the cannabis industry, would know the name Bruce Linton.

Linton was the man behind Canopy Growth Corporation (TSX: WEED, NYSE: CGC) as they went from market minnow to a market capitalisation of more than US$15 billion during his six-year tenure.

At one stage, Canopy was one of the biggest medical cannabis companies in the world.

There is no doubt Linton knows his way around the cannabis market in Canada, as Chairman and CEO of Canopy Growth he secured market support for 16 rounds of financing totalling more than $5 Billion in capital raises and oversaw upwards of US$3 Billion in M&A transactions.

Linton is a true entrepreneur, who knows how to get deals done and drive shareholder wealth. He has unparalleled levels of connections, expertise and influence in the cannabis industry.

The former Canopy CEO and entrepreneur has been eyeing off opportunities ever since his well-publicised Canopy departure.

Following Canopy, Linton launched Collective Growth, a NASDAQ listed acquisition company (a SPAC – a type of investment vehicle that is currently all the rage in North America) that aims to exploit the potential of hemp and disrupt many industries that go well-beyond medical and recreational cannabis.

Collective, which listed in May under the symbol CGROU was able to raise $150 million at IPO and Linton believes this blank cheque organisation can grow to a billion-dollar enterprise within 18 months.

CPH has wisely turned to Mr Linton to provide some advice on how it can drive shareholder value, and as CPH holders ourselves we hope Mr Linton can leverage his deep North American networks and relationships to add value to CPH.

In order to incentivise Linton, CPH has issued him with 30,000,000 options with an exercise price of $0.039 and 5-year expiry date.

Linton sees significant potential for Creso’s intellectual property (IP), established global distribution footprint and robust product pipeline.

He will leverage his industry expertise and experience advising cannabis companies to assist Creso Pharma in its global expansion and revenue generation through its product sales channels.

Creso’s strategic European location may also play a major expansion role, as he seeks out opportunities on this continent with Creso’s hemp and cannabis products.

Linton makes an interesting point when he tells Forbes, “You can buy a BMW right now, the E series...one of them is 21% made of hemp, and none of it comes from America. None, not a scrap of it. It's all from Europe.”

Here is Linton speaking about Collective, the industrial hemp revolution and his venture into psychedelics to treat anxiety.

As you can see, there was a big hemp and European focus, which is probably what has attracted Linton.

A further point of interest for CPH investors is the Australian Therapeutic Goods Administration (TGA) announcement earlier this year, which could also open up the local market.

TGA opens doors for cannabis players

A recent large news event in Australia was the interim decision made by the Therapeutic Goods Administration (TGA) in relation to a major regulatory change in the status of cannabidiol (CBD) products in Australia.

The decision recommends that CBD products be down-scheduled from schedule 4 and classified as schedule 3 medicines in Australia.

This would allow Australian consumers to purchase CBD products over-the-counter (OTC) through pharmacies without the requirement of a prescription.

This is a major opportunity for Creso Pharma to enter Australia and sell its CBD and hemp products in a market estimated to be valued at $200 million and set to grow rapidly in the near term.

Currently, Creso Pharma’s cannaQIX® 50 is being sold in Australia as a medicinal cannabis product under the ‘LozaCan’ brand via distribution partner Burleighs Heads Cannabis’ (BHC).

Creso Pharma has developed various CBD and hemp derived products in their cannaQIX® range using the company’s proprietary innovative delivery technology.

The products contain broad spectrum organic hemp oil extracts with CBD and they are pitched at reducing stress and supporting mental and nervous functions.

Australian cannabis companies reacted well to this regulatory news and they could be given a further boost if the US presidential election falls the way of the Democrats.

Democratic VP candidate Kamala Harris said a Democratic administration would support the decriminalisation of marijuana and the expungement of criminal records (for possession).

Post her debate with Republican Vice President Mike Pence, US cannabis stocks surged.

Could Australian stocks follow suit if the Democrats win the election?

We will find out in a few weeks’ time.

The final word

CPH holders have had a rough ride over the last 12 months, but we have a feeling that at current share price levels of around 2.9c could be a decent entry point in line with the sophisticated investors that came in via the recent placement.

The debt and convertible notes issues that have plagued CPH over the last 12 months appear to have largely been resolved with this latest funding round.

With steady revenues coming in, the appointment of the highly experienced and successful Bruce Linton, the TGA announcement, and product launches across the globe, this could be the point where CPH resets and regains market confidence.

While it is difficult to predict what will happen in future, we’ll be watching the Creso story closely as it steps up its game and hopefully leverages the influence of Linton.

Reason to consider CPH:

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.