Auroch moves from gold to lithium

Published 25-MAY-2016 11:36 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With around 40 ASX-listed companies already pursuing lithium exploration and/or production, the ASX will soon be welcoming another contender to the lithium mix, in the form of Auroch Minerals (ASX:AOU).

Earlier this week, AOU announced that it had acquired rights to the Hombolo Lithium Project in Tanzania, around 40km from Dodoma.

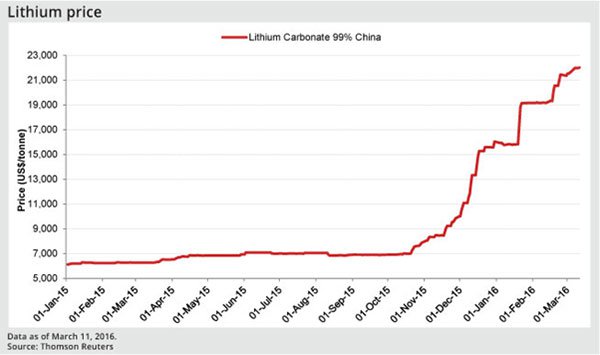

One of the major reasons AOU is keen to join the lithium frenzy is that high-grade 99%+ lithium carbonate prices have risen substantially since November 2015.

Priced at $7000 per tonne just 6 months ago, lithium carbonate is now trading at around $22,000 per tonne although it’s worth bearing in mind that lithium is not a standardised commodity and therefore does not trade on an exchange or in financial derivatives such as futures and options. All purchase deals are negotiated directly between buyers and sellers.

With so much gusto to be found in the lithium market, the ramifications on pricing have been profound and have in turn welcomed a flurry of lithium exploration from ASX-listed entities.

Auroch’s move into lithium echoes similar decisions made my several other metals explorers including Birmian Gold (ASX:BGS), Segue Resources (ASX:SEG) and Caeneus Minerals (ASX:CAD).

The ongoing boom in lithium has so far attracted former gold explorers in their desire to switch to lithium exploration. The prime reason for the seemingly sudden rise of lithium as a commodity, is the sudden adoption of electric cars and energy storage solutions being offered by companies such as Tesla, Foxconn and BYO.

Tesla managed to convince over 300,000 people to pre-order its Tesla Model 3 in the space of just a few days, which could finally usher in the moment when EV cars begin to outshine combustion engines in the eyes of consumers.

Hombolo Lithium Project – Acquisition Terms

AOU has entered into a conditional agreement to acquire an Australian company that owns the rights to Hombolo via a Tanzanian subsidiary.

The terms of AOU’s Hombolo acquisition are as follows:

- Initial non-refundable payment of $75,000,

- Issuance of 950,000 ordinary AOU shares upon signing of a binding agreement,

- Issuance of 2,050,000 ordinary AOU shares upon shareholder approval no later than July 18th,

- Further payment of $75,000 upon shareholder approval no later than July 18th,

- 3 million options exercisable at $0.20,

- 1,500,000 AOU shares at 12 Months following Completion,

- 2,000,000 AOU shares at 24 Months following Completion,

- 2,500,000 AOU shares at 36 Months following Completion.

As part of its due diligence, AOU has had a senior geologist on site for 10 days conducting mapping and sampling. Initial sampling indicates “the presence of numerous outcroppings and lithium bearing pegmatites” at Hombolo which is a positive initial assessment for AOU.

AOU’s future work area is adjacent to Liontown Resources’ (ASX:LTR) Mohanga Lithium Project where LTR’s preliminary fieldwork indicates lithium grades of up to 5.2% Li2O (lithium oxide). AOU’s close proximity to LTR raises the prospect of AOU proving up something similar to LTR once the necessary fieldwork has been completed and assessed during the rest of 2016.

Overall, AOU has secured the rights to 2 prospecting licenses, 3 granted primary mining licenses, 8 applications for primary mining licenses and 8 regional prospecting licenses under application – totaling 21 separate licenses with a total ground package of 1,700km2.

Most importantly for AOU, its location is part of an “excision” from the existing Liontown project that has already seen some preliminary exploration and includes “historical lithium occurrences” dotted around LTR’s tenements.

Hombolo has a small artisanal gemstone mine within the project which was used for gemstone mining in the past. Importantly for AOU, the now unused mine can be used to obtain direct sampling with AOU geologists having already “collected over 60 samples for initial whole rock assay which will document the levels of important elements such as lithium, tantalum and potentially other rare earth elements” says AOU.

Auroch will commence field operations in June with initial planned exploration activities to include trenching, mapping and sampling of the pegmatites and soil sampling.

Accompanying AOU’s proposed Hombolo acquisition, AOU Executive Chairman Glenn Whiddon said, “We are excited to be committing to the Lithium space during this period of massive technological change. Auroch has made a strategic decision to focus a portion of the funds it has received from the sale of the Monica Gold project in Mozambique towards this sector and is completing due diligence on several other projects worldwide. Our goal is to develop a portfolio of assets from grassroots to advanced, across several geographical and political jurisdictions to take advantage of the burgeoning battery market and to provide portfolio diversity to minimise risk to shareholders.”

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.