Auroch continues to dig up promising news at Nepean

Published 25-MAY-2021 10:43 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Auroch Minerals Limited (ASX: AOU) has provided a promising update on exploration activities at its Nepean Nickel Project (Auroch 80%, Lodestar Resources Ltd 20%) in Western Australia, prompting the company’s shares to open slightly higher.

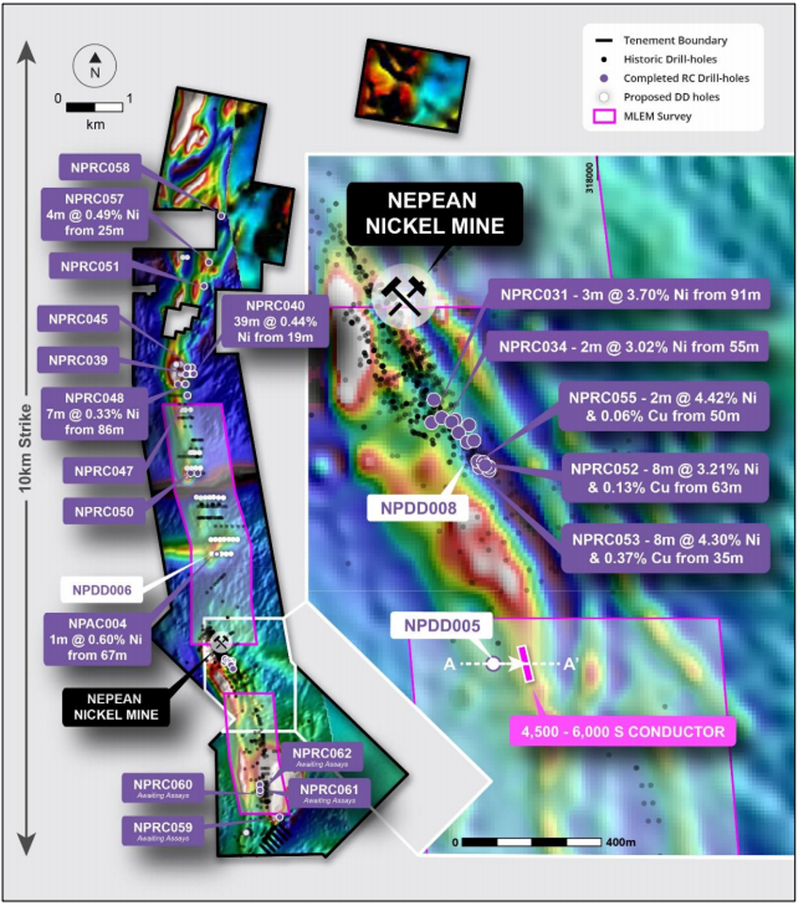

A three-hole diamond drill programme has been successfully completed for 730 metres at Nepean, designed to test three separate targets.

The first drill-hole (NPDD005) was designed to test a strong 4,000-8,000S (Siemens) conductor identified recently by a high-powered ground moving-loop electromagnetic (MLEM) survey 1km south of the historic Nepean nickel sulphide mine.

The location of the drillhole is shown below, indicating new diamond drill collars in relation to reverse circulation (RC) drill collars and the MLEM conductor to the south of the historic Nepean nickel mine.

The hole was successfully drilled to a depth of nearly 400 metres and intercepted a thick package of ultramafic units from 92 metres to 253 metres down-hole, cross-cut in places by intrusive pegmatite veins.

The important footwall contact to the ultramafic package was intercepted at 253 metres and characterised by a two metre wide sediment unit containing approximately 10% sulphides of predominantly pyrrhotite, pyrite and chalcopyrite.

From a geological perspective, the ultramafic unit directly above the contact exhibits a cumulate texture and the presence of sulphidic sediments on the contact is typical of the setting required for Kambalda-style nickel sulphide mineralisation.

Assays imminent, contact zone subject of further drilling

Down-hole electromagnetics (DHEM) have been conducted on the completed drill-hole, which confirmed that the intercepted sulphides are probably the cause of the MLEM conductor.

A refined DHEM model has produced 4,500-6,000S conductive plate dimensions of 100m x 150m steeply dipping WNW and striking NNW-SSE, which is coincident with the lithological strike.

The drill core is currently being processed and sampled and submitted for assaying, with results, in particular the geochemistry of the contact zone, to be used for further drill targeting.

Discussing the significance of these developments, while highlighting the relationship with Kambalda-style nickel sulphide mineralisation, Auroch managing director Aidan Platel said, “We are pleased to have successfully completed our first diamond drill programme at Nepean.

"The core provided by diamond drilling allows our geologists to record so much more textural and structural information that is just not possible to see in reverse circulation drill chips, and hence is critical to understanding the geological setting of each prospect.

"The sulphidic sediments intersected by drill-hole NPDD005, whilst not nickel sulphides, are important as they provide the source of sulphur necessary for Kambalda-style nickel sulphide mineralisation, and the fact that they are underlying a thick ultramafic package is very encouraging.

"Our Nepean MLEM survey resumes this week, so we are looking forward to potentially identifying new conductors to target the next drilling campaign at Nepean.

"We are also awaiting assays for 12 drill holes from the Woodwind Prospect, along strike from the high-grade nickel sulphide mineralisation at the Horn Prospect at the Leinster Nickel Project, and we expect to have the first batch of results from these holes within the next two weeks.”

Hole NPDD007 investigates shallow high-grade nickel mineralisation

Diamond hole NPDD007 was drilled as a metallurgical hole in order to better understand the shallow high-grade nickel sulphide mineralisation intersected in recent RC drilling.

The drill-hole intercepted a sulphide zone with a width of approximately 10 metres from 66 metres and within that it intersected 3.4 metres of the 'triangular ore zone' mineralisation from 72 metres down-hole.

This hole will be processed and assayed, while DHEM investigation is scheduled for later this week with the aim of understanding the conductive response of the matrix sulphide unit, and this is expected to assist in the future targeting of regional exploration drill programmes.

Diamond drill hole NPDD006 targeted a geochemical anomaly identified in air-core (AC) drilling earlier this year, where drill-hole NPAC004 intercepted 1 metre at 0.60% nickel from 67 metres in an end-of-hole sample in fresh rock.

The location of the anomaly is approximately 1.8 kilometres north of the historic Nepean mine.

NPDD006 was drilled to a depth of 255 metres, and the ultramafic – basalt footwall contact was intersected at 180 metres down-hole.

The drill core is currently being processed and sampled and submitted for assaying.

In line with hole 007, DHEM survey of the hole has been scheduled for later this week.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.