Auroch commences hole three as it targets the Neves Corvo trend

Published 14-AUG-2017 13:19 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

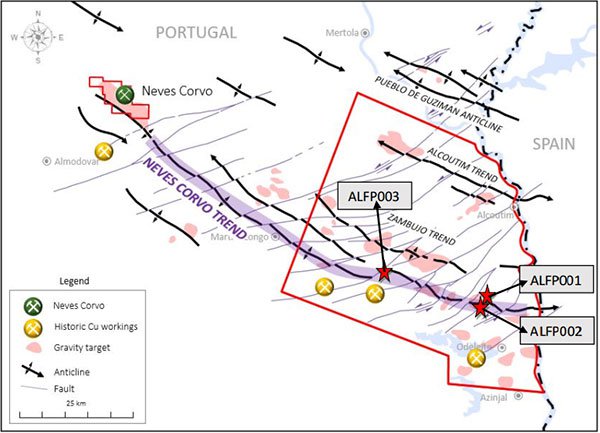

Having completed its phase 1 drilling campaign at its Alcoutim copper zinc project located in Portugal, Auroch Minerals (ASX: AOU) commenced the third hole on August 8.

Management was encouraged by the fact that the second hole intersected targeted stratigraphy Volcanic Sedimentary Complex (VSC) at 830 metres.

Results released since then have provided further confidence with Chief Executive Doctor Andrew Tunks saying on Monday, “Initial results in from hole ALFP002 (the second hole) confirmed significant magnetic similarities with that of Foupana magnetic anomaly, which the company believes is a strong indication of the prospectivity of the ground we are currently exploring”.

Commenting on the current drilling of the third hole, Tunks said, “Drilling of hole 3 has commenced, and with the data gathered from old BHP Billiton drilling and our own data acquisition from drilling we look forward to continued positive results.”

The third hole, ALFP003 is collared close to historic hole AC-1 (drilled by Billiton in 1986) which was abandoned at just over 1000 metres in sulphide rich black shales, interpreted

to be equivalent to the host rock mineralisation at Neves Corvo (Figure 1).

Ex-Billiton staff confirmed in a recent meeting that the hole was abandoned due to the inability of the rig to drill any further. The drill core containing sulphide rich black shales from AC-1 has either been entirely sampled or lost.

Hole 3 will test several hundred metres along strike from the AC-1 drill intersection into the Neves Corvo position (sulphidic black shales), as well as continuing deeper to test for additional mineralised horizons, similar to other deposits on the Iberian Pyrite Belt.

The following map highlights the significance of the current drilling campaign in terms of targeting the Neves Corvo trend.

From a share price perspective, AOU received strong support after announcing that it had intersected targeted stratigraphy with its shares increasing approximately 17% from 14.5 cents to 17 cents.

Of course, share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

This level was maintained until Friday of last week when a sell-off in the S&P/ASX 200 Materials index tended to have a broad-based effect on most mining stocks.

AOU closed at 15 cents on Friday, and has traded at that level on Monday morning, perhaps creating a buying opportunity.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.