ASX Companies increasingly adopting this practical ESG standard

Published 01-JUN-2021 11:30 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

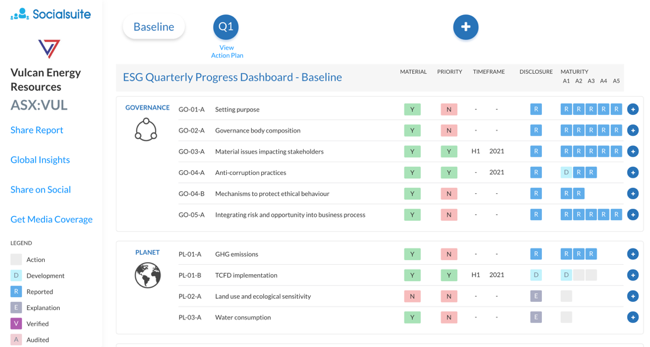

At the start of 2021, the first six ASX-listed companies began improving their Environmental, Social and Governance (ESG) credentials and reporting their progress against the World Economic Forum’s 21 universal ESG metrics, using “ESG on-ramp” technology platform Socialsuite.

After committing to Socialsuite ESG on-ramp in January 2021, Vulcan Energy (ASX: VUL) secured $120M from ESG investors.

Newly committed Province Resources (ASX: PRL) rose 30% on announcing adoption of ESG reporting and raised $18M including from ESG funds.

Three companies have appointed their first female director since adopting the ESG program and other early adopters report making practical progress against their ESG credentials.

Investors are increasingly demanding better ESG.

An additional thirteen ASX-listed companies recently signed on to ESG on-ramp and are leading the way globally by committing to ESG reporting.

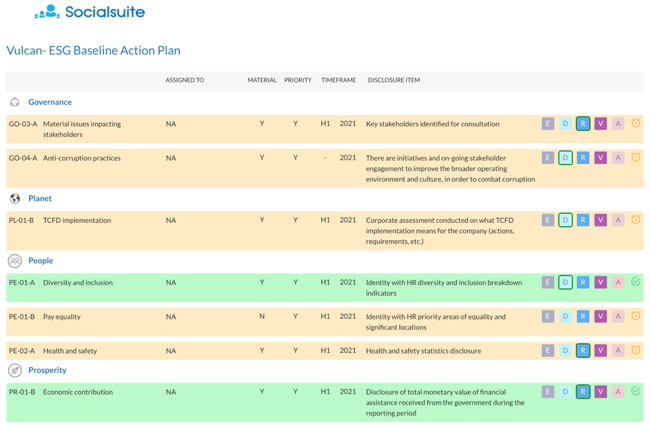

The initial six companies to sign up to Socialsuite’s ESG-on-ramp have now completed their baseline ESG report, first quarterly ESG action plan, and continue to report their progress to stakeholders.

These early adopters are:

- Euro Manganese Inc (ASX: EMN)

- Vulcan Energy (ASX: VUL)

- Elixir Energy (ASX: EXR)

- Minbos Resources Limited (ASX: MNB)

- Advanced Human Imaging (ASX: AHI)

- Whitehawk (ASX: WHK)

Thirteen new companies have now completed their baseline ESG report and are commencing their first quarterly ESG action plan:

- Province Resources (ASX:PRL)

- European Metals (ASX:EMH)

- Mandrake (ASX:MAN)

- Thomson (ASX:TMZ)

- Alexium (ASX:AJX)

- Pursuit (ASX:PUR)

- FYI Resources (ASX:FYI)

- Oneview Healthcare (ASX:ONE)

- Aldoro Resources (ASX:ARN)

- Synertec Corporation (ASX:SOP)

- MMJ Group (ASX:MMJ)

- Creso Pharma (ASX:CPH)

- 88 Energy (ASX:88E)

These companies have begun reporting on 21 core ESG metrics and will demonstrate their ESG progress over time to investors in quarterly dashboards and action plans to be included in quarterly financial and operational reports to the ASX.

Francis Wedin, Managing Director at Vulcan Energy explains: “At Vulcan, positive impact and ESG are at the heart of our company’s purpose. We are focused on creating long-term sustainable value, while driving positive outcomes for the business, and this has been demonstrated clearly through our funding round which secured $120M including from ESG investors. Working with Socialsuite has helped us get started with reporting our ESG position and has provided a clear action plan of how we can improve our ESG credentials over time.”

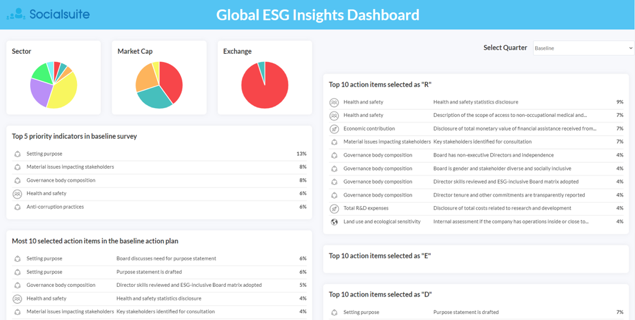

While ESG has been a priority for businesses for some time, a key challenge for small to medium ASX listed companies has been the lack of a practical way to measure, report and improve the shared and sustainable value they create. Socialsuite makes it easy for ASX-listed companies to commit to ESG reporting by providing a straightforward tool for measuring and improving their progress against the World Economic Forum’s ESG framework.

“Strength in ESG allows companies to access more investment, attract and retain talent and secure more customers as well as create social value while providing shareholder returns,” says Damian Hajda, Co-Founder and Director at Socialsuite.

“Socialsuite provides a clear and practical way companies can get started with ESG improvement based on the company’s size and resources, which can be scaled as capacity increases.

“Looking at the data from the first quarter, it’s clear the companies see where their attention needs to be focused and where they can make quick changes to deliver significant impact. Initially, we’ve seen a large focus from boards on finalising their purpose statement and ensuring compliance issues such as health and safety are being reported.”

Neil Young, CEO at Elixir Energy, says, “Working with Socialsuite enabled us to quickly and easily identify where there are gaps in our ESG strategy and how we can improve our position. In the last quarter we have appointed a female board director and are now actively seeking out decarbonisation projects to reduce our carbon intensity and deliver social value. We also have a clear roadmap for achieving ESG goals that will take more time.”

David Frances, Managing Director of Province Resources commented, “As we attempt to build a business that has the potential to supply zero carbon hydrogen to fuel the planet for multiple future generations we aspire to set the ground rules and pathway for our Company’s journey towards global ESG compliance and reporting supported by the Socialsuite package.”

Oneview Healthcare CEO James Fitter is also committed to making a difference saying, “The principals of ESG are grounded squarely in our culture and are ingrained into our company growth plans.

"We have long taken pride in the principles of diversity, inclusion and equality, but Socialsuite has provided us with additional transparency and a benchmark to focus on to ensure ESG goals are fully integrated into the operation of the company.

"It’s an over-used cliché to say your company makes a difference in the world but as a trusted partner to some of the leading healthcare systems in the world, we live the commitment to help create a safer, healthier world and witness this regularly through positive patient and clinician feedback,” Fitter concluded.

As the number of ASX companies adopting Socialsuite ESG grows, Socialsuite will be able to provide data to the public on how quickly ASX companies are progressing their ESG credentials over time and what each ESG indicators each sector is focusing on improving at any given time.

Socialsuite’s ESG technology helps companies work towards best-in-class ESG over time through

- quarterly monitoring of key ESG indicators

- quarterly prioritisation of ESG improvements

- assistance to implement ESG improvements

- team responsibilities and task management through quarterly ESG action plans

- ongoing ESG reporting to key stakeholders.

Socialsuite has clients across the Asia-Pacific, Americas and Europe. They include financial institutions, companies, government agencies, philanthropic foundations, not-for-profits, and NGOs.

To learn more about ESG reporting with Socialsuite, visit https://socialsuitehq.com/esg.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.