AOU Delivers us an Early Result

Published 31-MAR-2021 13:11 P.M.

|

4 minute read

It was only a few weeks ago that we invested in Auroch Minerals (ASX: AOU).

We have done well out of our battery metals picks, and have been observing that the world is going to need a lot more nickel in the transition to electric vehicles.

We chose to invest in AOU as it recently acquired a majority stake in a historical WA nickel mine, and it’s currently drilling to expand its nickel resource next to and below the existing nickel.

Today, AOU has made another step towards identifying a lot more nickel.

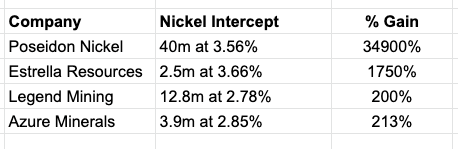

AOU has confirmed spectacular nickel drilling results that are superior to other nickel stocks that rose 1,750% and 213% respectively.

Before we delve deeper into today’s news, it's important to note that AOU’s nickel mine used to feed a local smelter owned by mining giant BHP.

BHP wants to ramp up nickel production in the area of AOU’s mine, with a view to sell to battery makers like Tesla.

So BHP is going to need a lot more nickel from nearby...

AOU’s nickel projects are within trucking distance to BHP’s nickel smelter and this includes the former nickel mine that once supplied BHP’s mill...

Now, we think that the massive upside in AOU is the potential extension of the remnant nickel resource at its existing mine.

AOU is hoping to discover a giant nickel body underneath the historical nickel mine’s original ore body.

It’s happened before in WA.

Another nickel company Western Areas discovered a huge ore body underneath a historical mine known as the Flying Fox nickel mine, that sent its stock price soaring.

AOU is attempting to repeat that success at Nepean. You can read how in our initial coverage.

Today’s drill results are another step forward for AOU.

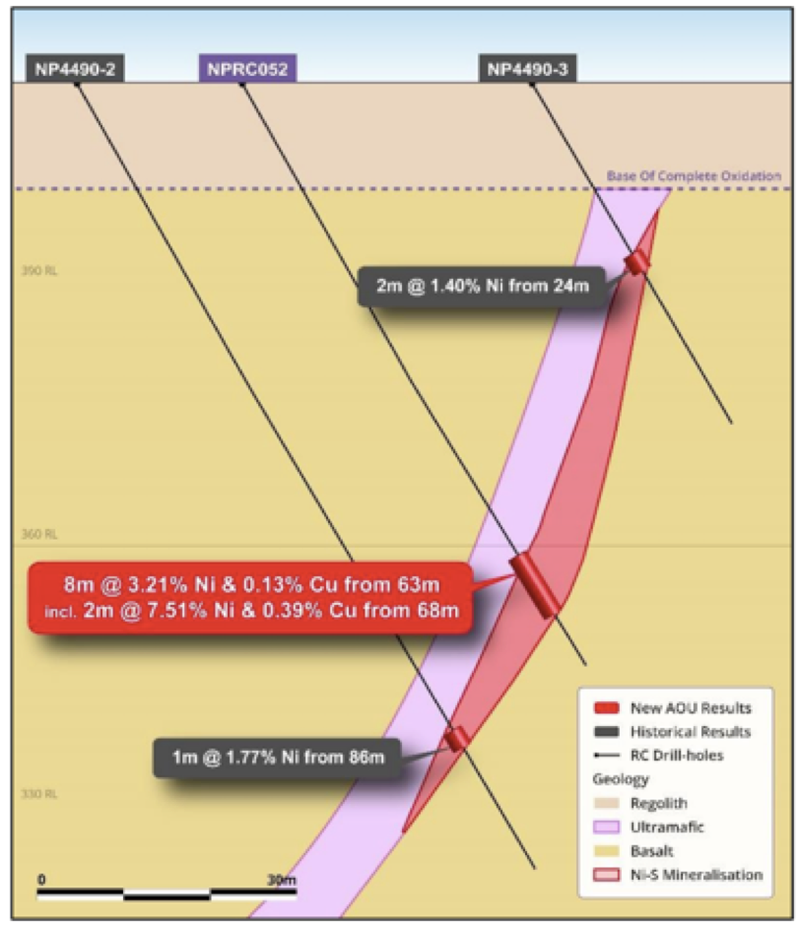

Today, AOU released assay results from Nepean that show thick high-grade nickel sulphides at shallow depths.

Getting great drill results at shallow depths is always a good sign - as it will mean cheaper costs to extract the nickel from the ground.

We think there is significant upside for AOU over the coming months if it continues to deliver high grade nickel intercepts.

ASX investors have had a long history of reacting positively to thick, high grade nickel intercepts:

AOU’s most impressive result today is 8m @ 4.30% Ni & 0.37% Cu from 35m.

As you can see in the table above, AOU’s result today is better than what Estrella Resources and Azure Minerals delivered, when they shot up 1750% and 213% respectively.

At 500m depth AOU’s results would be good, but at 50m depth it makes the intercepts that much better...

More on the significance of today’s results

Here is some other reasons why we really like today’s results - warning, this may get a bit technical, we tend to get a bit excited about nickel drilling:

- The thickness and the high grade of the intercepts is excellent.

- The shallow depth of the intercepts at 50m - that is very close to surface.

- Results seem to indicate AOU’s model of shallow high grade nickel sulphide mineralisation extends for over 500m of strike.

- The holes were designed to confirm AOU’s geological model in critical areas - so far, so good.

Our favourite image from the announcement is this one:

This is a cross-section of historical drilling and AOU’s drilling - it is a great example of where the historic drilling intercepted only 1-2m of sulphides because they were drilled where the lens starts to pinch out...

Whereas AOU drilled a hole in between them (the red call out box in the image above) to test the main area of the lens - and sure enough AOU hit a solid 8m of massive nickel sulphide mineralisation!

In our opinion, recent drill results have exceeded all expectations, and lay a solid foundation for AOU to progress forward to assessing a potential open-pit scenario at Nepean that could generate significant cash flow for AOU.

What's next for AOU?

Today’s drill results look to be just the start of a string of good news over the coming weeks, all with the aim of building on understanding the true extent of AOU’s nickel resources.

- More RC drill results coming: AOU is set to release further results from the remaining 17 holes of its maiden RC drill programme at Nepean.

- More AC drill results are coming: A regional air-core (AC) drill programme has also been completed along AOU’s Nepean Project’s 10km of prospective strike. Results will give us a better understanding of the potential of a larger nickel resource.

- High-powered ground moving loop electromagnetic (MLEM) survey: To be run over priority target areas of the 10km of strike to commence beginning of April.

- Diamond drilling is continuing at AOU’s Leinster Nickel Project to test the high priority aeromagnetic anomalies along strike from the Horn Prospect.

We will continue to provide updates as news from AOU and our other portfolio companies is announced.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.