American Pacific shows first glimpse of dual-commodity viability

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having acquired a highly sought-after asset in California earlier this year, American Pacific (ASX:ABR) has begun proving up its acquisition through early sampling and testworks at its Fort Cady Project — with a near-term Feasibility Study target of mid-2018 already set.

ABR is seeking to develop a dual-commodity project in California, producing boric acid and lithium in both commercial grades and quantities, according to early test results published today.

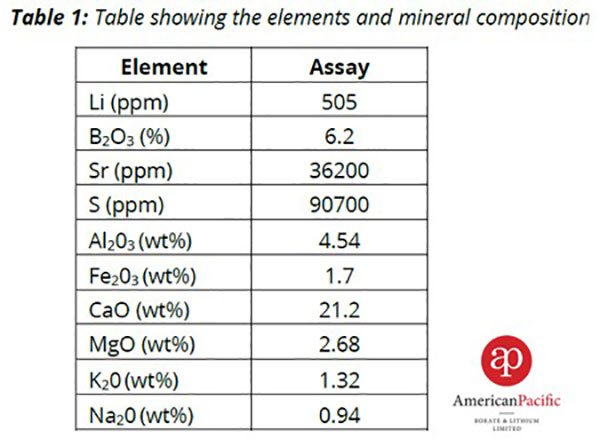

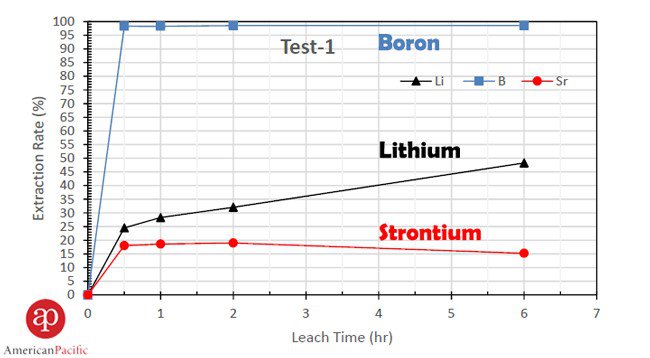

A total of five hydrochloric acid leach tests were performed on a five kilogram representative sample of core containing 6.2% B2O3 (11% H3BO3) and 505 ppm lithium. The tests lasted six hours and used different temperatures and different acid amounts to test recoveries of both lithium and boron. The first test used a 50°C fluid and maintained a pH of 0.5 for a period of six hours; generating 98.5% boron and 48.3% lithium recovery.

The 505ppm lithium is particularly significant when compared to other lithium brine producers such as SQM and Pure Energy, who are typically able to generate around 100-200ppm in each their respective Projects.

Test results in full:

Source: American Pacific

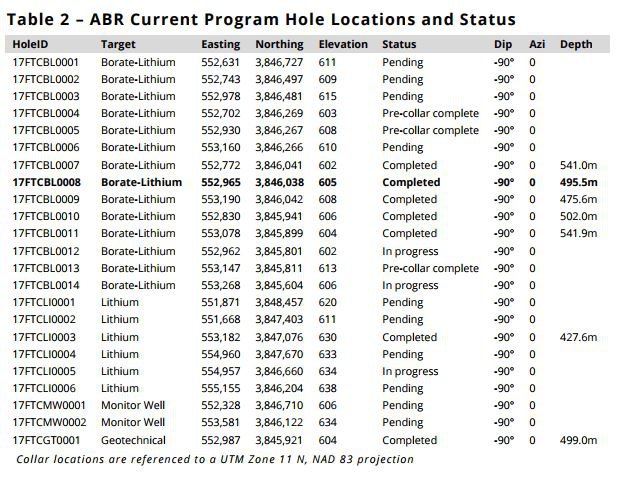

Fort Cady current program hole locations and status as below:

Source: American Pacific

Positive metallurgical results at an early stage improve the likelihood of ABR developing an economically viable Project, able to beat its nearest peers on cost, grade and quantity in boric acid. ABR wants to go one better by supplementing its known boric acid asset with a workable lithium-brine project.

It should be noted here that ABR is still in its early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

As part of its lithium processing research and development, ABR has appointed The Saskatchewan Research Council (SRC) to complete a colemanite ore leaching test program for ABR’s Fort Cady Project. The purpose of the testing program was to investigate lithium extraction potential by HCl leach at various conditions.

A total of five HCl acid leach tests were performed on ABR’s composite sample at various conditions, with averages charted below.

Source: American Pacific

It would seem ABR is keen to make early progress at Fort Cady, with strong margins a clear early target. “The excellent boron recoveries are particularly pleasing given we believe we are first and foremost a compelling boric acid project with a low capex target and likely high margins. Our lithium by-product project also looks compelling”, says ABR Managing Director & CEO Michael Schlumpberger.

“The addition of lithium enriched brines into the make-up solution should only increase our lithium by-product production. The initial testworks have helped inform our pilot plant test program that we expect to commence early in the new year.”

Given ABR’s swift ASX-listing and subsequent progress as a small-cap company, Finfeed.com reached out to ABR Executive Director Anthony Hall for an exclusive interview, to be published later this week.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.