A “fingerprint” for the early detection of Parkinson’s? IIQ builds on previous Alzheimer’s validation

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 1,150,000 IIQ Shares and 525,000 IIQ Options at the time of publishing this article. The Company has been engaged by IIQ to share our commentary on the progress of our Investment in IIQ over time.

Anyone who knows someone with Parkinson’s or Alzheimer’s disease will attest to how awful these diseases are.

Memory loss, hallucinations, shaking - the list of symptoms for both these diseases are frightening to think about.

And as our population ages, these neurodegenerative diseases will become increasingly major priorities for health organisations.

What if science could help us detect (and treat) these diseases early, by distinctly identifying the “fingerprints” of the disease?

“Biomarkers” are these fingerprints - naturally occurring molecules, genes, or other characteristics by which diseases can be objectively identified.

This new scientific frontier of early detection is looking more within reach for diseases like Parkinson’s and Alzheimer’s after today’s announcement from our biotech Investment, Inoviq (ASX:IIQ).

IIQ said today that it had further validated its NEURO-NET technology - greatly increasing the potential for earlier detection of the onset for Parkinson's disease:

(Source)

This builds on a previous June announcement that showed a similar “fingerprint” could be found in proteins associated with Alzheimer’s disease:

(Source)

This development shows that IIQ’s technology is expanding to new neurodegenerative diseases - and it's not too far-fetched to think the tech could soon be put to use on other conditions of the brain.

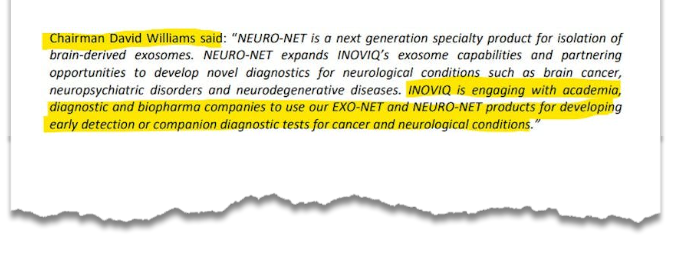

Hidden in plain view of today’s IIQ announcement, was a little snippet of a quote from IIQ Chairman David Williams that got our attention:

(Source)

In short, it appears that IIQ’s NEURO-NET technology is getting serious attention from (potentially much larger) diagnostic and biopharma companies.

Especially now that IIQ has demonstrated that its technology is now validated for both Alzheimer’s and Parkinson's.

Armed with this validation, and while its early days given its only just happened, we think there could be some larger companies lining up in IIQ’s biotech “data room” from these engagements.

Currently, there is no lab or imaging test that is recommended or definitive for Parkinson’s disease. (Source)

If a test is to be developed, it could require IIQ’s NEURO-NET exosome technology to isolate the “fingerprints”.

Hence, why we think IIQ’s product for Parkinson’s and Alzheimer’s could be of interest to larger companies than the ~$61M capped IIQ.

Ultimately as Investors, commercial traction is what we want to see as IIQ’s research program expands.

Partnerships, licensing deals, sales of research tools - it all feeds into our IIQ Big Bet:

Our Big Bet for IIQ

“IIQ re-rates to a +$500M market cap on commercialisation of its breast cancer test, its ovarian cancer test, neurodegenerative disease test and/or its solid tumour (breast cancer) therapy.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our IIQ Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

IIQ webinar on tomorrow

With good progress being made by IIQ on a number of fronts, we’ll be tuning in to the company’s EGM webinar, which will be hosted online on Wednesday (tomorrow), 21 August 2024 at 2:30 PM AEST:

Click here to register for IIQ’s webinar tomorrow

Reminder: what are exosomes?

Today’s news is about a product that IIQ has developed called NEURO-NET, that isolates brain-derived exosomes.

Before we dive deeper into IIQ, here’s a quick science lesson.

Exosomes are extra-cellular “containers” released by ALL human cells.

(You may see exosomes referred to as “EVs” in some IIQ announcements - which stands for “Extracellular Vesicles” - and vesicles is really just a technical term for “containers”).

Exosomes are “nano-scale” tiny - much tinier than a human cell, and were only discovered in the early 1980s. (Source)

Exosomes carry molecular cargo (e.g. DNA, RNA, proteins and lipids) that act as cell messengers or biomarkers of disease.

Think of exosomes as the “couriers” or “postmen” for messages being delivered around the human body.

They pick up and drop off messages (biological information) to different parts of the body which trigger tailored responses from different cells.

Because of their tiny size, exosomes are able to cross the “blood-brain barrier” and potentially, provide a fingerprint of the health or disease status of the brain.

Read our launch note on IIQ below to find out more about what exosomes are, and why they could be so important to a range of diagnostic and therapeutic breakthroughs:

Our New Investment is Inoviq (ASX: IIQ)

What does IIQ do?

IIQ is developing technologies using exosomes to both diagnose (find what’s wrong) and treat (fix what’s wrong) various conditions.

IIQ has various products (both exosome and non-exosome) at various different stages of development. Here are some key highlights from its technology:

- A breast cancer test that detects 19% more breast cancers than the current FDA approved test.

- A breast cancer therapy that kills 75% of breast cancer cells in 72 hours (test tube).

- Work ongoing for tests across ovarian cancer, and neurodegenerative diseases like Alzheimer’s (and now Parkinson’s).

- An in-market exosome isolation tool for other companies working with exosomes, already generating revenue

IIQ has three different business applications for its exosome and non-exosome based technologies:

- Research Tools (US$661M market size) - IIQ has an exosome-based tool used by researchers to enable biomarker discovery (identifying diseases) and validation (supporting the research of new treatments). This is the tool that IIQ is generating revenue from already.

- Diagnostic Products (US$6.1BN market size) - IIQ is developing exosome and non-exosome based tests for screening and monitoring various conditions including breast cancer and ovarian cancer.

- Therapeutics (US$55.3BN market size) - IIQ is developing a “weaponised” exosome engineered to target and treat solid tumours. IIQ is at an earlier development stage with this one compared to its Research Tool and Diagnostic Products.

As we mentioned above, IIQ is already making revenue from its research tools segment - this brought in $261K last quarter, which should continue to help fund IIQ’s research and development efforts.

Currently capped at $61M, IIQ’s most recent quarterly report showed a $9.2M cash balance at the end of June quarter, with a further $2.379M coming in after the quarter ended.

That comes after the company raised $7M from institutions last quarter at 50c/share followed by a heavily oversubscribed SPP.

The SPP was almost three times oversubscribed - IIQ ended up scaling back the demand and taking ~$2.4M of the $7.3M in applications.

Huge demand in SPPs is a good sign there are buyers out there for a stock.

We see IIQ as currently very well funded to deliver on expected catalysts, in addition to the surprise upside we got to see today on Parkinson’s disease...

Back to today’s IIQ announcement...

Today’s news is valuable because IIQ has validated that its technology can successfully isolate brain-derived exosomes in BOTH Parkinson's disease and Alzheimer’s.

This is a great “proof of concept” demonstration that it can show to bigger companies that are seeking to develop novel diagnostics - which opens the door for potential partnering opportunities as we mentioned above.

The key sentence in today’s announcement for us was this:

“NEURO-NET enriches known protein biomarkers of neurodegenerative diseases by 5-8-fold compared to measuring them directly from blood.”

NEURO-NET helps IIQ capture these proteins within exosomes which were then studied by the prestigious Walter & Elisa Hall Institute at the University of Melbourne.

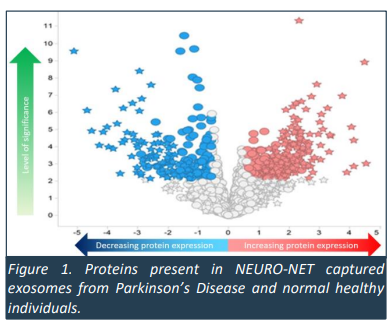

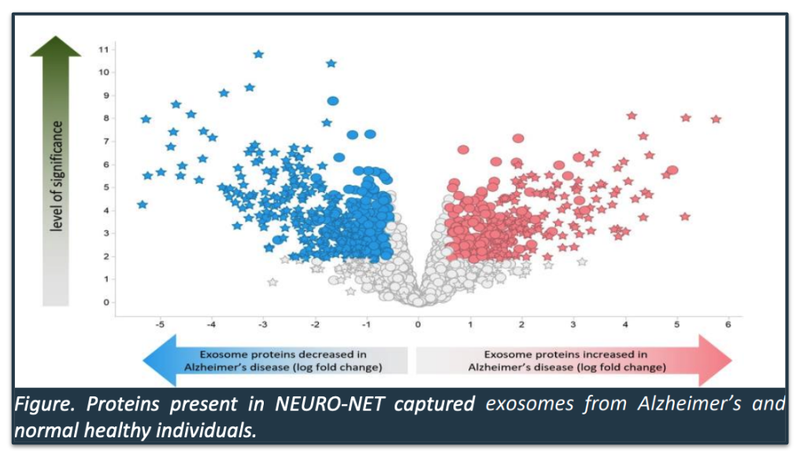

A study by that organisation produced a “map” of proteins which looks like this:

(Source)

This is one view of a potential “fingerprint” for Parkinson’s disease.

This “fingerprint” looks remarkably similar to the untrained eye as the “map” of proteins produced in IIQ’s June announcement on Alzheimer’s disease...

Below is a “map” of proteins that IIQ NEURO-NET product was able to isolate for Alzheimer’s:

(Source)

IIQ said in that June announcement that it will now be putting AI to work on understanding this map - “these proteins will be combined using AI algorithms to develop a potential exosome-based blood test for Alzheimer’s Disease.”

Ultimately, we want to see this data form the basis for IIQ to help a potential partner develop an Alzheimer’s diagnostics tool and now, a Parkinson’s diagnostic tool.

We think it's also possible that NEURO-NET could have applications in other neurodegenerative diseases as well, such is the beauty of scientific research.

You just don’t know sometimes, where it will lead you.

How does today’s news impact our IIQ Investment Memo?

We see today’s news as unexpected upside for us as IIQ Investors, with NEURO-NET now being applicable to Parkinson’s in addition to Alzheimer’s...

Objective #3: Advance neurodegenerative disease test (Alzheimer’s)

Milestones

✅NEURO-NET validation data (Alzheimer’s test)

🔲Start exosome diagnostic development for Alzheimer’s Disease

Source: What do we expect IIQ to deliver? Section - IIQ Investment Memo 12-June-2024

We knew that it had potential for Alzheimer’s when we Invested, so we’re now hoping that IIQ might be able to expand the neurodegenerative disease test to new diseases, and advance discussions with the entities IIQ is engaging with that were alluded to in today’s announcement.

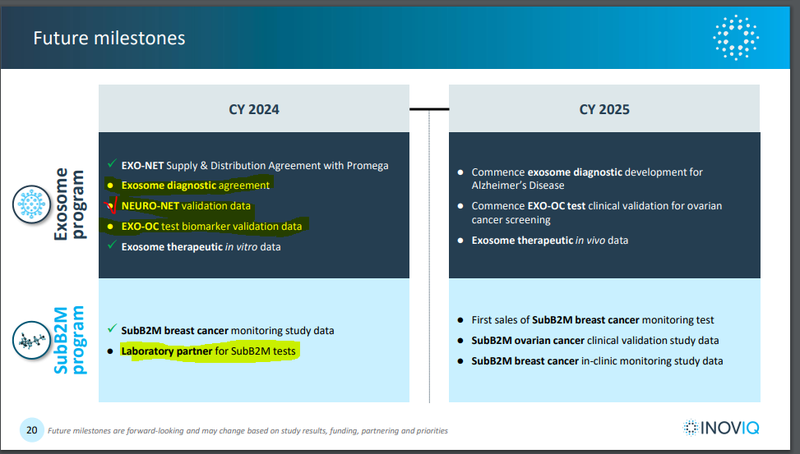

What’s next for IIQ?

In particular, here’s what we are looking for:

- A laboratory partner for its “SubB2M” breast cancer blood test - which detects 19% more breast cancers than the leading test (CA15-3 test by $332BN Roche) with an impressive 81% sensitivity and 93% specificity across a range of breast cancers.

This would speed IIQ’s path to market and the prospect of making money. IIQ also has an ovarian cancer SubB2M test.

- An exosome diagnostic agreement - some form of commercial arrangement for IIQ’s exosome based tests. This would show that an external party sees the potential in IIQ’s exosome based tests.

- Exosome ovarian cancer test validation data - which will tell us how accurately IIQ’s test detects this disease.

Below is a timeline of these potential catalysts:

(Source)

While we know scientific research doesn’t proceed in a straight line, this year we are hoping IIQ can make progress in securing a laboratory partner for its “SubB2M” tests for breast cancer (and ovarian cancer).

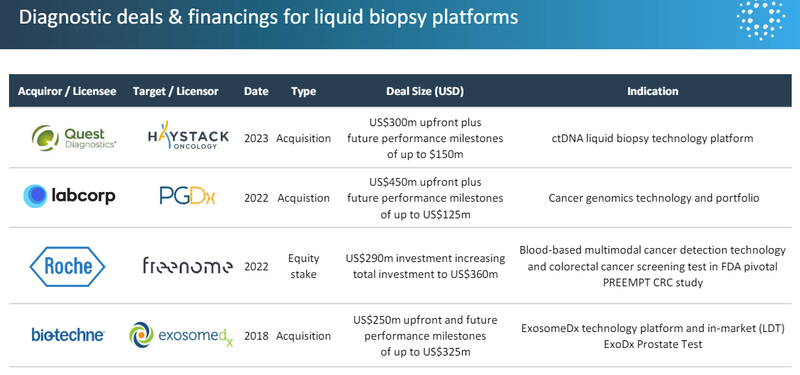

The recent deal sizes for liquid biopsies (blood tests) for cancer hover in the US$250-US$450M in upfront payment range:

(Source)

And those deal sizes are all at multiples of IIQ’s current market cap.

But as is the case for all early stage biotechnology investments, while those deal sizes do look good and are the type of catalyst we are Invested for - things can also go wrong...

What could go wrong?

As Investors we always like to understand at least some of the risks of an Investment before Investing - but we will never be able to identify all of them.

For IIQ, we identified some risks in our June 2024 IIQ Investment Memo.

This mainly applies to the solid tumour (breast cancer) therapy, which is currently in the preclinical phase of its development - noting that clinical validation for the diagnostic arm of IIQ’s business can still go wrong.

Early stage biotech risk

There are some standard risks that are associated with early stage biotechs, although the treatment appears effective in a test tube, this might not translate to humans. Key risks:

The treatment is ineffective

The treatment is not considered safe for human use

Patient recruitment is delayed

Ethics approval is delayed

Source: What could go wrong? Section - IIQ Investment Memo 12-June-2024

Additionally, another risk we are conscious of is “commercialisation risk” - meaning IIQ may find it difficult to bring its diagnostics into the market or other competitor products could crowd out IIQ’s product offerings.

We’re looking for near term traction on a laboratory partner for its SubB2M tests to reduce this risk.

Our IIQ Investment Memo

You can read our Investment Memo in the link below.

This memo provides a short, high-level summary of our reasons for Investing. We use this memo to track the progress of all our Investments over time.

In our IIQ Investment Memo, you can find the following:

- What does IIQ do?

- The macro theme for IIQ

- Our IIQ Big Bet

- What we want to see IIQ achieve

- Why we are Invested in IIQ

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.