$60M Asset Valuation for $2.4M Capped ROG

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

$2.4M market capped Red Sky Energy (ASX:ROG) is undergoing a significant overhaul.

With a new board and strategy in place, the company has unveiled a plan to acquire strategic, conventional onshore oil assets in the USA. The company is seeking to acquire proven, producing oil assets that can generate cash flow now, and are profitable even at current oil prices.

Phase one of this oil asset aggregation strategy began last year, with the company announcing a planned acquisition of 50% of the Cache Oilfield, in the USA.

The acquisition price is capped at just $2.1M for its 50% of Cache, which is significantly less than a recent independent $60M valuation for the entire Cache Oilfield.

Owing to a cyclical low in oil prices, assets like the Cache Oilfield have become relatively cheaper, with ROG picking up the asset at an implied per acre valuation of between $650 – $1,200 per acre.

The $30M valuation for ROG’s 50% share of the asset is in stark contrast to ROG’s current market cap of $2.4M.

With low production costs of just $18.67 per barrel anticipated from the Cache Oilfield, ROG is well placed to make money even with the current oil price, and much more in a rising oil price environment.

The Cache Oilfield has produced over 5 million barrels to date, however this was from wells drilled in the 1960s. By applying modern drilling techniques, ROG plan to jump start the oil field and revive its production capacity over the coming months.

To fund the transaction, ROG intends to raise $1.85M in the coming weeks, which is enough for the company to drill a first up production well, right beside a proven production well in the field.

Based on evaluations undertaken to date, this first well could produce between 250 and 500 barrels of oil per day, allowing the company to start generating strong revenues almost immediately.

ROG’s new oil aggregation strategy, which works at todays oil price, could soon pay off, especially if the oil price recovers over the coming months.

Pursuing a New Strategy in a Traditional Way

In November 2014, ROG announced the acquisition of a 50% stake in the Cache oil field in Colorado, USA at a price of between $1.2 – $2.1 million. This was followed up on 16 March 2015, by executing a definitive document to acquire 50% Cache from its current vendors which include ‘Monument Global Resources Inc’ (MGRI).

MGRI are the current operators of the field, and will continue to operate it once ROG takes up its 50% stake.

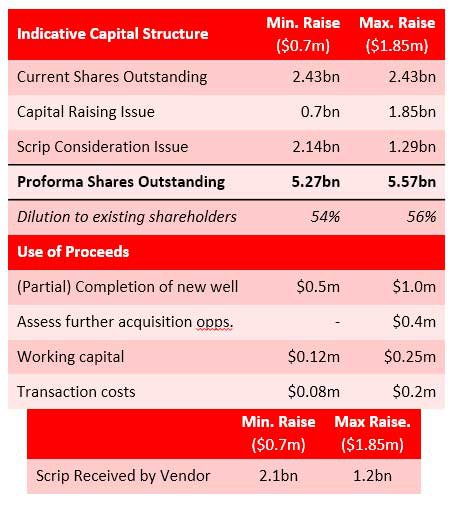

The deal will be completed following a shareholder meeting scheduled for July 17th 2015. ROG expects to issue between 1.29 and 2.1 billion shares at a deemed issue price of $0.001. Overall ROG wants to raise $700,000-$1.85M by issuing 700 million-1.85 billion shares.

MGRI stand to receive a further issue of shares for any shortfall of capital between the actual raising and the maximum that was allowed.

Since the signing of a binding terms sheet in November 2014, ROG has embarked on a thorough due diligence process including the commissioning of an independent valuation of ROG’s proposed investment in the Cache oil field.

The valuation was conducted by Global Resources & Infrastructure (GRI) and concluded that ROG’s stake is worth between $29.66M – $35.27M. To satisfy ASX listing rules, an Independent Experts Report (IER) was prepared by ‘Nexia Melbourne Pty Ltd’ thus substantiating the independent report published by GRI.

ROG has now finalised the legal documentation and is able to put the offer to its shareholders within the coming weeks. The transaction is expected to be completed subject to shareholder and regulatory approvals, as well as raising up to $1.85 million.

Cache Oilfield in Focus

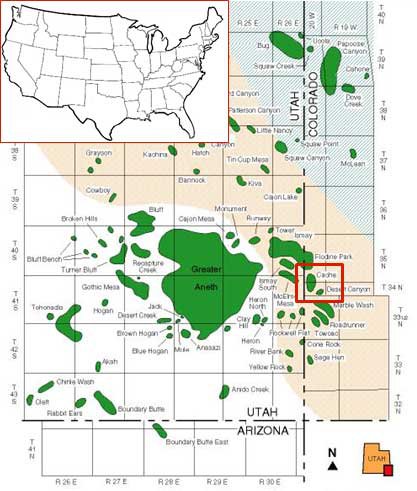

The Cache Oilfield is located in Montezuma County, Colorado in the United States, approximately 10 miles east of the much larger ‘Greater Aneth’ field. Greater Aneth produces around 100,000 barrels per day and boasts a resource of 1.5 billion barrels of Original Oil in Place (OOIP).

According to GRI, the ‘Greater Aneth’ field is an analogue for the ‘Cache’ field – which adds to GRI’s conclusion that oil production from Cache could total over 5 million barrels over the next 10 years.

The Cache field is the most productive oil field in the Colorado portion of the Paradox basin, having produced over 5 million barrels since being discovered in the 1960’s, with Original Oil in Place of 24 million barrels. According to GRI, 80% of the OOIP (19.3 million barrels) are yet to be tapped.

Cache is considered a relatively low-depth oil field where crude deposits are extracted at a depth of ~5,600 feet, which assists in keeping operating costs low for ROG.

The independent valuation carried out by GRI states that 5 million barrels remain recoverable and a production rate from the first well of 250-500 barrels per day is likely. By applying a conservative production estimate of 350 barrels per day (in-line with GRI’s independent assessment), ROG expects to maintain a production cost of just $18.67 per barrel – profitable even in today’s low oil price environment.

To estimate original-oil-in-place (OOIP) and rates of recovery, GRI used existing data derived from drilling activities and the production history of the Cache field along with recent petrophysical and geophysical analysis as part of an independent technical assessment.

The amount of oil recoverable is estimated to be at least 5 million barrels depending on whether modern extraction techniques such as carbon dioxide (CO2) and water flooding are used. Independent technical analysis combined with ROG and MGRI assessments indicates that extra recoverable reserves using these technologies will add a further 5.1 to 6.0 MMSTB to the remaining reserves.

The GRI report also makes note of how the analogous ‘Aneth’ field experienced a boost in production via CO2 flooding, work overs and infrastructure upgrades.

These activities have never been conducted before at the Cache Oil field, and will therefore be a top priority for ROG once the acquisition is complete.

Furthermore, from recent geophysical and petro-physical analyses, the independent assessors expect additional oil to be available for production as there are still areas within the field where no previous drilling has been undertaken.

Cache is currently producing at a rate of approximately 12 BOPD (barrels of oil per day) of sweet 440-450 API oil from a single well first drilled in the 1960s. Despite producing oil, the well itself is no longer viable due to mechanical issues and deteriorating borehole integrity.

ROG intend to utilise horizontal drilling technology and extraction techniques in order to establish significant flow rates from new wells. Drilling laterally within the reservoir interval maximises the probability of intersecting zones of higher porosity and permeability, which in theory should lead to higher sustainable oil flow rates.

To that end, two test wells have been earmarked to test the efficacy of lateral drilling on flow/recovery rates with the potential bonus of finding fresh primary oil reserves in the southern part of Cache that have only been partially drilled.

Its first act once the acquisition is complete is to drill a production well beside the one remaining historically producing well. It’s expected that this well should produce significantly more than the remnant 12 BOPD still being produced from the historic well, which was drilled in 1967 and once produced over 300 BOPD.

According to independent assessors GRI; ROG could expand the rate of production significantly from current rates up to as high as 1,500 BOPD depending on well performance.

At this stage, if ROG obtains the necessary shareholder approvals and funding, the company plans to drill one well in the immediate future with a second well soon after. Overall, ROG expects the Cache project to require at least 6 new wells alongside seismic and 3D surveys in order to extract the most oil from the field.

This imminent drilling will test ROG’s production model and could potentially be supplemented by 3D seismic analysis and additional wells by the end of the year, depending on results.

New Team, New Direction

ROG’s underlying commercial strategy is being led by Russel Krause, Non-Executive Chairman and Clinton Carey, Managing Director. Both individuals have recently joined ROG having been appointed in November 2014 and January 2015 respectively.

Under the leadership of Mr. Krause and Mr. Carey, ROG plans to build a portfolio of US-based on-shore conventional oil & gas assets with Cache being the first transaction of its type as part of its new strategy.

After the Cache deal is complete, ROG will bring on-board an experienced team already working at the Cache site for current vendors MGRI, which will become a substantial shareholder in ROG as part of the deal.

Kerry Smith, an oil industry veteran with over 30 years’ experience (and founder of MGRI) is expected to fill the Executive Chairman role while William Reinhart is expected to become Non-Executive Director, bringing over three decades of industry experience having held positions at several oil companies including ‘Mobil Exploration’.

Adapting to the Cold in Energy

ROG’s latest shift into conventional oil and ultimately embarking on an asset aggregation strategy targeting producing assets, could finally turn the tide for this previously embattled company.

ROG has turned to experienced navigators of the crude oil industry both from a corporate and a geological perspective to usher in a period of potential prosperity for the company.

According to Managing Director Clinton Carey, “Oil prices remain suppressed by global market conditions which is putting severe strain on non-conventional producers which typically extract oil at around $60 cost per barrel – this is counter-productive given current prices”.

He added, “Futures contracts agreed when oil prices were much higher is keeping many non-conventional producers viable. If crude oil prices remain flat or fall further, ROG will be able to sustain commercially viable production given our sub $20 per barrel cost price whereas non-conventional and capital expensive exploration is becoming increasingly difficult to justify”.

“The Cache acquisition represents a new exciting opportunity for ROG and is its first step in a new direction. Cache has been purchased in a depressed oil environment but as it is a traditional oil play, it can and will, make profits at current oil prices. This acquisition provides a platform from which the Company will be able to continue to build a portfolio of quality assets.”

By focusing on conventional, low-cost oil production, ROG is going back to the roots of oil production which could prove to be the most effective strategy considering the current weakness in oil prices.

Furthermore, with future crude oil prices facing such uncertainty and volatility in the global commodities markets, ROG’s conventional approach provides substantial leverage to rising oil prices while low-cost production insulates ROG against falling oil prices to a much higher degree than capex hungry high-tech oil exploration.

The information in this website is general information only. Any advice is general advice only. Your personal objectives, financial situation or needs have not been taken into consideration.

Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. S3 Consortium Pty Ltd (CAR No.433913) is a corporate authorised representative of AG Capital Markets Pty Ltd (AFSL No. 292464).

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.