1STAvailable delivers strong first quarter growth and strategically positioned to outperform in fiscal 2017

Published 27-OCT-2016 14:06 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

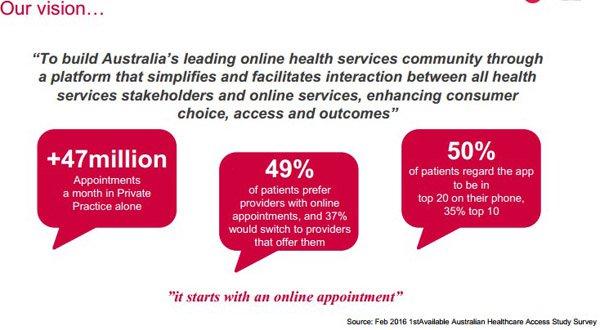

1stAvailable (ASX: 1ST) has delivered a strong first half performance from a financial and operational perspective, while also forging some promising client relationships.

The company is an Australian online healthcare portal that simplifies and facilitates digital interaction between health services and consumers. The group provides cloud-based solutions including online search and appointment booking services for healthcare providers, reducing waiting times for patients and helping to automate healthcare providers’ administrative services.

With healthcare services stretched it is not surprising to see 1ST continue its impressive growth trajectory.

The company’s monthly recurring revenue for the three months to September 30, 2016 was $193,000, representing year-on-year growth of more than 40%.

Furthermore, monthly new consumer registrations have increased by 400% to more than 20,000 a month since July 2015. This positions the company strongly in terms of generating robust recurring income.

However, we should remind readers that investment decisions should not be based on forward looking statements or historical share price performances alone. Investors should seek independent financial advice if considering this stock for their portfolio.

1ST branches out into new industries and expanded its position in dental

In tandem with today’s quarterly update, the company announced that it had negotiated a new subscription agreement with a major dental corporate client.

Under the agreement, the 1ST platform will be rolled out initially to their New South Wales dental centres which accounts for 130 dentists.

This represents a substantial increase in the company’s share of the dental market with its customer base already including Primary Health Care’s dental division and the Pacific Smiles group.

The company has also made impressive inroads into the optical healthcare market with its clients including high profile organisations such as Bupa Optical, The Optical Company and a major group of independent optometrists.

This area of the company’s business is expected to be a strong growth driver in the December quarter.

1ST’s services also extend to the luxury cosmetics market where new agreements have been negotiated with leading retailer, Napoleon Perdis which involves the rollout of its platform of 85 stores and six academies. This will assist in generating subscription revenue for the company.

These developments suggest fiscal 2017 will be an important transitionary period for the group, having established meaningful positions across the dental, optical and retail industries.

Substantial increase in recurring revenue points to strong growth in fiscal 2017

As highlighted by Managing Director, Klaus Bartosch, recurring revenue is a relatively accurate forward performance indicator, and with the company not far off generating $200,000 per month, 1ST is well-positioned to substantially outperform its fiscal 2016 annual revenue of circa $2 million.

Having ended the quarter with a cash balance of $5.6 million, 1ST looks to have the financial backing that will go a long way to finding its growth initiatives throughout the rest of fiscal 2017, including investment in building sales across its healthcare markets and introducing new products which will provide additional sources of income as well as revenue diversification.

Looking at near-term growth drivers, Bartosch said, “As subscription revenue grows, we increase the addressable base for our products which puts the patient first and will contribute to new transaction-based revenue”.

It is worth noting that 1ST’s net tangible assets per ordinary security as at June 30, 2016 was circa 2.9 cents, indicating that its recent trading range of approximately 5 cents doesn’t accurately reflect the underlying value of the business, as well as its growth potential.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.