Shares, Options and Performance Rights Explained

Published 12-JUL-2022 14:00 P.M.

|

6 minute read

When investing in individual companies it is important to see how one investment compares to other potential investments.

One way that we do this is by comparing the capital structures of stocks - which allows us to make decisions about a stocks’ relative value.

We use an internal portfolio management document (which we share with you today), that provides a holistic overview of the shares on issue, options on issue, performance rights, and director's holdings.

Each of these ‘securities’ makes up the capital structure of the business, and it’s important to identify who owns the securities and the potential ‘conditions’ attached to each.

Shares on issue

Shares represent a proportionate ownership or ‘equity’ in the company - and gives the shareholder certain rights.

Shares give you the right to vote on decisions made by the company - the more shares you have, the more your vote counts.

Shares can also provide other entitlements like dividend payouts, access to share purchase plans and more.

These rights underpin the value of the shares.

At the most basic level share prices move up and down as investors speculate on the potential value of a company, and potential value of the shares in the future.

But how can you find the value of a company?

The most common way to value a company is by calculating the market capitalisation or ‘market cap’, and you can find it by calculating:

Number of Shares on Issue x Share Price = Market Cap

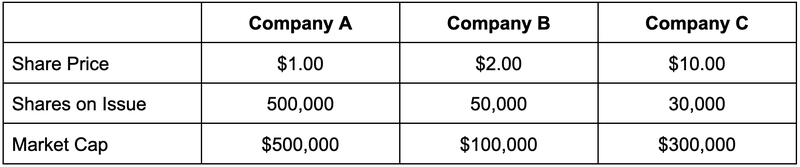

The market cap can be extremely useful in comparing companies within the same sector that have different share prices and a different number of shares on issue.

We have created a table to illustrate this point:

Despite having the lowest share price, Company A is the most valuable based on its market cap. And even though Company C has fewer shares on issue than Company B, its market cap is higher because of its higher share price.

These calculations can help investors compare and contrast companies with different share prices and shares on issue - to help inform a decision about whether the company is over or undervalued.

Options on issue

An option is not a share, but a right to purchase a share at a predetermined price within a certain time period.

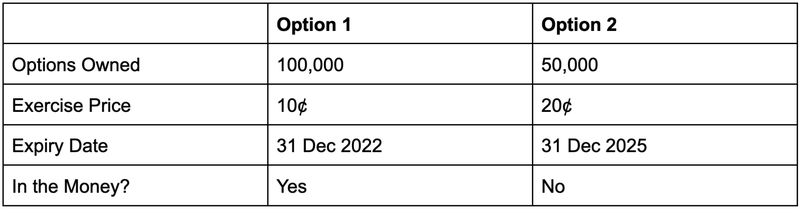

Let’s say that Company A has a share price of 15¢ and an investor owns two types of options in that company, as represented in this table:

Option 1 gives the investor a right to purchase 100,000 shares by paying 10¢ per share (a total of $10,000) to the company, before the 31st of December 2022.

Option 2 gives the investor a right to purchase 50,000 shares by paying 20¢ per share (a total of $10,000) to the company, before the 31st of December 2025.

The option is considered ‘in the money’ if the current share price is above the exercise price of the options. So with Company A’s share price of 15¢ Option 1 is in the money, whereas Option 2 is not.

In this scenario the investor can exercise the option for a price below the current share price — a decision that they will likely (and should) make.

For the company, this can be both good and bad.

Good, because it raises money for the company (the investor has to pay a price to convert the options into shares).

Bad, because once the options are exercised, the investor might immediately sell the shares on-market, putting downwards pressure on the company’s share price.

Knowing when options expire and their exercise price is important information that helps inform investors of any potential dilution that may be on the horizon.

In any case, it’s important to see how many options are on issue at any given time and at what price these are likely to come to market to be more informed when making an investment decision.

It is important to note that options don’t act like shares; they don’t provide ownership rights like voting rights, access to dividend or share purchase plans to the holder of the options — a technical but important distinction to make.

Performance rights and incentives

Performance rights are not shares either. They are a promise to issue shares to the management of a company if certain performance incentives (called vesting conditions) are met within a certain time period.

When a performance right vests (on successful completion of a milestone) the company will issue shares directly to the holder of these performance rights, diluting the ownership of current shareholders.

At first glance, dilution may sound scary but we like our portfolio companies granting key management personnel performance rights as it helps to align the interests of key management to that of retail investors.

Generally, there are two types of performance rights:

- Share price incentive: These are performance based incentives that vest if a company’s share price hits a certain level by a certain time. If the share price is achieved the directors (and management) will be issued shares.

- Company performance incentive: These are performance incentives that relate to hitting key milestones for the company. For example, delivering a Scoping Study, achieving a minimum JORC resource estimate, or delivering on a sales budget.

Understanding the performance rights help inform investors as to the motivation of the management and the team around them.

We think companies that have both share price and company performance incentives for their key management tend to have the best balance between company promotion and business execution.

Performance rights are generally proposed at a company’s annual meeting, when the incentives of key management are set and voted on by shareholders (remember owning a share gives you a vote).

For investors, knowing how many performance rights are on issue, and the vesting conditions behind those performance rights, can help to frame their interpretation of company decisions.

Conclusion

Identifying a company’s capital structure (market cap, shares on issue, options on issue and the performance rights/incentives) is some of the first due diligence work we do on a potential investment opportunity.

Without a holistic view of a company’s capital structure it would be impossible for us to assess whether a company makes for a good investment or not.

The obvious caveat is that the capital structure is just one step in a list of due diligence processes we run through.

Below is a link to the internal document that we use to track each company in our Portfolio. Click on the different tabs at the bottom of the sheet to see details of options, performance shares and director holdings.

Click here to access our internal document

We track these live as each company announces movements on their share registers.

(DISCLAIMER) Please note: We cannot guarantee the accuracy of the information in this spreadsheet. We manually update it every day from information announced by the stocks listed. Sometimes this information is incomplete or incorrectly recorded. Do not rely on this data to make investment decisions, you will need to do your own due diligence and research to evaluate the accuracy of this information.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.