Wild west of investing: why crypto regulation is required

Published 04-MAY-2018 15:07 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With little to no regulation in the alt-coin space before now, and with so few countries recognising Bitcoin as a form of currency for tax purposes, cryptocurrencies have become more and more popular.

Take Eddy Zillian for example. Zillian ‘risked everything’ when he began investing in cryptocurrency at just 15 years old. The self-proclaimed ‘Wolf of Crypto Street’ opened an account with online trading platform Kraken, investing a little over US$12,000.

Just three years later at the age of 18, Zillian is now worth “several million”

Eddy Zillian and his $500k BMW

But before you bite the bullet and pursue your dreams with reckless abandon, you may want to consider all the factors at play in this new and wild terrain.

You feeling lucky, punk?

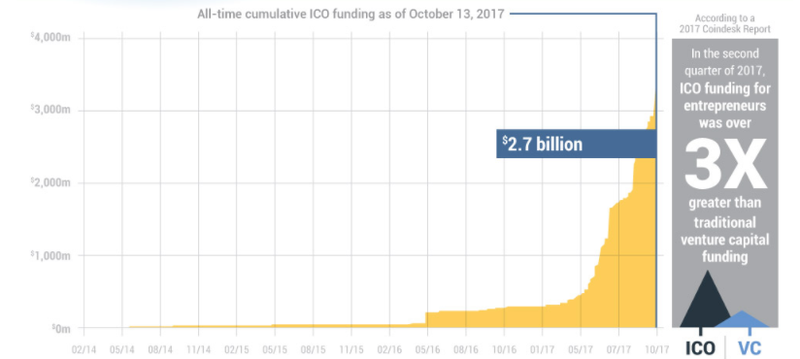

A rapid surge in ICOs or ‘initial coin offerings” (as seen below) has been a significant factor in the push to tighten legislation around cryptocurrencies.

ICOs are at an all-time high, and are largely open to anyone anywhere.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Unlike IPOs, ICOs are not regulated and are high risk propositions. They are seldom treated as securities and have more in common with crowdfunding or kickstarter campaigns.

Several scams have rocked the world of ICOs in recent months, with Confido headlining a slew of examples where investors were collectively robbed of millions of dollars.

Having billed itself as a ‘smart contract’ developer, Confido was to act as an escrow between buyer and seller during a business transaction. Initially things went well — the company held its ICO on TokenLot and raised over US$350,000, before trading at a high of US$1.20 on November 14.

Then in a feat challenging Houdini himself, the entire Confido team disappeared overnight, tanking the coin’s price to just two cents. Confido CEO Joost van Doorn was never heard from again, with internet users later theorising that Doorn’s headshot on the Confido website was pulled from a LinkedIn user in Amsterdam.

In a bizarre twist of events, Confido provided an update on its website indicating that it would buy back investor tokens for a ‘nominal fee’ until February 16, and would cease thereafter. No further explanation of the events transpiring to the announcement has been given, and the legitimacy of the update is unknown.

The Confido scandal, along with the recent LoopX scam and BitGail hack, serves as a cautionary tale for those looking to throw big money at ICOs.

True regulation reform in sight

Several countries are already moving to reform this investment craze.

China’s move to block cryptocurrency exchanges saw twitchy hands come to the fore, with Bitcoin losing half its value in less than three months.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

In Australia, growing concern over regulatory backing has seen the Australian banking sector withdraw their support for the cryptocurrency market. Adrian Lee, who is a senior finance lecturer at University of Technology Sydney, said the banking boycott was expected.

“There’s this murky issue of you buying something that doesn’t have any regulatory backing, and can be transferred off to do something else.

“The volumes have grown so quickly and the number of people using these services have grown so quickly," he said.

The move caused CoinSpot, which is one Australia’s leading cryptocurrency trading platforms, to suspend trading in AUD late last year.

“The temporary restriction on AUD deposits will remain in effect until at least the first week of the new year. As the demand for Bitcoin and other crypto assets skyrockets it is in everyone’s best interest to ensure we have regulated, safe and stable digital currency service providers instead of pushing Australian consumers underground,” CoinSpot wrote in an update on its website.

Australia is one of the countries to recognise Bitcoin as a form of currency, with traders now liable under ‘capital gains tax’ from late last year.

Regulation reform is also gaining momentum in the US, where leading industry watchdogs are calling on congress to amend key legislation. The Commodity Futures Trading Commission (CFTC) has been able to engage its anti-fraud powers to enforce cases against suspicious Bitcoin trading, but CFTC Chairman Jay Clayton has called on the US government to do more.

The International Monetary Fund also called for regulation earlier this year. “We are actively engaging in anti-money laundering and countering the financing of terrorism. And that reinforces our determination to work on those two directions,” Head of IMF Christine Lagarde said.

India, South Korea and the UK have also reaffirmed their intentions to regulate cryptocurrencies.

Darren Sommers of Melbourne firm KHQ Lawyers says, “It’s scary how many people I’ve heard of who see a lack of regulation as an incentive, whereas it should be the opposite. The massive ups and downs Bitcoin has experienced recently is surely enough to warrant legal certainty.

“Make no mistake, regulation is coming and the authorities will not hesitate in making an example out of someone when that time comes,” he concluded.

Henrik Anderson, Chief Investment Officer of crypto asset firm Apollo Capital, also welcomes regulation.

“At the moment digital is the domain of risk traders and day traders. But institutional investors like super funds and trusts have a cascade effect so if they enter the digital market the benefit is shared and more people win,” he said.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.