Vector targets gold trifecta in the Congo

Published 05-JAN-2018 12:21 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high-risk product. We stress that this article should only be used as one part of this decision-making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

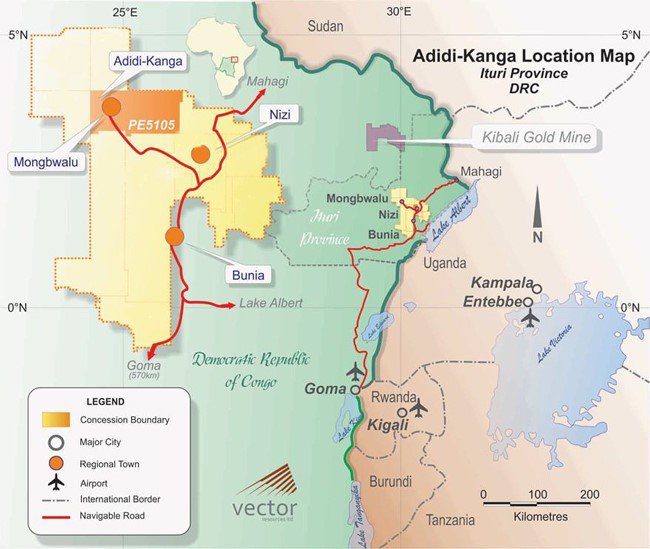

An Australian junior gold explorer has today published an update regarding its trifecta of gold projects in the Democratic Republic of Congo (DRC). Vector Resources (ASX:VEC) recently signed several gold joint venture transactions in order to secure significant land position and resource holding in one of the world’s largest greenstone belts.

VEC has signed binding agreements with state-owned gold mining company Société Minière de Kilo Moto (SOKIMO) to finalise joint venture agreements for its fully-owned Kibali South and Nizi Gold Projects located in the Ituri and Haut Uele Provinces in the DRC.

Source: Vector Resources

In addition, VEC has signed Heads of Agreement deals with Mongbwalu Gold Mines and Fimosa Capital for VEC to obtain a 60 per cent interest in the world-class Adidi-Kanga Gold Mine, part of the Mongbwalu Gold Project, located in the Ituri Province of the DRC.

It should be noted here that VEC remains a speculative stock operating in a high-risk area and investors should therefore seek professional financial advice if considering this stock for their portfolio.

A review of the status of the Adidi-Kanga Gold Mine has confirmed that the mine is already permitted for development, with Environmental and Social Impact Assessments completed and financial guarantees in place with the appropriate regulatory and administrative bodies in the DRC.

Adidi-Kanga Gold Project update

Adidi-Kanga is considered a world-class project comprising 13 licenses extending over 5,033 square kilometres that were the subject of extensive exploration activities by AngloGold Ashanti in the past. AngloGold completed significant exploration and development activities between 2005 and 2013, with the recorded data likely to be of technical use for VEC.

A Feasibility Study for the development of the Adidi-Kanga Mine was finalised by AngloGold Ashanti, who then commenced initial mine construction activities. AngloGold also secured the purchase and delivery of approximately 70 per cent of the mechanical equipment proposed to be installed under the Feasibility Study, at a cost of over US$70 million.

Source: Vector Resources

A review of the historical exploration and resource drilling is currently ongoing and VEC is assessing the amount of work VEC will need to complete upon finalisation of the proposed joint venture, following on from AngloGold’s previous DFS.

From the activities undertaken so far, a number of positive findings have already been identified at Adidi-Kanga. VEC says it may be able to incorporate additional areas of mineralisation defined by previous wider spaced drilling by AngloGold Ashanti into a new JORC-compliant Resource that VEC wants to complete in the first half of 2018.

Kibali South Gold Project Update

Following the completion of a technical due diligence assessment in late 2017, VEC’s technical team is now on site at Kibali to obtain more detailed information.

According to a shareholder update VEC stated that, “further meetings with senior management from SOKIMO are scheduled later this month in South Africa and the DRC, with negotiations on the key joint venture terms and timings to be finalised”.

Finalisation of due diligence reviews and joint venture negotiations for the Kibali South Gold Project remain on schedule and are anticipated to be completed by the end of February 2018.

Nizi Gold Project Update

The license area at VEC’s Nizi project comprises the historic King Leopold Mine, that was mined during Belgium colonial times and operated throughout the 20th century.

In addition to the King Leopold Gold Mine several other gold prospects have been identified and these are currently the subject of the ongoing technical due diligence work on the Nizi Gold Project.

A key area of focus of the technical due diligence review is the Baluma Gold Oxide Project, which has already been explored by SOKIMO through two auger and RAB drilling programs.

VEC’s technical management team and its consultants have completed extensive due diligence work over the last four weeks and are currently working in the DRC to finalise this step. VEC’s directors have progressed legal due diligence as well as the proposed joint venture documentation.

Both of VEC’s new transactions remain on schedule for completion in January and February 2018. If VEC’s subsequent development work proves to be successful, the company has the potential to transform itself from a junior explorer into a major gold company over the coming few years.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.