Tando ready to start vanadium drilling in August

Published 30-JUL-2018 15:18 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Tando Resources (ASX:TNO) has announced it is set to start an extensive two-pronged drilling program at its SPD Vanadium Project in South Africa in August.

The imminent start of drilling follows notification of grant of the Mining Right for the SPD Project by the South African Department of Mineral Resources. Drilling contractors have been engaged and will commence mobilising shortly, with site preparations already well advanced.

Drilling phases in detail

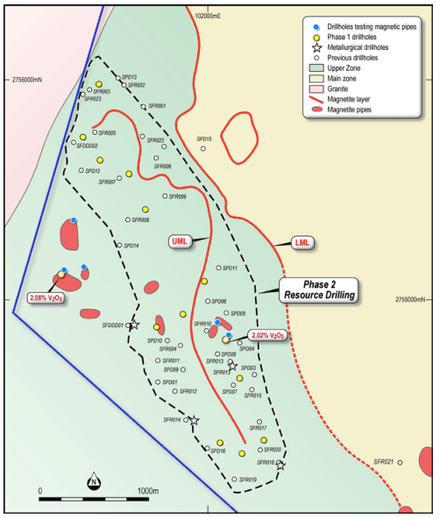

Phase One of the drilling program will comprise 18 holes for 1,650m at the SPD deposit, where there is currently a resource of 513 million tonnes at a grade of 0.78% V2O5 defined under the SAMREC code. This resource is a “foreign resource”.

The drilling is aimed at converting this “foreign resource” to a Mineral Resource estimate (MRE) as defined in the JORC Code. TNO expects the MRE will be published by October, 2018.

Phase One will also include the first holes to be drilled at the shallow, high-grade vanadium pipes which sit within a 3km radius of the SPD deposit. The company has reported a host of high-grade vanadium assays from samples taken from the surface of these pipes with assay results consistently above 2% V2O5.

According to the company, these vanadium grades highlight the strong potential for the pipes to underpin a simple, low-cost, high-grade DSO operation with a compressed development timetable.

Following completion of the Phase One drilling program, TNO will move straight into Phase Two, which will be aimed at upgrading the maiden JORC Resource to an Indicated category (provided results are as anticipated).

To achieve this goal, Phase Two is currently designed to comprise 58 holes for 5,550m. The cost to complete the entire Phase 1 and Phase 2 drilling programme and the resultant resource estimations is estimated at A$1.4 million.

TNO has current cash reserves in excess of A$4 million and consequently is fully funded for the drilling program as well as the metallurgical and mining studies which will follow completion of the drilling program.

It should be noted that this is an early stage company, so investors should seek professional financial advice for further information if considering this stock for their portfolio.

Due diligence and completion

Following the grant of the Mining Right, TNO has now completed formal due diligence on the SPD Vanadium Project.

It is anticipated that acquisition of a 73.95% stake in the SPD Vanadium Project will occur in late August following satisfaction of the remaining conditions precedent, including South African Reserve Bank approval and approval by TNO’s shareholders at the general meeting scheduled for 20 August.

TNO Managing Director Bill Oliver stated that the issue of the Mining Right was a significant step for the SPD Vanadium Project.

“We believe SPD is a world-class vanadium asset. Our view is supported by the historical drilling results and more recently, the outstanding high grade results we have achieved from sampling the vanadium pipes on site,” he said.

“We are confident that the imminent drilling program will justify our strong belief in the SPD Project, which we already know hosts an extensive deposit with high-grade vanadium.

“There is also substantial upside in the vanadium pipes, where the sampling results show there is potential to generate significant early cashflow via a low-cost DSO vanadium operation. With the energy sector undergoing a structural shift in favour of renewable energies and demand for vanadium forecast to grow strongly as a result, our work at SPD is timed perfectly.”

The region around the SPD Vanadium Project contains critical infrastructure such as:

- High voltage power lines and sub stations operated by the state provider ESKOM

- Water resources including the De Hoop Dam 15km south of the project

- Rail links

- Sealed roads around the project area

- Mining service companies and support business in the immediate area

- Available skilled workforce within the local community and the region

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.