Speculators drive Adriatic ahead of results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Recent media speculation regarding upcoming assay results increased trading activity in Adriatic Metals (ASX:ADT) in the lead up to Monday, July 16, 2018.

Speculation surrounded the anticipated timing of release of assay results for BR-4-18 and BR-5-18 at the company’s Rupice polymetallic project in Bosnia.

As a backdrop, the project comprises a historic open cut zinc/lead/barite and silver mine at Veovaca and Rupice, an advanced proximal deposit which exhibits exceptionally high-grades of base and precious metals.

Adriatic’s short-term aim is to expand the current JORC Resource at Veovaca and to complete an in-fill drilling programme at the high-grade Rupice deposit.

After the market closed on Monday, management was able to appraise investors of assay results from the recent hole BR-4-18, and the company also advised that the drilling of BR-6-18 had been completed.

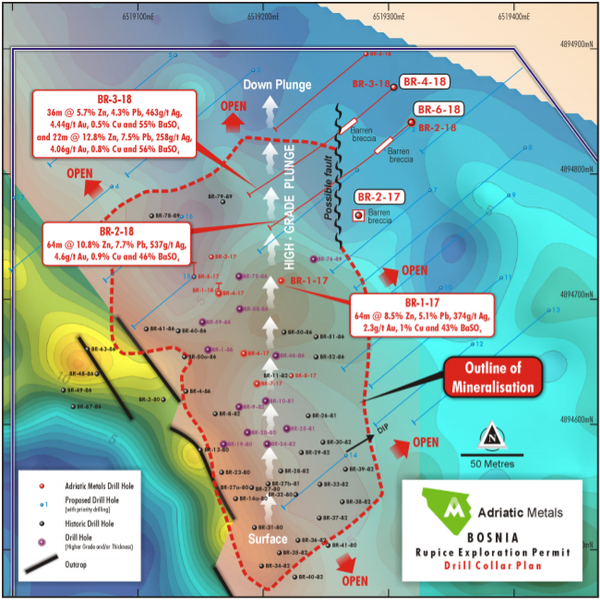

Importantly, these results as shown below are part of the company’s 15,000 metre drilling program, and as such should not be considered in isolation, but considered in the context of other data as illustrated on the mapped area.

Significantly, only limited drilling to date has already resulted in extensions to known mineralisation, as well as confirmation that the resource remains open at substantial widths in several directions.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Results provide a better understanding of big picture

The current drill program including the recent three holes leading up to BR-4-18 enhanced Adriatic’s understanding of the stratigraphic and structural controls on mineralisation at Rupice North.

The company will further investigate the eastern flank of Rupice North based after examining this recent data.

On this note, ADT’s CEO, Geraint Harris highlighted the importance of upcoming results from BR-5-18 in saying, “This information will help us to understand the down-dip potential at Rupice and whether these holes represent an isolated embayment in the mineralisation or a more significant eastern boundary.

“However, the mineralisation remains very much open in all directions, and we eagerly await the results for BR-5-18 which sought to test the down plunge extension.

“The programme will also include infill drilling within the area of known mineralisation to enable us to include all metals in a Maiden Mineral Resource Estimate within the first half of 2019.”

Importantly, Harris has extensive experience in managing projects across Europe, Asia and former Soviet regions.

Speculation driven by high grade results to date

There appears little doubt that the degree of speculation leading up to the release of upcoming assay results which resulted in the company’s shares soaring circa 25 per cent in recent weeks was accentuated by the company’s success in early drilling.

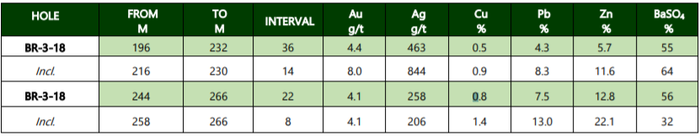

BR-3-18 returned thick intercepts of high grade mineralisation, with particularly robust zinc grades.

These included 36 metres grading 4.4 g/t gold and 5.7 per cent zinc and 22 metres at 4.1 g/t gold, but extremely high-grade zinc of 12.8 per cent.

It is also worth noting that within those two intercepts, zinc grades of 11.6 per cent and 22.1 per cent were delineated.

Extends Rupice North Zone

These drill results culminated in a significant extension to the north and notably down dip at the Rupice North Zone.

Management expects a continuation of step out drilling will substantially expand its knowledge of the broader deposit, as well as the highly mineralised zone recently defined.

The fact that the mineralised zone remains open at substantial widths in several directions provides the company with numerous options in terms of exploration targets.

Extra drill rig to be brought on-site

Management confirmed that it currently has three rigs drilling operating at Rupice, and intends to bring a fourth rig to site as soon as possible, a move that will enable it to thoroughly drill test in all directions.

Areas such as Bosnia, Serbia, Romania and Bulgaria are attracting plenty of attention from the big corporates as the area has been identified as highly prospective for base and precious metals with limited exploration.

Its popularity is demonstrated in the following map of the broader region.

Benefits from board and shareholder experience

Adriatic has a strong board with experience in managing large projects for multinationals.

Of particular importance given the company’s zinc focus and project location is the experience that chief executive Geraint Harris’ brings to the table.

Harris worked and lived in numerous countries across his career including Europe, North and South America, Central Asia, former Soviet Union and China.

He was also manager mine services for Lisheen (high grade U/G) in Ireland, one of the biggest zinc mines in the world until its recent closure.

Providing an extra boost was the introduction of Sandfire Resources (ASX:SFR) as a new cornerstone investor and strategic partner.

Not only does Sandfire’s management team have an extensive working knowledge of a multi-commodity mining production operations, but it brings technical and commercial expertise, including financing experience.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.