Shree spikes as it advances Nelson Bay

Published 24-JUL-2019 09:30 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

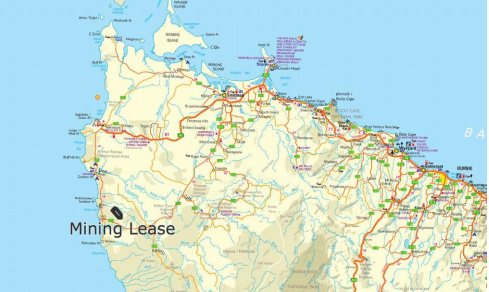

Shares in Shree Minerals Ltd (ASX:SHH) surged more than 30% on Tuesday after management informed the market that the company was actively advancing the re-permitting activities that form part of the development process of the Direct Shipping Ore (DSO) project at Nelson Bay River Iron in north-west Tasmania.

An advanced working draft of the Development Proposal and Environment Management Plan (DPEMP) has been submitted to the Environmental Protection Authority (EPA) for their review as part of the assessment process.

The location of Shree’s wholly owned Nelson Bay River Project including Mining Lease 3M/2011 is shown below.

Progress at the project comes at an opportune time given that the iron ore price has maintained its strong momentum.

Management said that the iron ore price had continued to improve, rising to a range around US$120 per tonne (CFR China) for benchmark 62% iron.

The group also highlighted that there had been a substantial reduction in discounts for medium grade iron ore such as the 58% iron that Shree produces.

Coinciding with these dynamics, there has been further improvement in premiums for material with lower impurities like low alumina (as previously produced by NBR) as Chinese authorities continue their emphasis on environment control.

The reduction in the Australian dollar against the US dollar is also working in Shree’s favour.

The iron ore prices in Australian Dollar terms have further improved due to the exchange rate of the AUD with USD at around US$0.70 levels compared to around US$0.95 levels when the NBR project was last operating in 2014.

Effectively, the market prices have more than doubled for the company’s DSO iron ore products in the last year, due to improving fundamentals in the sector.

In management’s view, any near-term supply response is expected to be limited, particularly with little latent capacity left at major iron ore exporting ports and railways in Australia.

Shree to benefit from existing infrastructure

NBR has a JORC compliant global iron Resource of 11.3 million tonnes, including Goethitic-Hematite Resource of 1.4 million tonnes and magnetite Resource of 7.8 million tonnes.

The project has three types of resources: Direct Shipping Ore (DSO), Beneficiable Low-Grade Resource (BFO) and a Magnetite Resource.

The Resource at NBR covers approximately one kilometre in strike length of goethite-hematite mineralisation including approximately 400 metres of magnetite.

The magnetite resource can produce high grade concentrates for Blast Furnace Pellets (BFP) and Dense Media Magnetite (DMM).

A cap of oxide resource covers the magnetite resource and extends southwards for a further 600 metres of strike.

The oxide resource is composed of goethitic-hematite DSO and magnetic goethitic-hematite material amenable to beneficiation.

NBR was previously producing fines and lump DSO products until being placed on care and maintenance since June 2014 following sharp falls in the iron ore price.

Following the recent improvement in iron ore prices, management has commenced actively pursuing re-permitting activities forming part of development process of DSO project at NBR.

Shree is seeking approval to re-open the mine that would allow the company to complete the existing DSO pit by extraction, processing and shipment of the remaining hematite ore.

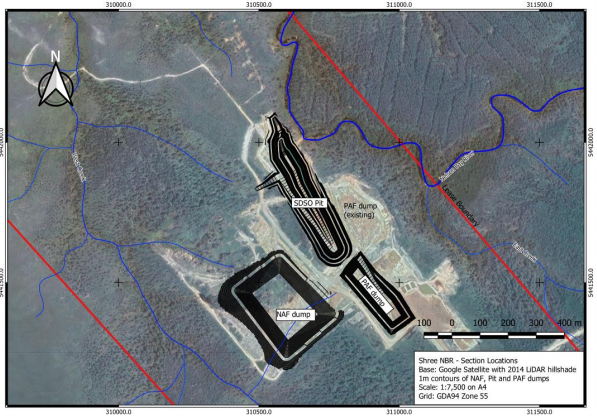

The revised project will utilise associated infrastructure including the existing Waste Rock Dump (WRD), Run of Mine pad, roads, water and other infrastructure, all located within the current mine footprint.

South DSO pit 25% complete at 15 metres

The DSO does not require major processing beyond crushing and screening, allowing immediate trucking to the port where it is shipped to overseas markets.

The south DSO pit (SDSO) was developed in 2013, and production commenced in November 2013 with first shipment occurring in January 2014.

The iron ore shipments totalled 181,000 tonnes historically.

The NBR product (DSO Lump and Fines) has been very well received and is in demand by customers due to its low impurities like alumina (Al2O3) at only 1.3%.

Management intends to extend the SDSO pit to a depth of approximately 80 metres in order to mine the remains of the near-surface oxidised ore body which comprises DSO hematite.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.