Shell Watch: SLT to acquire Australia’s number one ‘rental only’ property website

Published 18-FEB-2015 08:19 A.M.

|

12 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Select Exploration (ASX:SLT) has signed a binding Term Sheet with Rent.com.au Pty Ltd (RENT) to acquire 100% of the issued capital of RENT, Australia’s leading website and mobile platform devoted exclusively to the rental property market.

RENT has created the only national marketplace for renters to find their next rental property from both agent and private landlord listings, as well as providing a range of services needed by renters in the renting process.

RENT estimates that there are approximately one million private landlords in the market, representing nearly half of Australia’s rental advertising market, who are still advertising their rentals offline, in traditional print media or by word of mouth.

Following completion of the acquisition, SLT will be renamed Rent.com.au Limited and the Board and management team of RENT will be retained – with RENT founder and CEO Mark Woschnak being appointed Managing Director and CEO of the company.

RENT provides the real estate industry a much needed expansion in tailored services to both the renter and landlord market, by creating an online home of renting.

It is the significant, offline, private landlord market that RENT is aiming to transition from print to online at www.rent.com.au. New listings will combine with the over 50,000 currently active rental listings from real estate agents already on the site.

With 30% of Australians renting and an average tenancy duration of around 10 months, the rental market is large. Every time a property is re-listed on the website, RENT generates revenue from listings, upgrades and its range of services – it’s this recurring revenue potential from a new, previously unaddressed market, which is one of the key opportunities for growth.

30% of Australia’s population are renters

RENT have positioned themselves differently to the two leading property websites in Australia – realestate.com.au and Domain. These sites are focused chiefly on property sales – with rentals getting second billing and only found on side tabs.

RENT is considered to be one of the last opportunities for moving a traditional print-based business like the property rental market into the online space by creating a genuine online marketplace – representing all industry participants in the process.

It’s happened before with the car sales market – Carsales.com (ASX:CRZ) now commands a $2.4BN market cap, and in a similar way to rent.com.au, they started by getting the dealer network on board and then opening up to private car sellers.

Likewise, Seek Ltd (ASX:SEK), owner of Australia’s number 1 job search site, seek.com.au, started by targeting offline job advertisers. Seek Ltd is now valued at $6.8BN and has been one of Australia’s online success stories.

RENT is planning to repeat this formula for the rental market via their website and mobile platform.

rent.com.au — Australia’s No.1 rental property website

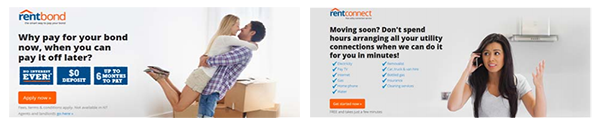

As part of RENT’s offering to make renting easier, RENT has just launched a new product called RentBond in association with Certegy Ezi-Pay, a subsidiary of ASX-listed Flexigroup Ltd (ASX:FXL), which allows renters to spread their bond payments over a three to six month interest free period. This service helps alleviate the financial burden faced by renters when having to find four weeks bond upfront at the beginning of new tenancies.

RentBond will be offered on RENT’s main website, rent.com.au, which in January 2015 had over 230,000 monthly unique visitors viewing 54,000 active property listings from 5,600 nation-wide rental agencies as well as private landlords.

Following shareholder approval, SLT will re-list as Rent.com.au Ltd and conduct a capital raise to support its plans to further monetise RENT’s online businesses, which have had AUD$10.3M invested in them to date.

As part of the acquisition, SLT is proposing to undertake a consolidation of its issued capital. The consolidation price is yet to be set, but SLT says it’s aiming to have a share price of at least $0.20 following the move. Once that’s done, SLT will pursue a capital raise led by Baillieu Holst and GMP Securities under a full form prospectus.

A shareholder meeting to approve these moves will be held in mid-March of 2015 with re-compliance expected to take place in early April.

The rental market opportunity

The current rental population in Australia stands at 7 million.

Traditionally, Australia’s 2.6 million rental properties have been advertised in newspapers and magazines throughout Australia and managed through real estate agencies and services, or through private arrangements.

But Australia’s online rental listings market is growing rapidly as more and more property agents, private landlords, advertisers and renters use the internet to conduct their transactions and manage their relationships. Indeed Real Estate is consistently the leading category within the fast growing online classifieds advertising market, which grew at 22.8% for the year to September 2014.

RENT’s website, rent.com.au, was established in 2007 to target these four revenue streams and is now Australia’s number one “rental only” web site and mobile platform.

SLT says its acquisition of the company will see increased investment and expansion of the RENT’s established platforms to take full advantage of the sector’s growth.

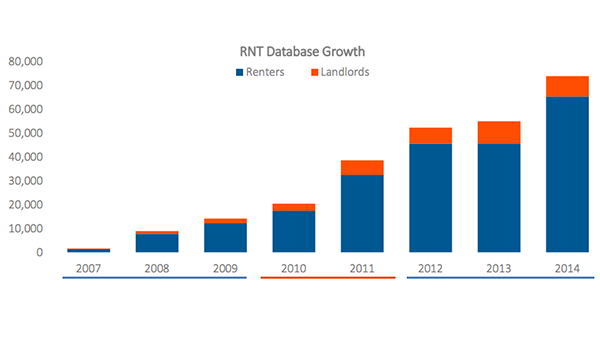

Over its eight years of operation, AUD$10.3M has been invested in rent.com.au and its feature services, resulting in rapid expansion across Australia:

AUD$10.3M has been invested in rent.com.au

Once SLT’s acquisition of RENT is finalised, the company is planning an aggressive marketing and sales campaign to increase rent.com.au’s web traffic and drive strong revenue and profits for the Company.

SLT’s Chairman Ian Macliver says the array of products already put in place by RENT will serve that strategy well. “Around 30% of the Australian population currently rent their homes and that number is forecast to grow in line with other developed nations,” he says.

“The acquisition is attractively priced for SLT shareholders and RENT has a solid, sensible and strong growth plan that will allow it to significantly expand its business.”

Rent.com.au’s full spectrum service

The company’s growth strategy is based around the website and mobile platform rent.com.au and its array of rental services.

The site was established in 2007 by new media entrepreneur and RENT CEO Mark Woschnak, and lists rental properties from rental agencies as well as private landlords. The rent.com.au website also offers a number of rental services that augment the main listings including RentCheck, RentConnect, and RentReport.

The latest to be launched is RentBond, a financial assistance service that allows tenants to pay their rental bond over a three to six month interest free period instead of one upfront payment. It was initially trialled in Western Australia and has now been made available across the nation.

Rental bonds can often be in the vicinity of $2,000 to $3,000 and tenants can struggle to put up so much money at once, especially if their existing bond is still being held-up. RENT says the RentBond service bridges the gap and gives it potential commercial access to the 7 million renters in Australia who pay bonds as a necessity.

With three million annual rental transactions in Australia and an average bond price of $2,000 there is a total market potential of $6BN worth of annual funding for RentBond to tap into.

“The first quarter is typically the busiest time when people want to search and find their next rental property to live in,” says RENT CEO Mark Woschnak.

“We’re pleased to be able to offer renters a wide range of property listings from real estate agents and private landlords to choose from, as well as great products such as RentBond, which help make the frustrating process of finding and moving into a rental property much easier and less costly.”

Through the launch of RentBond, RENT now offers a full spectrum service for renters and those listing properties, including the utility connection service RentConnect, the tenancy, ID and credit database RentCheck and RentReport, which provides vital statistics for renters on suburbs and properties.

Each of these transaction-based services represent potential revenue streams and RENT says it also has an extensive suite of additional rental service products in the pipeline. This could cater to the removalists, contents insurance, builders and cleaning services markets – tying up an otherwise fragmented rental services market.

All of these products will form the basis of the Company’s plans to expand its scope once the acquisition is completed.

Making rent pay – RENT’s market push

RENT is the only website in Australia that exclusively caters for the rental market, offering services for the four main commercial market participants – renters, property agents, private landlords and advertisers.

There are 7 million renters in Australia, a number that represents 30% of the population. RENT expects the ranks of renters in Australia to grow as home ownership becomes less affordable and renting becomes more of a lifestyle choice.

RENT says that on average renters in Australia move every ten months, and there are around three million rental transactions every year throughout the nation, five times as many transactions as the property sales market.

There are 1.4 million properties in Australia managed by property agents representing only about 54% of all rental properties. Each property is estimated to generate $2,500 in annual agent revenue.

RENT taps into this market by offering listing services on its rent.com.au webpage for a fee, as well as subscriptions for branding, enquiry, leads and management tools.

It also sells premium services to property agents to increase renter engagement with listings and offers statistics that help identify strong suburbs or rental trends.

However, RENT estimates that half of Australia’s rental advertising market is still offline, whether through traditional print listing or word of mouth. Most of this offline activity is from private landlords, a section RENT sees as a key growth market.

Offline vs. Online: $219 for a 3-day newspaper run, compared to $99 for a 4-week rent.com.au listing

There are 2.6 million rental properties in Australia and RENT estimates that non-agents manage 46%, with up to one million private landlords in the market.

To attract their business, RENT offers listing services with a one off advertising fee and supports products such as RentCheck for background checks on tenants, and RentReport for rental pricing and other statistics. RENT positions these products and services as a cheaper and more effective method of advertising a listing than traditional outlets such as newspapers.

Finally, RENT offers an online location for the $4.4BN online advertising industry to target renters, typically a selective audience encompassing the 18-35 year old demographic as they look to move house. RENT’s rent.com.au website supports banner advertising, sponsorship and database marketing.

All of these products and services are fully integrated into a digital online platform that supports both web based and mobile interaction at all times.

SLT says RENT is strategically positioned as a market leader in the online renting sector and ripe for expansion.

Commercialisation and overseas expansion on the cards

Since its inception in 2007, RENT has concentrated on building up its business through establishing a robust IT and mobile platform in rent.com.au, attracting a critical mass of national property content and developing a range of supporting online products such as RentBond.

SLT’s goal in acquiring RENT is to commercialise all of the company’s rental services. In doing so, it will capitalise on the strong consumer base it’s already built of over 200,000 unique visitors a month and over 50,000 property listings.

The company says it will do this through targeted marketing and brand awareness campaigns across Australia to drive more traffic to the site, attract more listings and engage consumers with RENT’s products.

This strategy will build on the methodologies developed in smaller scale campaigns already run by RENT that resulted in immediate increases to website traffic.

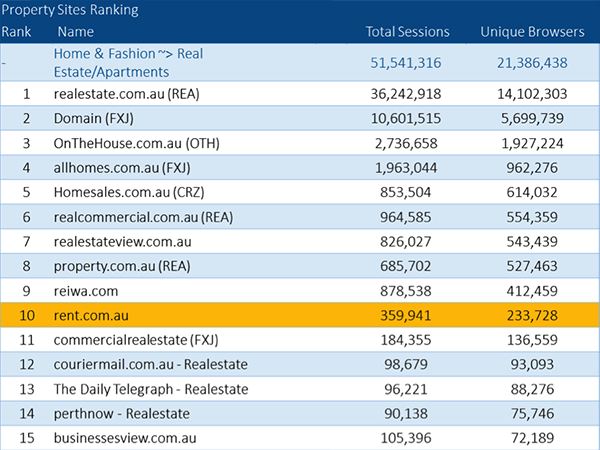

Current website rankings are listed in the below table:

Source: Rent.com.au Pty Ltd

In addition, the Company plans to look at ways to commercialise the internet domain names RENT has acquired over the years, including www.rent.asia, which could allow expansion into the large Asian online rental market.

Once the acquisition of RENT is complete, SLT will relist as Rent.com.au Ltd and embark on a capital raise to support the re-compliance process with the ASX. It says 50% of the money raised will be used to support its marketing and sales efforts and recruit extra staff to support the current RENT team who will remain with the business.

The fine print of SLT’s RENT deal

Subject to shareholder approval, SLT has signed a term sheet agreement to acquire 100% of the capital of RENT, an arrangement made with the company and its major shareholders who hold 70% of the entity.

The deal will see RENT shareholders sell their stakes to SLT and procure the remaining shareholders to do the same. SLT has invested $250,000 into RENT to take a 2.7% stake.

SLT is offering a consideration whereby it will issue 1.78 billion shares on a pre-consolidation basis plus 24.5 billion performance shares post consolidation to be issued to RENT shareholders. As part of the acquisition SLT is proposing to undertake a consolidation of its issued capital.

The consolidation price is yet to be set, but SLT says it’s aiming to have a share price of at least $0.20 following the move. Once that’s done, the Company will pursue a capital raise led by Baillieu Holst and GMP Securities under a full form prospectus.

SLT will also pursue a name change to Rent.com.au Ltd to reflect the acquisition and RENT’s Founder and CEO Mark Woschnak will be appointed as CEO and Managing Director of the new company.

A shareholder meeting to approve these moves will be held in mid-March of 2015 with re compliance expected to take place in early April.

Once the transaction and all approvals are received, the new entity – Rent.com.au Ltd – will pursue its expansion strategy across all of RENT’s present suite of products, and work to develop more entries into the online renting market in Australia and beyond.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.