PAK focuses on Elko after North American consolidation

Published 19-MAY-2016 15:22 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Pacific American Coal (ASX:PAK) has sold its remaining 30% stake in GCI, a coal exploration and development company, in order to fully concentrate on its flagship Elko Coking Coal Project in British Columbia, Canada.

PAK completed a “strategic review” of its activities and decided to sell its stake in GCI for A$1 million (US$720,000) in order to raise development capital for Elko. The sale means that PAK recovers its entire initial investment amount of US$731,250 which it now intends to deploy at Elko to advance exploration.

The proceeds from the sale will be paid incrementally over the forthcoming two years, commencing in January 2017. Until the entire sum is repaid, PAK is able to retain a Board position at GCI and maintains full voting rights until the outstanding amount is repaid. As a safety measure, PAK will receive an 8% premium on any outstanding payments in addition to a 4% penalty rate for late payments.

Elko Coal Project

PAK’s coal exploration is progressing well seeing its summer work program at the ELKO Project rewarded, with the announcement of its maiden JORC Resource of 257 million tonnes.

However, the US coal downturn has seen coal production levels fall to their lowest levels since 1986 with the closure of 264 mines in the US. PAK says this factor has forced it to “limit its investment in this sector, and to review all of its US projects to ensure the longer term viability of the company.”

To assist in this, PAK says it has “implemented a swathe of initiatives to help reduce overheads and ensure the business can conserve cash to weather the downturn in the current market conditions”.

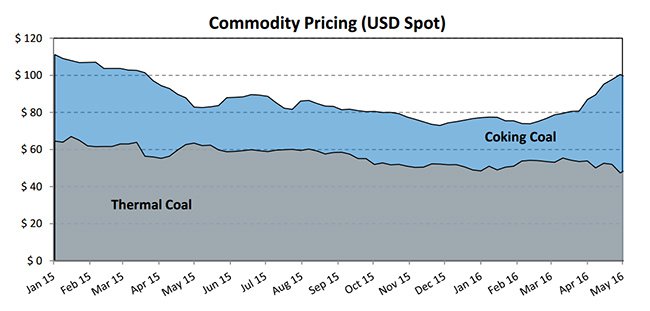

Coal prices have been under severe pressure for several years under the weight of oversupply and lower demand for energy globally. Particularly detrimental to the coal industry was/is the sharp pullback in demand for steelmaking and the introduction of alternative energy sources that continue to erode coal’s dominance as the prime fossil fuel on the planet.

Metallurgical coal prices have started to show signs of upward mobility, rising from around $78/t at the start of the year, to around $100 today.

PAK sees this recent improvement as a cue to accelerate development of its North American asset portfolio and has therefore taken steps to focus all its energy on Canada rather than America.

According to a company statement to shareholders, PAK said “The recent increase in coking coal prices has resulted in renewed interest from Asia in potential off-take arrangements”.

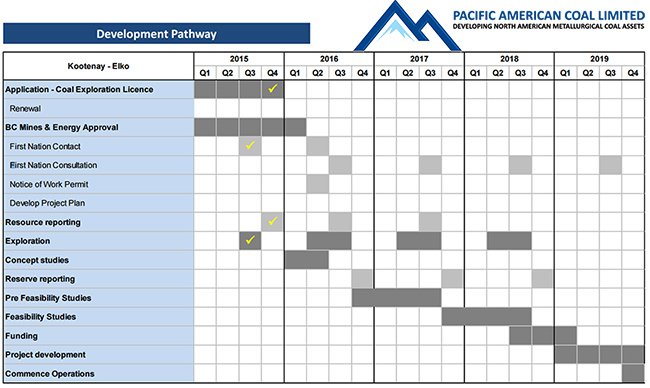

With its coal exploration hopes boosted by improving prices, PAK is determined to accelerate its exploration schedule. First on the agenda is improving its official JORC Resource definition, first announced in November 2015. Next, PAK must prepare a ‘Notice of Works’ to obtain the required permits from Canadian authorities. And finally, PAK is already working on its conceptual mine design, layout and infrastructure which will be summarily added to its permitting application.

PAK’s most recent development timetable indicates a Pre-feasibility Study (PFS) will commence sometime in Q4 2016 to be completed in mid-2017.

More about Pacific American Coal (PAK)

In addition to coal exploration in North America, PAK is also moving into the fledgling graphene market after entering into a Heads of Agreement (HOA) to take a controlling interest in Imagine IM, the leading Australian developer of graphene-based coatings for industrial textiles and fibres. Founded in 2014 by Chris Gilbey and Phillip Aitchison, the company develops commercial applications for graphene and associated advanced carbon based materials. Imagine IM is the first company in the world to develop conductive geomaterials using functionalised graphene.

Imagine IM intends to build Australia’s first commercial graphene manufacturing plant in the foreseeable future with a focus on geosynthetics.

The pilot plant will have an output capacity of up to 10 tonnes per year of graphene. Imagine IM plans to use two tonnes of the graphene output in the first year of operation for products aimed at customers in Australian manufacturing.

For PAK, Imagine represents a significant commercial stake in the developing graphene space and may make a material contribution to PAK’s bottom line once Imagine begins to generate sales revenues.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.