New Portfolio Addition: Early stage critical metals explorer

Our new Portfolio addition today is Lycaon Resources (ASX:LYN).

LYN is a small, early stage explorer looking to make a niobium and rare earths discovery in the newly opened West Arunta province in WA.

LYN holds ground with a similar EM anomaly near where WA1 Resources recently made a niobium & rare earths discovery. This discovery re-rated the company from a share price of 13c to now sit at $2.28 per share.

A return of ~1,800%.

This is the kind of result every small cap exploration investor is looking for.

There has been a surge of interest in the West Arunta region in recent weeks following WA1’s discovery, and we are betting on LYN being able to deliver its own discovery in 2023.

...while obviously keeping in mind the risks of investing in small cap explorers, and especially “nearology plays”. This is a high risk bet, and we are prepared for whatever the outcome of the drilling will be - good or bad.

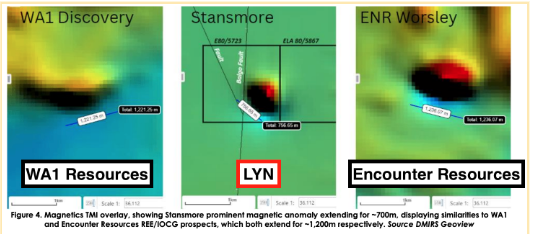

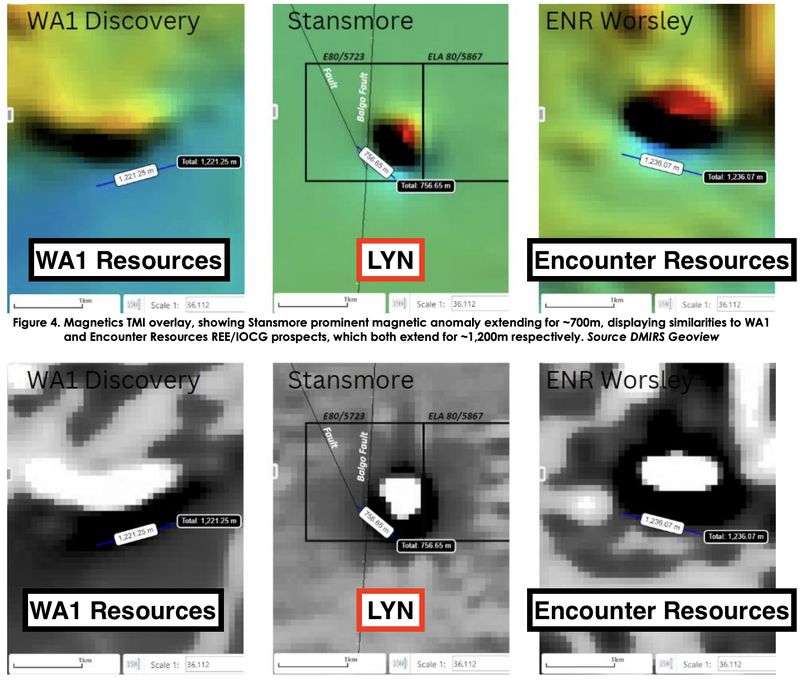

LYN’s new ground was pegged BEFORE the WA1 discovery. It’s had some previous drilling that has confirmed shallow cover, and probably most importantly, evidence of a discrete magnetic anomaly that looks eerily similar to what WA1 ($114M market cap) and Encounter Resources ($74M market cap) drilled to make a discovery.

LYN is now in a position where it holds a drillable target similar to WA1 Resources and is trading at a fraction of its market cap.

LYN’s anomaly is in the middle of this image:

LYN also holds an interesting copper and nickel exploration project which we will talk about in our next note.

Today we will share our Investment Memo for LYN where we cover why we Invested, what we expect to see from LYN over the next 12 months and importantly the risks of this early stage exploration investment.

This brings us to our “Big Bet” for our latest Investment.

"See LYN’s share price to re-rate by over 1,000% off the back of a new metals discovery, and the definition of a deposit significant enough to move into development studies."

This is our standard “Big Bet” for any early stage minerals exploration company with multiple projects.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LYN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

2022 has been the year of exploration across our Portfolios.

Some of our notable wins were companies that started the year as explorers and are ending them with a discovery in hand and more importantly a share price materially higher than where it started:

- Latin Resources - made a lithium discovery in Brazil and saw its share price rise by up to 650% between February and April.

- Galileo Mining - made a PGE discovery in WA and saw its share price re-rate by up to 875% in May.

- Invictus Energy - is one announcement away from declaring a discovery - we should know by Friday, but the company is up 782% since our Initial Entry.

When explorers are successful the returns are great, but just because a few like the above succeed, and LYN is near WA1’s success, doesn’t mean that it is a guarantee that LYN will successfully make a discovery. There’s a long list of failures in exploration investing.

We have placed our bet on LYN and will now patiently wait for them to drill.

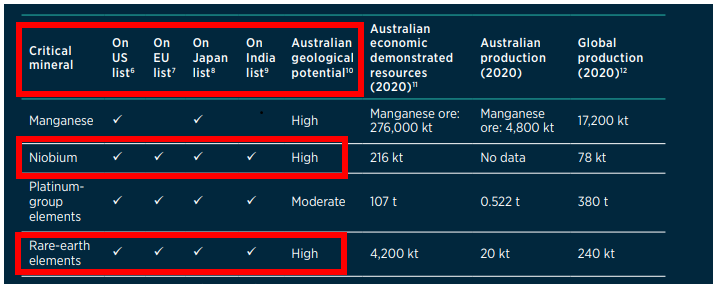

Whilst exploration success and new discoveries are generally rewarded by share price appreciation, it also matters what type of commodity is discovered.

If the macro thematic is strong enough, the market reaction to new discoveries can be a lot more explosive than say for a commodity that is out of favour - which is why we are currently Investing in critical metals explorers like LYN.

An example of an out of favour commodity is gold, where gold discoveries just haven't been rewarded with any meaningful re-rates.

Two of our exploration successes this year fit the description of both a “critical mineral” and with exposure to one of the hottest thematics in the market right now - the battery metals macro theme.

LYN has a drill ready exploration target, exploring for both niobium and rare earths - battery metals that are recognised by the US/EU/Japan/India and Australia as critical minerals.

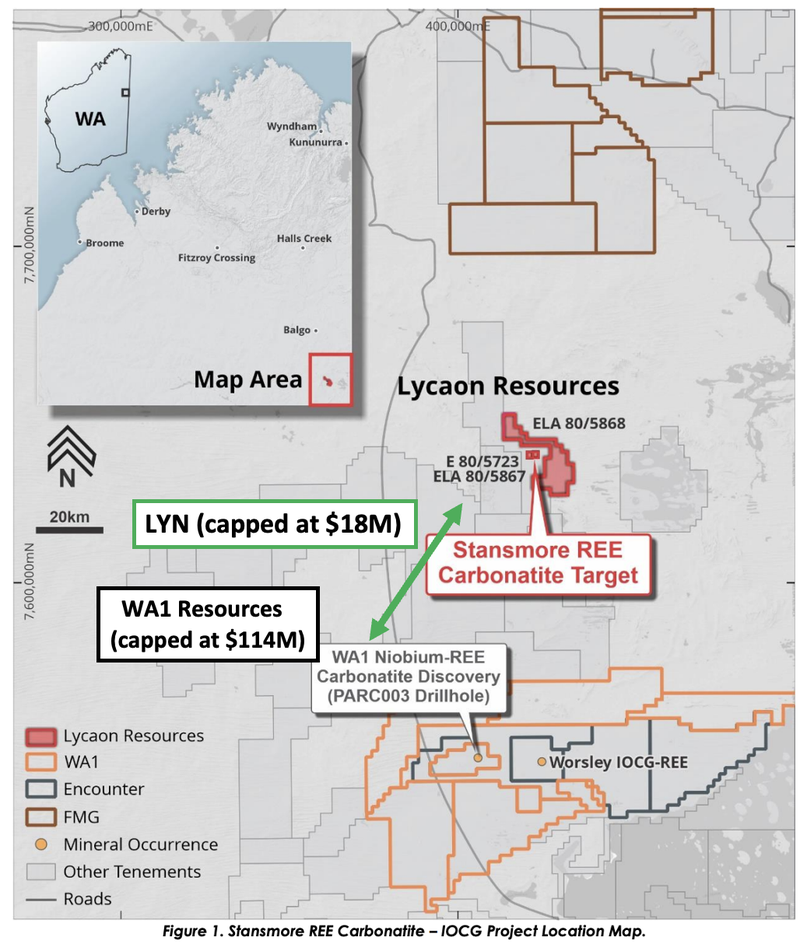

LYN’s ground sits ~94km to the north of a successful discovery by WA1 Resources and sits over similar geological fundamentals.

Before WA1 made its discovery, all it really had was a distinct geophysical anomaly much like LYN’s.

In July of this year, WA1 tested its target with a six hole RC drilling program.

Less than three months later, the assays came in and WA1 Resources confirmed a new niobium/rare earths discovery.

The discovery re-rated WA1 Resources from a share price of ~13c (pre discovery) to now trade at $2.28 per share - a return of ~1,800%:

Off the back of this move, last week WA1 raised $10M at a $2 share price (at a 13% premium to its market price at the time) - which is a strong indicator of market interest in its discovery and the region as a whole.

WA1 is now capped at $114M.

Our Investment LYN has a market cap of just $18M - almost ~6.5x smaller than WA1 Resource’s market cap using the last closing price.

More importantly though, LYN has an almost identical geophysical anomaly to WA1 - let’s look at it again:

LYN’s project also benefits from a drilling program that mining giant BHP did on the ground back in 1982, when it was looking for diamonds.

BHP’s drilling was shallow RAB drilling to a maximum depth of 12m.

That drilling intersected “intrusives and strong carbonate alteration” that could be prospective for the same type of rare earth carbonatite mineralisation WA1 Resources discovered.

Given the drilling didn't find anything that indicated the presence of diamonds, BHP walked away from the project.

Since then the ground has seen effectively no exploration work.

The key takeaway from this is that the geology LYN is looking for could begin from a depth of only ~12m - a lot shallower compared to WA1 Resources whose discovery starts at a depth of ~74m.

LYN is now in a position where it holds a drillable target similar to WA1 Resources and is trading at a fraction of its market cap.

Given LYN is largely a nearology Investment, we also scored the company based on our “nearology” Scale.

A “nearology” exploration investment basically means backing an explorer that is searching for a discovery NEAR a recently made discovery - this can be based on distance and sharing similar geological qualities.

It's important to also note the “nearology risk”in our LYN Investment Memo:

Nearology Risk: We have observed that nearology plays rarely succeed - as we have seen over the years with failed investments in the Fraser Range Nickel rush, the Julimar Province PGE rush and the Earaheedy Basin lead-zinc rush. Whilst LYN’s current key project sits near existing discoveries and is prospective, the chances of the company actually making a discovery are low.

🎓For a detailed run through of how we rank nearology investments check out our educational article here: How to evaluate “nearology” investments.

At a high level our scale works as follows (rating of 4 being the best):

- ✅ “Entry level” nearology - If two projects are geographically close its good - but if there is different geology, then it's almost irrelevant.

In terms of geographical distance, LYN ticks this box, with its project sitting ~94km to the north of WA1 Resources and LYN’s ground is prospective for carbonatite hosted niobium/rare earths.

- ✅ “Better” nearology - Two projects have the same geology and structures, but no supporting data - or drilling that downgrades it.

LYN also ticks this box with supporting data from six RAB drillholes completed by BHP in 1982 which intersected “intrusives and strong carbonate alteration” that may be prospective for rare earth carbonatite mineralisation.

- ✅ “Even Better” Nearology (LYN fits here) - Two projects have the same geology and structures WITH supporting drilling / geochemistry.

LYN fits in here with a clearly defined drill target in the form of a ~700m long geophysical anomaly - a similar anomaly to the one WA1 Resources drilled and made a discovery at.

- ❌ “Best” Nearology - There is an extension of the same deposit.

LYN isn't in this category with no existing discovery immediately around it.

At the moment LYN has an EM target and is yet to drill test it, this is why we think LYN trades at a discount to its peers in the Arunta region who are trading closer to the $100m+ market cap level.

LYN therefore ranks a level 3 “Even Better” on our nearology scale and we hope to see the company drill its prospect in 2023.

The exploration process here should be relatively simple:

- 🔃 Geochemical sampling/mapping as well as refining of geophysical survey data.

- 🔃 Plan and design its drilling program so as to improve probability of success.

- 🔲 Drill the target.

We are invested in LYN as nearology exposure to WA1 Resources and because it has a far smaller market cap with potential for a re-rate should a discovery be made.

We are happy to hold our Position through to that period and will follow the same Investment Strategy that we do for most of our junior exploration Investments (more detail on this in our Investment Memo).

As part of our new Investment launch, we have also released our 2023 LYN Investment Memo, where you can find:

- Why we Invested in LYN

- Our long term bet - what we think the upside Investment case for LYN is.

- The key objectives we want to see LYN achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Why we invested in LYN

Below are the five key reasons why we Invested in LYN:

- Ground pegged before a region opening discovery - LYN holds a GRANTED Exploration licence in an emerging rare earths/critical minerals region. This means LYN can start firming up a drilling program over the project area immediately. LYN’s project is ~94km north of WA1 Resources and Encounter Resources.

- Similar drill target to WA1 Resources - WA1 Resources discovery was made after the company drilled into a distinct geophysical anomaly. LYN’s project hosts a similar geophysical anomaly that warrants drill testing. We see this as a key drilling target for LYN.

- Historic data confirming the right type of geology - In 1982, BHP ran a six hole drilling program on LYN’s ground and intersected “intrusives and strong carbonate alteration” that may be prospective for rare earth carbonatite mineralisation. BHP’s intercepts came from only 6m below the surface. BHP at the time were attempting to drill for diamonds.

- Low shares on issue & tight capital structure - LYN has only ~34.5 million shares on issue, with ~4 million in escrow until November 2023. If a new discovery is made, the supply of shares available to buy could be relatively low, which may increase the strength of a re-rate in the company’s share price, should it materialise.

- Relatively low market cap leveraged to exploration success - LYN has a current market cap of $18M, with $3.3M in cash at Sept 30, 2022, and an enterprise value of $14.7M. If a successful discovery is made, the share price should re-rate significantly. For example a ~$70M market cap on the back of a discovery would see LYN trading at around $2.

Our long term bet:

LYN’s share price to re-rate by over 1,000% off the back of a new metals discovery, and the definition of a deposit significant enough to move into development studies.

This is our standard “big bet” for any early stage minerals exploration company with multiple projects.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LYN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What we want to see from LYN achieve over the coming 12 months:

Objective #1: Pre drilling work at its niobium & rare earths project in WA.

We want to see LYN complete target generation work to refine its existing data further. This work will help improve the company’s understanding of its project and help design a drilling program.

Milestones:

🔲 Geochemical surveys

🔲 Geophysical surveys

Objective #2: Drilling at its niobium & rare earths project in WA.

We want to see LYN get on the ground and drill its project in the West Arunta region.

Milestones:

🔲 Commence drilling

🔲 Assay results

Objective #3: Target generation and then drilling at its Nickel/Copper/PGE projects

We want to see LYN complete target generation work across its other projects to identify the highest-priority drill targets. We want to see at least one of these projects get drill tested in 2023.

Milestones:

🔲 Geophysical surveys

🔲 Geochemical surveys

🔲 Commence drilling

🔲 Assay results

What are the risks?

Exploration risk: LYN is yet to make an economic discovery, with all of its projects considered early stage prospects. Inherently there is a risk that future drilling programs return nothing and LYN’s projects are considered stranded. There is plenty of time before drilling starts in 2023 - so there could be periods of share price weakness prior to drilling.

Macro Theme Risk: The West Arunta province is hot right now after WA1’s discovery and incredible share price run, but it could cool off before LYN drills its West Arunta prospect in the second half of 2023.

Nearology Risk: We have observed that Nearology plays rarely succeed - as we have seen over the years with failed investments in the Fraser Range Nickel rush, the Julimar Province PGE rush and the Earaheedy Basin lead-zinc rush. Whilst LYN’s current key project sits near existing discoveries and is prospective, the chances of the company actually making a discovery are low.

Funding risk: LYN is a junior explorer with no revenues to fall back on to fund its exploration. As a result, the company relies on new funding for future exploration programs. LYN may need to regularly raise new capital from investors to finance its exploration programs.

Market risk: LYN is an early stage exploration company chasing new discoveries. There is always a risk that a market wide sell off will hurt LYN’s share price the most, given investors will look to withdraw capital from the higher risk investments in their Portfolios first.

What is our Investment Plan?

We are a substantial holder in LYN with 7.13% of the company. We Invested in the 10c pre-IPO, at the 20c IPO and again at 40c. Our average entry price over the last 18 months is 25.6c.

There are still at least three months before any drilling will take place - leaving plenty of time for a “pre-drill result speculation” price rise to creep in and probably also a few quiet periods where the share price may drift down.

The key goal is to hold a material position for discovery, but if the share price is trading at over $1.20 in March/April next year, we will consider selling around 15% of the position to de-risk, claiming some capital back for tax, operational costs and new investments elsewhere which is our general model.

Also see our trading policy here

Our LYN Progress Tracker

We recently began launching “Progress Tracker” slide decks for our Portfolio companies.

Below is the LYN Progress Tracker document.

We will use this internally to keep up to tabs on the company's progress. It shows how the project was brought into LYN and the progress made up to today, along with what we want to see the company achieve next.

Click here to check out our LYN Progress Tracker

If you want to follow the progress of our Investment in LYN over the next 3 years make sure you are subscribed to our Catalyst Hunter mailing list or read our weekend newsletter.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.