A new direction leads to resurrection at TSC

Published 08-NOV-2019 10:40 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While the broader period 2018 to 2019 has been a transitional year for Twenty Seven Company Limited (ASX:TSC), in terms of concrete news flow and related share price appreciation it has mainly been in the last four months that the company has come under the microscope.

The positive momentum started in early July when the new management team said that it was going to focus on historic economic gold intercepts found within a 12 kilometre prospective strike zone at the Rover project, 140 kilometres from Leonora in the West Australian goldfields.

Within a month, it was evident that this strategy was paying off, and during that period the company’s shares increased three-fold.

Management has since been able to provide more detailed exploration results regarding the Rover project, providing sustained share price strength.

However, before delving into the Rover Project it is important to gain an appreciation of what has changed at the roots of the company as this will provide an insight into how it is placed to take advantage of newfound opportunities.

Board restructure and revised commodity focus

In April 2019, TSC underwent a board restructure with the most significant development being the appointment of Robert Scott as a non-executive director.

Scott has extensive experience as an executive in the mining industry having been on Sandfire Resources’ (ASX:SFR) Board since 2010 and overseen the development and commercialisation of the world-class, high-grade Degrussa Copper-Gold Mine in Western Australia as well as overseeing its ongoing exploration activities.

Scott also brought board experience in the mining and energy sectors through his involvement with other companies including RTG Mining Inc which has advanced copper and gold exploration interests in the Philippines and Bougainville.

Scott has a strong global corporate background having been an international partner with Arthur Anderson, and he is also a fellow of the Institute of Chartered Accountants.

Today, it is Robert Scott as chairman and Ian Warland as chief executive that are shaping the company’s future.

The new board’s initial focus was a review of the macro environment and reconciling how best to optimise the current asset mix to generate maximum value for shareholders.

With cobalt having been on a cyclical downturn for the past 12 months, the board determined it prudent to broaden the group’s strategic scope to encompass base and precious metals, whilst actively re-aligning the asset mix.

Revised focus on precious and base metals

Notably, the re-rating in the gold price over the prior 12 months to more than US$1500 per ounce (+ $2200 per ounce in Australian dollar terms) materially enhanced the prospectivity of the group’s established Rover Project in Western Australia’s goldfields.

It was on this basis that management decided to strongly focus on the 12 kilometre prospective gold strike along the eastern boundary of Rover that the geology team had been investigating.

Preliminary evidence from rock-chip and soil assay results had highlighted the potential for volcanic massive sulphide (VMS) mineralisation at the Creasy II prospect.

Creasy 1 has several shallow economic drill intercepts with up to 1.94 g/t gold, making it one of the priorities for upcoming drilling.

By October, a game changing geophysicist report had identified more than 20 high-priority gold, volcanic massive sulphide (VMS) and nickel targets at the Rover Project.

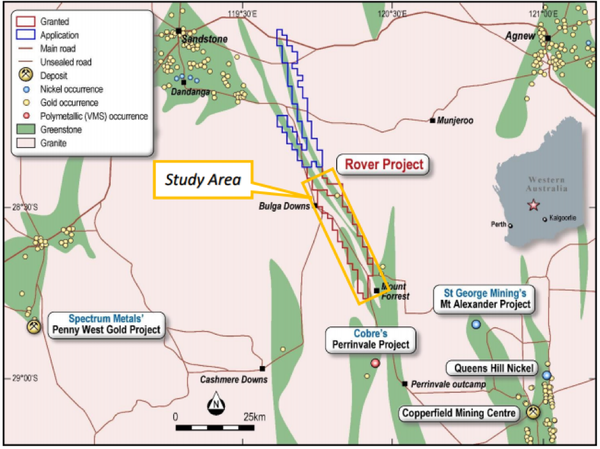

The study identified seven gold / nine VMS targets, extending across the 12 kilometre prospective gold strike (part of the Maynard Hills greenstone belt) covering Creasy 1,2 and 3, with four gold and two nickel targets along Cook Well greenstone belt.

The study area is highlighted on the following map which also shows other emerging projects, in particular Spectrum Metals’ Penny West Gold Project which recently was the subject of a company transforming discovery.

The study has delivered TSC considerable optionality to maximise shareholder value and significant incremental exploration upside.

There is now a clear pipeline of targets at a range of exploration stages.

These comprise drill ready targets at Creasy 1 gold and Creasy 2 VMS, and early stage targets under shallow cover that will require further geophysics and geochemistry.

Upon receipt of approvals, TSC will commence drill testing at Creasy 1 and 2, and concurrently develop the prospective pipeline of identified gold, VMS and nickel targets for future drill testing.

With a drilling contractor appointed towards the end of October, it is not out of the question that market moving news could come to hand by the end of December.

While TSC has also had early stage exploration success at its Midas Project, Broken Hill, this mainly points to copper-cobalt mineralisation.

With management keen to focus on precious and base metals at this stage, detailed follow-up exploration at Midas could take a back seat.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.