LNR Now Drilling Australia’s Hottest Rare Earths Province

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 16,623,582 LNR shares and 3,500,000 LNR Options at the time of publication. S3 Consortium Pty Ltd has been engaged by LNR to share our commentary and opinion on the progress of our Investment in LNR over time.

It begins.

Finally, our rare earths exploration Investment Lanthanein Resources (ASX:LNR) has started drilling some of the hottest rare earths property in Australia.

Drilling is targeting high-grade rare earth mineralisation in the Gascoyne region of WA, with the aim of making a new discovery.

We Invested in LNR hoping it can follow its two rare earths neighbours' success.

LNR’s biggest neighbour, Hastings Technology Metals is destined to be the second largest rare earths producer on the ASX.

Hastings raised $110M last week, adding to the $150M funding injection from Andrew ‘Twiggy’ Forrest’s private company to develop Hastings’ world-class rare earths project.

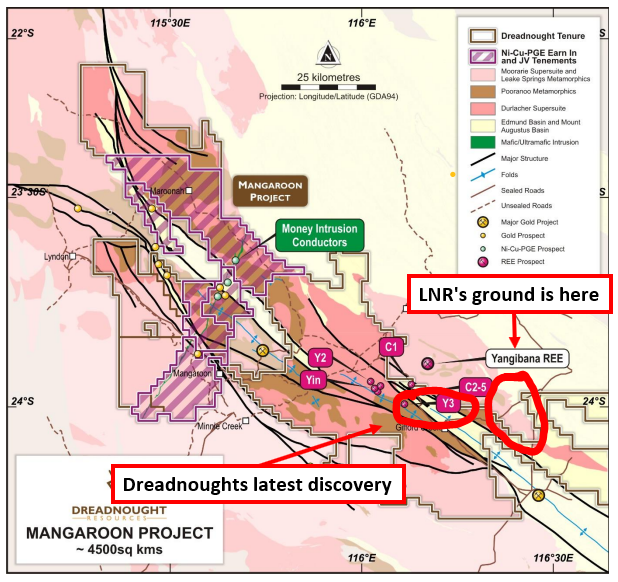

Dreadnought Resources, another of LNR’s neighbours, has seen its market cap re-rate since it started drilling and made a major high-grade rare earths discovery less than 35km from LNR.

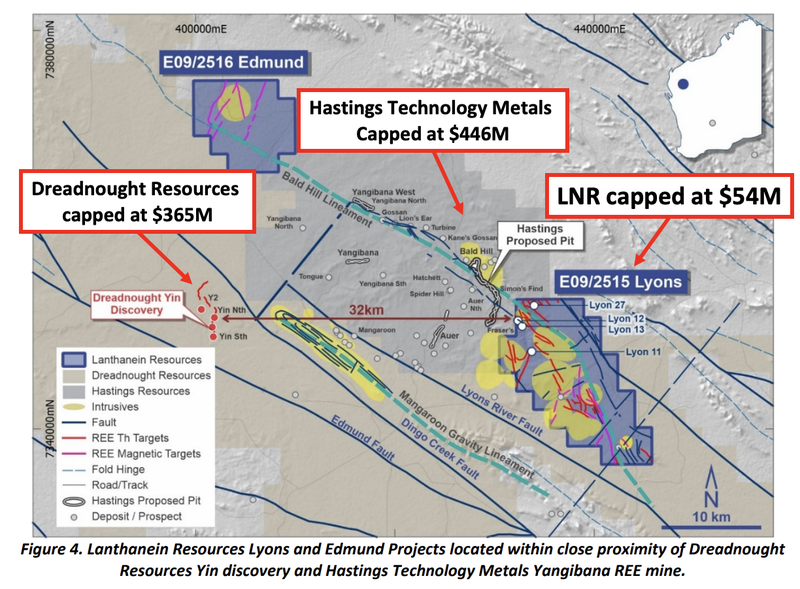

- LNR is 2.5km from $446M capped Hastings’ rare earths deposits

- LNR is 32km from $365M capped Dreadnought’s discovery

- LNR, capped at $54M, has just begun drilling.

Our Big Bet

LNR discovers and proves a rare earths deposit significant enough to become an acquisition target for one of its bigger neighbours Dreadnought or Hastings - or LNR becomes part of a consolidation play for all three companies.

NOTE: The above is what we think the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done by the company to get to this outcome and obvious risks which need to be considered, some of which we list in our LNR Investment Memo.

Right now, LNR is drill testing the geology that has delivered exceptional high-grade rare earth rock chips (as high as 8.01%) at outcropping ironstones over >2.5km strike.

LNR shares important geological similarities with its bigger neighbours Hastings Technology Metals and Dreadnought Resources, which followed almost identical pathways to discoveries.

Here’s the exploration pathway, and how LNR has followed it:

- They each confirmed that the outcropping ironstones were mineralised with rare earths through rock chip sampling programs - LNR has done this, returning grades of up to 8.01% in rock chips taken from outcroppings ✅

- They each ran geophysical surveys and ranked the highest priority targets ahead of drilling - LNR done this, pinpointing 12 high priority drill targets, ranked using the same methods Hastings used leading up to its discovery in 2016 ✅

- They each drilled into these targets and confirmed discoveries - LNR is drilling NOW 🔃

As mentioned above, LNR is capped at only $54M, compared to its two neighbours - Hastings capped at $446M and Dreadnought at $365M.

We hope LNR can emulate the success of its neighbours and become the third major player in this region with a rare earths discovery of its own.

We have seen it many times before where a company (oftentimes the most advanced in a region) is backed by someone with deep pockets and goes on to acquire smaller players in the region.

Andrew Forrest recently stepped up and backed Hastings — which has the most advanced rare earths project in the region — with $150M to take a stake in a Canadian-listed magnet maker. This will allow Hastings to integrate its rare earth mine into a vertical supply chain providing high quality magnets to European car makers.

Other big rare earths players, such as the $8BN Lynas Rare Earths, might just be taking notice of what’s unfolding in the Gascoyne too.

But talk of M&A activity is a little bit early for LNR — first it must drill and hopefully find something of value... which we will find out in the next couple of months.

To see how LNR got to the point of its first ever drilling program check out our LNR “Progress Tracker” where we track LNR’s project from acquisition through to a hopeful discovery.

Click here to see our LNR “Progress Tracker”

More on LNR’s rare earths drilling

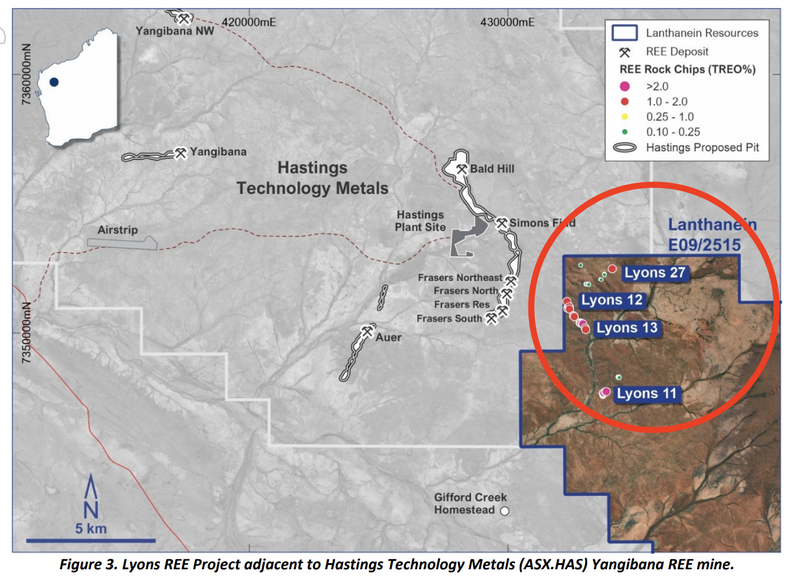

LNR’s current drilling program will be focusing on the “Lyons prospects” that border Hastings Technology Metals’ Yangibana rare earths project.

The particular focus of the program will be the outcroppings of ironstones where LNR previously confirmed rare earths mineralisation with grades of up to ~8.01% total rare earths oxide (TREO).

LNR will be targeting these outcropping ironstones, to see if the mineralisation extends at depth, whilst at the same time testing the carbonatite structures that the company has interpreted to extend deep underground.

If LNR can confirm rare earths mineralisation in both the ironstone and carbonatite structures then it will have returned similar drilling results to its neighbours Hasting’s and Dreadnought.

In a previous note we set our expectations for what we want to see from LNR’s drilling program:

After reviewing the drilling results that were enough for LNR’s neighbours Dreadnought Resources and Hastings Technology Metals to declare discoveries, we have set the following expectations for this round of drilling:

- Bull case = ~10-20m with rare earth grades of 2-3% (TREO)

- Base case = ~5-10m with rare earth grades of 1-2% (TREO)

- Bear case = No mineralisation is found

We also note that LNR confirmed today that it has already lodged an additional Program of Works (PoW) application for a follow up drilling program.

This should mean that if a discovery is made, then LNR can go back in and continue drilling out the project to try and better understand the size/scale potential of what we are hoping is a discovery.

How does LNR stack up against its much bigger neighbours?

In our last note, we did a deep dive on the valuation differences between LNR and its much larger capped neighbours.

The main difference between them is:

- Hastings Technology Metals, capped at $446M, has an established JORC resource/reserve and is moving into the mine development stage.

- Dreadnought Resources, capped at $365M, made its first discovery a few months back.

LNR, on the other hand, has spent most of the year refining its drilling targets, ranking the ones with the highest probability for a successful discovery in preparation for the current drilling program.

A quick recap of where LNR’s neighbours are at...

Dreadnought Resources

A few months back LNR’s neighbour Dreadnought returned grades as high as ~39.7% total rare earths oxide (TREO) from rock chips taken from outcropping ironstones at its project located west of Hastings’ project.

In July, Dreadnought drilled into those ironstones and confirmed a new discovery with intercepts as high as ~35m and grading up to 6.05%.

Earlier this week, Dreadnought put out another set of good assay results and confirmed that a new discovery had been made, this time even closer to LNR’s ground.

Since its July discovery, Dreadnought's share price has gone from 4c to now trade around ~12c per share, now trading with a market cap of $365M - almost 7x LNR’s current market cap.

Similar to Dreadnought, LNR has outcropping ironstones and is now drilling these targets — we hope it can emulate its neighbours' success and make a new discovery.

Hastings Technology Metals

Moving further up the project development chain is Hasting Technology Metals.

Hastings’ project sits right on the border of LNR’s tenements and is dubbed “Australia’s next rare earths mine”.

Hastings’ has a 27.4mt JORC resource with a TREO grade of ~0.94%, as well as an ore reserve of ~17.42mt at 0.95% TREO.

Hastings’ advanced project has received non-binding financing for its project from the Australian government of $140M and, more recently, has attracted the attention of Australian mining billionaire and head honcho at Fortescue Metals, Andrew “Twiggy” Forrest.

But just like all big companies, Hastings’ origins are relatively humble.

Hastings — in almost identical fashion to LNR and Dreadnought — had ground full of ironstone outcroppings where rock chips were returning grades as high as ~26% TREO.

After drilling those outcropping ironstones, Hastings went on to declare its Yangibana project a new rare earths discovery later that year in July 2014.

Hastings' discovery came off the back of intercepts measuring between 4m-8m with TREO grades up to 3.44%.

Interestingly, Hastings’ Bald Hill deposit sits just ~2.5km from LNR’s tenements (where LNR is now drilling) and was initially just a set of outcropping ironstones.

As we mentioned above, LNR is following the same playbook that its neighbours used to elevate them from small explorers to their current market caps in the hundreds of millions of dollars.

LNR‘s project has:

- Outcropping ironstones with confirmed rare earths mineralisation from rock chips grading as high as 8.01%.

- Similar style geology to its neighbours: Outcropping ironstones + deeper carbonatite structures.

- 12 high priority geophysical targets.

We are hoping LNR, with its first drilling program, can make a discovery and ta its market cap from its current $54M to levels more in line with its neighbours.

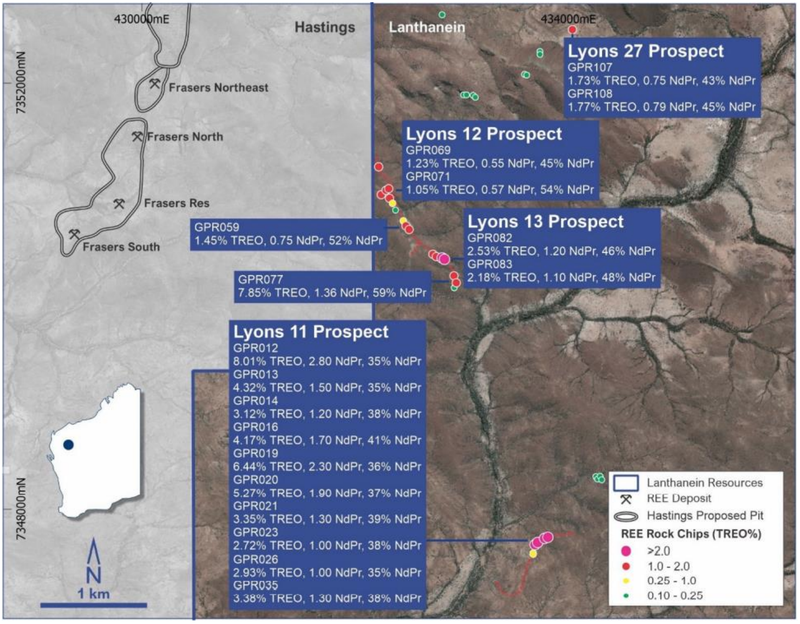

Here are LNR’s high grade REE bearing ironstones discovered to date — the initial focus of the maiden drill program.

What’s next?

Results from the drilling program 🔄

With drilling now underway the next major catalyst for LNR will be the initial drilling results.

As with all drilling programs, the assay results will be the ultimate tell of whether the company has made a new discovery.

After reviewing the drilling results that were enough for LNR’s neighbours Dreadnought Resources and Hastings Technology Metals to declare discoveries, we have set the following expectations for this round of drilling:

- Bull case: ~10-20m with rare earth grades of 2-3% (TREO)

- Base case: ~5-10m with rare earth grades of 1-2% (TREO)

- Bear case: No mineralisation is found

Very rarely do junior explorers make discoveries off the back of their first drilling program, so as our base case we aren’t anticipating a new discovery.

Even in the bear case and no mineralisation is hit, LNR still has multiple targets to drill test.

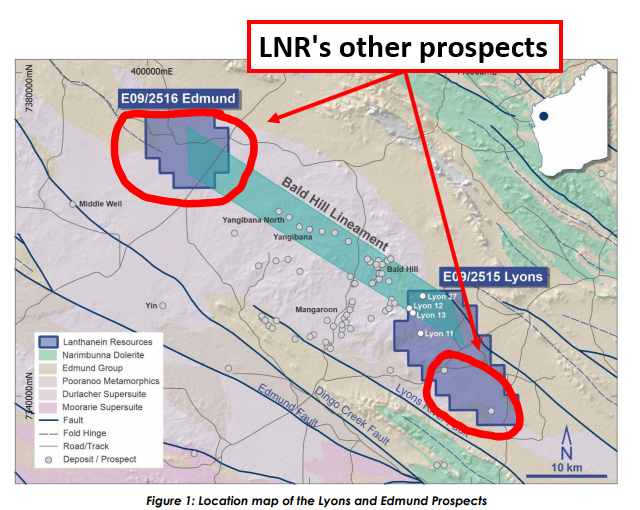

Below is a map of where the other prospects sit.

What could go wrong from here?

The big risk now for LNR is ‘exploration risk’.

Something we continue to stress with our exploration Investments is that there is never any guarantee that an explorer will make a discovery.

Target generation works can throw up interesting targets, and the drilling program may look de-risked to a certain extent, but we always go into these maiden drilling programs with our expectations set relatively low.

Rarely do junior explorers make a new discovery with their first drilling program.

Our expectation is generally to see them learn enough from the first drilling program to warrant going back in and doing more exploration.

This is something we have flagged in our 2022 LNR Investment Memo. To see all of the risks we have listed, click on the image below:

2022 LNR Investment Memo

Below is our 2022 Investment Memo for LNR where you can find a short, high level summary of our reasons for investing.

The ultimate purpose of the Investment Memo is to track the progress of LNR throughout 2022 using the objectives set in the memo as our benchmark.

In our LNR Investment Memo you’ll find:

- Key objectives for LNR in 2022

- Why we continue to hold LNR

- What the key risks to our investment thesis are

- Our investment plan

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 16,623,582 LNR shares and 3,500,000 LNR Options at the time of publication. S3 Consortium Pty Ltd has been engaged by LNR to share our commentary and opinion on the progress of our Investment in LNR over time.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.