Inca's Peruvian Riqueza Project progressing well

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Inca Minerals (ASX:ICG) could be one of the busiest stocks on the market at the moment.

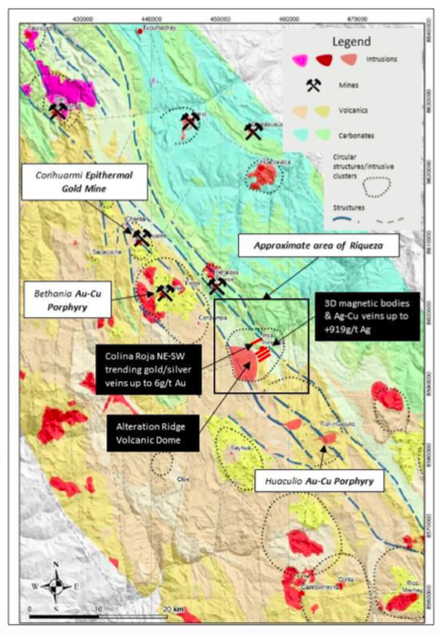

Just a couple of weeks after executing a Memorandum of Understanding (MOU) to acquire a second new IOCG (iron oxide copper gold) focused project called Frewena Fable in the Northern Territory, ICG wanted to remind investors that it is still hard at work at its Riqueza Project in Peru.

In July, Inca instigated a project-wide grid soil sample geochemical mapping program at Riqueza.

That program is now 80% complete with approximately 1000 samples of 1269 now taken.

Inca has also completed a WorldView3 satellite imagery-mapping program at the South32 year-1 exploration campaign.

South32’s funding has seen the company complete:

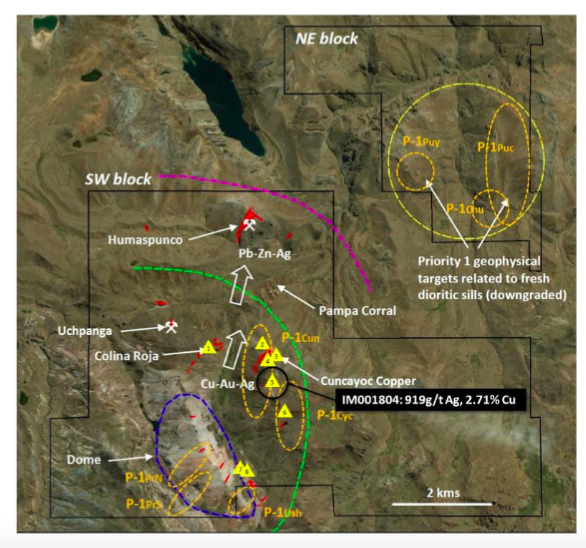

- Airborne magnetics and radiometrics geophysical survey (pre-Earn-in Agreement) identifying +40 geophysical targets, including 29 priority targets;

- Expert reconnaissance geological mapping identifying an intermediate sulphidation epithermal system;

- Reconnaissance rockchip sampling (in conjunction with expert reconnaissance mapping) identifying 919g/t silver and >3% copper;

- 3D magnetic modelling, identifying several large unexplained magnetic bodies;

- Project-wide grid soil sample geochemical mapping program (80% complete); and

- WorldView3 satellite mapping program.

Inca has previously identified a large 7km x 5km intermediate sulphidation epithermal system and discovered new mineralisation at the Cuncayoc Copper Prospect (peak results: 919g/t silver; 3.31% copper).

Furthermore, as reported on 19 August by Finfeed, Inca identifiedseveral large unexplained magnetic bodies extending below surface geophysical targets. One of these magnetic bodies, Huasijaja, is estimated to be 1,000m long, 400m wide and 500m thick, some 200 million cubic metres.

For full program details of the work being conducted at Riqueza, please see today’s announcement.

This cumulation of results from this exploration has significantly progressed Inca’s understanding of Riqueza in terms of its potential for hosting aTier-1 deposit.

All program work is designed to help Inca identify and prioritise possible drill targets.

Inca will now focus on the completion of geochemical mapping and integration of all datasets (layers) at Riqueza, whilst the technical committee (comprising representatives of Inca and South32) will determine the details of remaining year-1 program, which will be based on results to date.

The company will also turn its attention to its Australian assets with a field trip to Frewena Fable scheduled for November and the second EPM comprising the MaCauley Creek Project (EPM27163) to be granted this month.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.