Empired: a turnaround story at a cheap price

Published 14-OCT-2016 16:36 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is the potential for shares in IT services group, Empired (ASX: EPD) to stage a significant come back in coming months as confidence returns after a number of one-off items impacted its fiscal 2016 result. When these were flagged at the start of 2016 the company’s shares crashed from circa 80 cents to trade as low as 23 cents.

However, over the last six months the company has mainly traded in a tight range between 35 cents and 45 cents, with the latter being yesterday’s closing price, up 100% on the group’s 12 month low.

Chris Savage from Bell Potter believes the issues that created a ‘perfect storm’ in fiscal 2016 aren’t likely to recur in 2017. He expects the group to turn around a loss of $1.7 million in fiscal 2016 to a profit of $5.3 million in 2017, representing earnings per share of 4.4 cents.

This represents a PE multiple of approximately 10 relative to yesterday’s closing price. If Savage is on the mark with compound annual earnings per share growth expectations of circa 35% out to 2019 the company appears attractive on a price-earnings to growth basis (PEG).

Impressive track record

The following demonstrates the one-off nature of EPD’s fiscal 2016 performance, clearly showing the company’s strong record in terms of growing revenue and earnings during the period 2012 to 2015 inclusive.

It must be said though there is no guarantee that this upswing will continue, so if considering an investment in this stock seek professional financial advice.

While EPD fell down the earnings line in fiscal 2016, revenues increased from approximately $130 million in 2015 to $160 million. Over the last four years the company has grown the top line by 300%.

Consequently, EPD’s Managing Director Russell Baskerville’s summation of fiscal 2016 appears valid. In part, he said the 2016 financial year was one of consolidation, acquisition, integration and organisational alignment following a period of rapid expansion, preparing Empired for its next chapter of growth.

He went on to say, “These initiatives had a negative impact on our financial performance in the first half of the financial year but we are confident they will contribute to long-term sustainability and value creation for our shareholders”.

As highlighted by Savage, the absence of the one-off events that impacted the company’s performance in 2016 were recently evident when management reported a better than expected second half result in August.

At this point the company said it was confident of a much better full-year result in fiscal 2017, which will mean a strong performance in the six months to December 31, 2016.

While the company’s interim result won’t be released until February next year, it is quite likely that guidance will we provided before that stage.

Consequently, EPD should continue to be a news flow driven story with its share price responding accordingly. However, investors who have faith in the prospect of a turnaround may see its current trading range as a useful entry point.

There is already enough information out there for Savage to make a call on the stock as he has just increased his 12 month price target from 55 cents to 65 cents and upgraded his recommendation from hold to buy.

Potential corporate activity

As well as having confidence in a turnaround, Savage highlighted that there is the prospect of corporate activity. He referred to recent transactions including the acquisitions of Oakton by Dimension Data, UXC by CSC and Telstra’s purchase of Readify. He also noted the recent $1.63 per share bid for ASG Group (ASX: ASZ) by Nomura Research Institute.

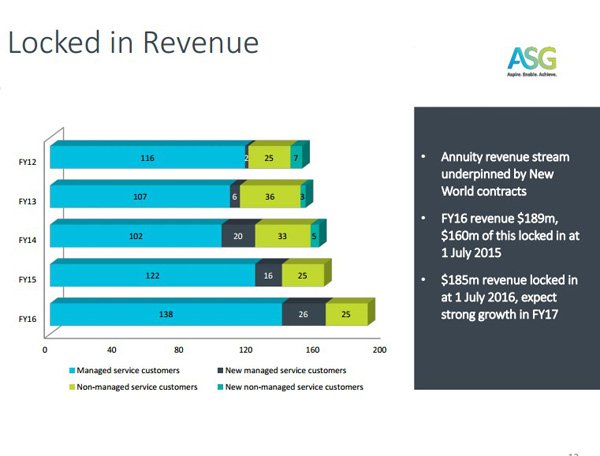

ASZ’s performance since 2012 has for the best part been disappointing. As indicated below, revenue growth between 2012 and 2015 inclusive was sub 10%.

Even taking into account the stronger performance in fiscal 2016, revenue growth between 2012 and 2016 was 25%, compared with the 300% delivered by EPD.

What is important though is that during the same period ASZ’s earnings per share have gone backwards while EPD has achieved strong earnings growth.

Consequently, if ASZ can receive a bid that represents a 38% premium to its volume weighted average share price over the last three months then there is a fair chance that a bid for EPD would also carry a significant premium.

It should be noted that broker projections and past share price performances are not an indication of future earnings and trading patterns, and should not be used as the basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.