Egan Street boosts gold resource with high-grade ounces

Published 27-NOV-2018 17:06 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Egan Street Resources Ltd (ASX:EGA) has taken another key step towards developing a high-grade gold operation at its Rothsay Gold Project in Western Australia with a substantial increase in the Mineral Resource to 454,000 ounces.

The Mineral Resource Estimate (MRE) has increased by 53,000 ounces, principally from shallow extensions to the main Woodley’s Lode into areas that have historically been poorly, or not at all, tested, as well as through the identification of additional mineralisation on the Woodley’s East hanging-wall lodes.

The key Woodley’s Shear Mineral Resource increases by 46,000 ounces to 342,000 ounces, representing 75% of the total resource.

The upgrade stems from a combination of successful infill and extensional drilling completed since the last Mineral Resource update announced on May 14, 2018.

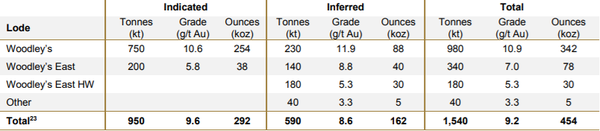

As indicated below, the increased Resource comprises 1.54 million tonnes at 9.2 grams per tonne gold for 454,000 ounces, reflecting the outstanding high-grade nature of the Rothsay Project.

Egan Street to benefit from Australian dollar gold price

Egan Street could be targeted by investors looking for oversold gold stocks, particularly given its relatively near-term production profile which would enable it to generate cash to fund future exploration and plant expansion.

Recent selling could only be attributed to negative sentiment towards the broader sector and extreme volatility in equities markets over the last three months.

As FinFeed recently pointed out, it should be noted that Australian producers are benefiting from a decline in the Australian dollar, and the current price of approximately $1700 per ounce delivers healthy margins when one considers production costs are generally in the order of $1000 per ounce.

As a point of comparison, when at its peak between 2011 and 2012 the gold price fluctuated around the US$1700 per ounce mark.

However, during this period the AUD:USD midrange rate was USD$1.05, implying an Australian dollar gold price of $1619 per ounce.

Consequently, our miners are better off today as the Australian dollar hovers around the USD$0.72 mark

High grades translate to low-cost production

This buoyant price environment along with stellar grades is extremely important when examining the company’s production prospects, as it indicates the strong potential to be a low-cost, high-margin project which can deliver robust financial returns.

This was highlighted by EganStreet managing director Marc Ducler who noted the strengthened economic outlook at Rothsay saying, “This latest increase in Resources paves the way for further growth in production and free cashflow at Rothsay.”

In fact, the Rothsay Project has been a highly economic operation even during the exploration stages as Ducler noted in saying, “This Resource upgrade came in at discovery cost of $30 per ounce and since the listing of EganStreet our discovery cost has averaged $35 per ounce.

“The consistency of these metrics provides further confidence that the Rothsay Gold Project will deliver value well beyond our initial production target published in July 2018.

“With the main Woodley’s Shear increasing to 342,000 ounces at around 11 grams per tonne gold, these high-grades underpin the high margins we expect once in production.”

Uptick in indicated resource to feed into reserves increase

Importantly, the Indicated portion of the Mineral Resource which is available for conversion to Ore Reserves has increased by 46,000 ounces to nearly 1 million tonnes at 9.6 grams per tonne gold for 292,000 ounces.

There are also strong prospects and plenty of options for resource expansion with new areas of high grade mineralisation intersected during recent drilling.

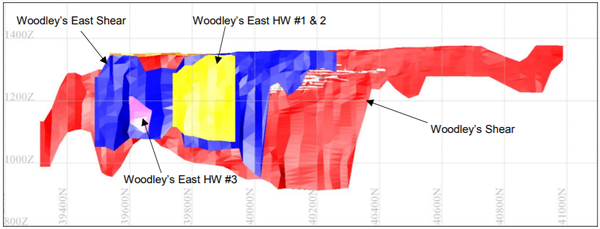

Exploration drilling programmes executed by EganStreet have intersected a third Woodley’s East hanging-wall zone of mineralisation which now forms part of the MRE.

Together, the three Woodley’s East hanging-wall zones (Woodley’s East HW), total 177,000 tonnes at 5.3 grams per tonne gold for 30,000 ounces.

These three lenses are parallel to Woodley’s and Woodley’s East Shears and are located in close proximity to the Woodley’s East Shear, making them accessible by the underground mine development in the definitive feasibility study (DFS).

The new zone is located approximately 10 metres east of the Woodley’s East Shear.

All three lenses are open in every direction and their extents are not defined, providing significant scope for further resource expansion.

Positive implications for DFS

In July, EganStreet released a DFS based on a redevelopment proposal targeting unmined fresh material which could be accessed via the existing portal and decline which requires rehabilitation.

The key findings of this DFS included production of 250,000 ounces over an initial 6.5-year mine life, with a pre-production capital expenditure estimate of $36.1 million, cash costs of $941 per ounce, and all-in sustaining costs (AISC) of $1083 per ounce.

Based on these metrics, what could be deemed as a start-up mine would be very economical at all levels.

An investment of $36 million is very modest in terms of bringing a project into production, and based on the strong Australian dollar gold price, the AISCs imply a robust margin of approximately $600 per ounce.

The November 2018 MRE extends approximately 200 metres to the south, and it is currently being incorporated into an updated mine design and schedule, which anticipates a second portal and decline due to ore strike extensions.

This has the potential to give the project greater flexibility, earlier ounces and higher sustained production rates.

With the increase in the MRE, the company is confident that the updated mine design will deliver a larger mining inventory to the DFS, with multiple mining zones providing increased ore throughput and consequently improved project value.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.