Cobalt market shows off its commercial feathers

Published 03-JAN-2018 14:41 P.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Lithium-ion batteries are seizing as many column inches as they are sales receipts. The rise in interest for lithium ion batteries is due to a battery-driven future that has already captured consumer imagination.

Tesla’s record sales of electric vehicles is case in point.

Given the high-earning potential the cobalt industry is currently presenting, investors have been quick to seek out value-based cobalt junior explorers. It is becoming increasingly likely that given the surging demand for high-performance batteries requiring growing amounts of cobalt over the next 5-10 years — any explorer capable of getting into cobalt production is likely to offload all its output into a market gasping for higher-grade batteries and better power storage.

The lithium-ion battery market is forecast to expand to $46.2 billion through 2023, which represents an 11% average annual growth rate. It is no surprise that Warren Buffet has invested heavily in electric-cars, especially in view of the shortage that banks and market analysts are expecting. In fact, Berkshire Hathaway-backed BYD has become China’s single largest electric car manufacturer over the past 5 years.

The tendency to switch to cleaner and more efficient electric vehicles is even going legislative. Europe is working towards mandating electric vehicles directly into law with the Netherlands leading the charge on this front. Dutch legislators have mandated all new cars to be of the electric variety by 2025 and Germany is considering similar action.

Could lithium become the ‘new gasoline’? The answer, it seems, is yes.

And it is dragging other commodities such as cobalt into primetime territory.

However, it should be noted that commodities and their prices do fluctuate and caution should be applied to any investment decision in the commodities and related stocks mentioned further in this article. Seek professional financial advice before choosing to invest.

Problem in paradise

The sharp change of cobalt application and demand has put pressure on production supply routes and brought to the surface, an unsightly problem bellowing in the underbelly of African resource exploration.

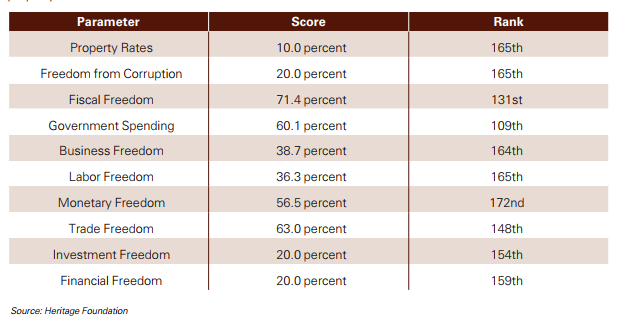

It happens that 60% of the world’s cobalt comes from the Democratic Republic of Congo (DRC). The political climate in the country has led to shocking effects of war and disease.

The BBC has termed DRC’s domestic troubles as “Africa’s world war” that has claimed over 5 million lives as a direct result of fighting or because of disease and malnutrition, and says these effects were “fuelled by the country’s [DRC’s] mineral wealth”.

In a recent report, KPMG and the Heritage Foundation ranked the DRC between 109th-172nd in the world for a range of parameters including ‘labour freedom’, ‘freedom from corruption’, and ‘government spending’.

On the face of it, cobalt has become a conflict metal in the DRC and PR-conscious large-scale consumers of cobalt such as Tesla, Panasonic and Apple simply do not want to be seen doing business with the DRC or its cobalt-laden mines.

The investment community is becoming educated on the sector and can see the massive demand potential. The smart dollar is moving to places like Australia and Canada in order to satiate the growing cobalt demand globally.

Following the booming trends we’ve seen with graphite and lithium, the ongoing growth of cobalt is translating into a longer and more sustained period of interest, as long as the demand follows the same trajectories as forecast.

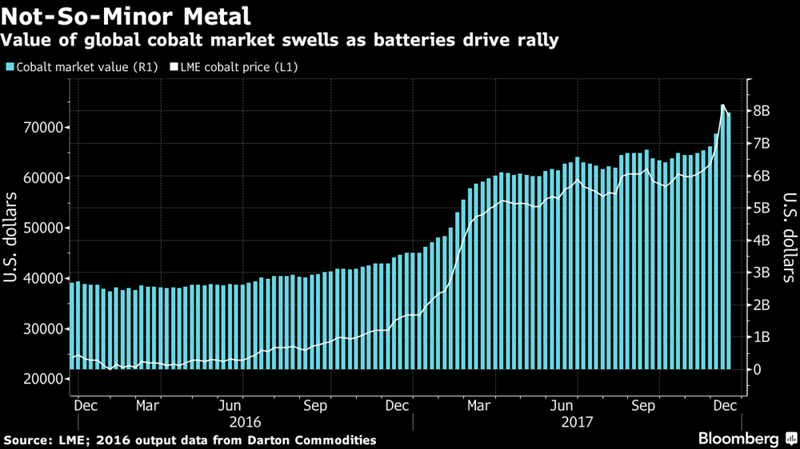

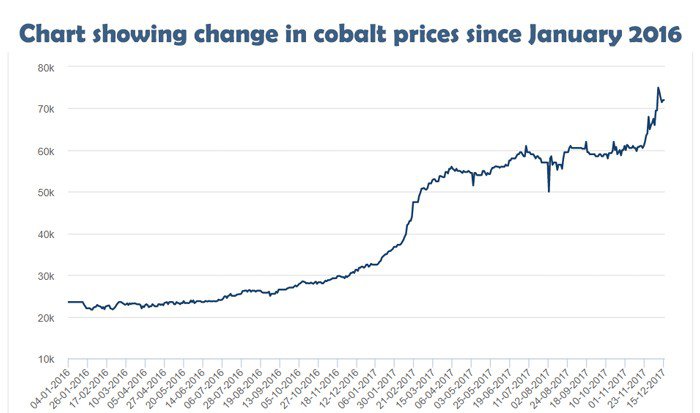

According to analysts, strong cobalt prices are likely continue to drive demand, with cobalt prices recently reaching $62,500/t — up 240 per cent from 12 months ago.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Such price performance typically welcomes a troop of new explorers to the commodities market, and just like lithium explores boomed last year, so have their cobalt cousins, this year.

New entrants have included the likes of Northern Cobalt (ASX:N27), Ardea Resources (ASX:ARL), Australian Mines (ASX:AUZ), Meteoric Resources (ASX:MET), Victoria Mines and Cazaly Resources (ASX:CAZ).

It should be noted these are speculative stocks and investors should seek professional financial advice when considering these stocks for their portfolio.

The concerted move into cobalt exploration is being underpinned by consistent price inflation in cobalt prices:

Source: London Metals Exchange

The larger names already active in cobalt include Rio Tinto and Glencore, although their project ambitions tend to be highly capex-dependent and their share-market valuations tend to be top-heavy given the multitude of projects large-caps typically progress simultaneously.

In terms of value, smaller juniors such as Northern Cobalt (ASX:N27), Meteoric Resources (ASX:MET) as just two examples, present both a risk and an opportunity — the risk is not being able to extract sufficiently-economic amounts of cobalt. The opportunity, is for junior explorers to prove up large amounts of cobalt rather quickly, and thereby initiate mining sooner rather than later.

Given their smaller market-size, small-cap stocks offer investors a less expensive means of finding exposure to the cobalt industry, in comparison to large-caps such as Rio. Rio Tinto (as well as other mature miners) has taken steps to grab a fistful of cobalt, at this early stage too. Cobalt’s turbo-charged rise may explain Rio Tinto’s move to expand exploration in Minnesota, US.

With that being said, small-cap investors realise that investing in stocks is a highly personal decision with the associated risks and rewards, completely at the discretion of the investor.

Glencore PLC (LON:GLEN)

Glencore (OTCMKTS:GLCNF) (LON:GLEN) is the largest Global cobalt producer, with 2016 cobalt production of 28,300 tons. Once Katanga Mining (Glencore owns 86%) comes back online in Q4 2017, Glencore’s effective (including Katanga) cobalt production will increase further, heading towards 50-60000 tons pa by 2019. At this point Glencore represents almost 50% of total global cobalt production, making it the largest cobalt miner in the world.

Northern Cobalt (ASX:N27)

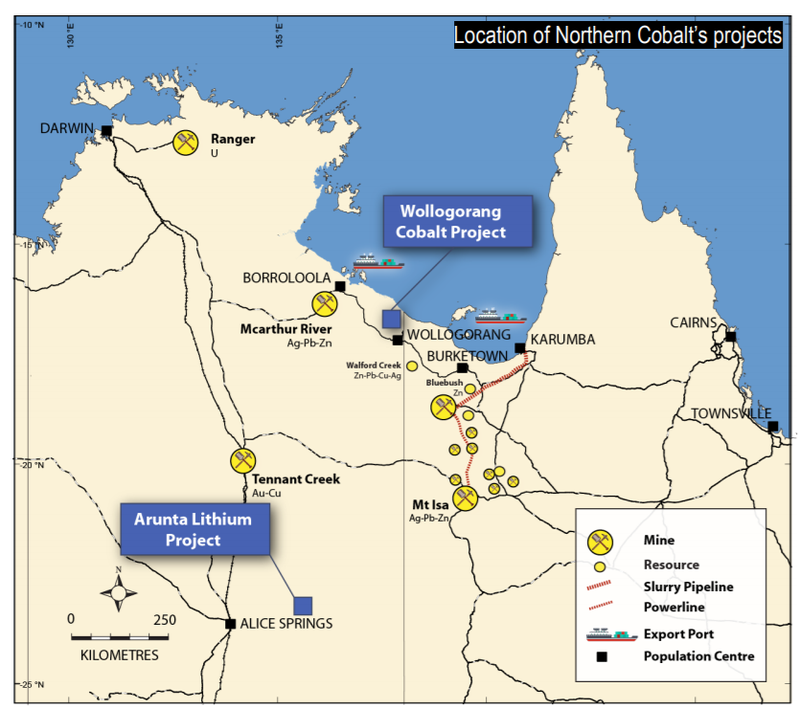

Northern Cobalt (ASX:N27) listed on the ASX earlier this year and wants to expedite its development by fast-tracking resource drilling at its cobalt project in the Northern Territories. It has taken over a site in the Northern Territory, near the border of Queensland, where Rio Tinto was targeting copper in the mid-1990s. The company already know where the first 200 drill holes are going, and the drill rig has been prepared for an extensive drilling program.

Not only does N27’s Board led by Chairman Len Dean, have aspirations to develop a cobalt resource, it is also pursuing lithium commercialisation via recently acquired lithium tenements adjacent to its flagship Wollogorang cobalt project, which is also in the Northern Territory.

Source: Northern Cobalt

The company has applied for four adjoining tenements to compeiment the landholding, which has been labelled the Arunta project. In addition to lithium, the tenements are believed prospective for cobalt, cerium, tantalum and rare earth elements niobium and ytterbium — as part of what N27 Chairman Len Dean calls a complimentary “new project acquisition in central Australia aligning with the company’s strategy to pursue commodities essential to the renewable energy future of the planet”.

N27’s activities have been closely watched by investors, with N27 shares rising from around $0.20 to as high as $0.80 per share in November.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Ardea Resources (ASX:ARL)

Ardea Resources is an Australian explorer who owns 100% of the massive Kalgoorlie nickel-cobalt project (KNP) in Western Australia. ARL’s total cobalt resource is estimated at 386,000 tons of contained cobalt (at 0.05% grade), which places it as one of the largest in Australia. ARL is conducting exploration and hopes to update the market with a Pre-Feasibility Study in early 2018.

From the international crop, Cobalt 1 (ASX:CO1) are chasing high grade cobalt and look set to merge with three others listed on the Toronto Stock Exchange. While European Cobalt (ASX:EUC) is right on the doorstop to supply to European car manufacturers like Volkswagen who have made strong signals of a switch to electric vehicles.

Cazaly Resources (ASX:CAZ)

A diverse portfolio of quality assets and a low capex environment creates room to manouvre for CAZ, as yet another junior cobalt explorer (and aspiring producer).

With a portfolio of projects containing gold, copper, zinc, cobalt, zinc, nickel, iron ore, graphite and lithium, CAZ is a polymetallic investment option with recent rock-chip results raising hopes of a strong Resource declaration next year.

Archer Exploration (ASX:AXE)

AXE is a stock that could readily be termed as the ‘one-stop-shop’ for batteries having abundant graphite, magnesite, and cobalt assets in its portfolio. AXE currently sports Australia’s largest manganese and graphite Resources and has recently moved to add cobalt to its development itinerary.

In addition, the company has a collaborative arrangement with the Australian Research Council (ARC) on the development of graphene, a graphite based material likely to find its way into the EV battery technology race. AXE has just replaced its CEO with a graphene specialist after a swift takeover of Carbon Allotropes, and intends to not only serve shareholders as miner — but also — as a metals processing company able to service the full supply-chain of modern commodities such as graphene.

If this wasn’t enough, AXE also has commercial exposure to copper and gold after announcing timely gold and copper finds at its Blue Hills Copper project in South Australia.

Walking into a metals wonderland

Cobalt demand is rising fast — but understanding cobalt’s product lifecycle and development stages are key to seeing that as a market industry, we could be on the cusp of something much bigger.

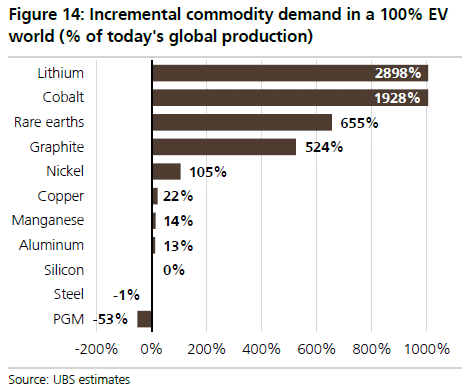

As increasingly more nations and societies embrace electric vehicles and battery-powered energy-storage, demand for the battery building blocks such as lithium, graphite and cobalt should continue to rise steadily for decades to come. Without even considering grid storage (something which Tesla is also working on in South Australia in partnership with the SA Government), lithium-based energy is set catch-up to and outstrip traditional energy generation achieved through pollutive combustion methods.

Throw in the Asian effect in terms of population and greater spare capacity — and you get an absolutely blistering pace of global energy competition in which investors can find great opportunities.

If you thought Tesla’s Gigafactory plans were audacious, just wait and see what Chinese and Japanese manufacturers develop over the next few years. Once Asia syncs up to the energy-storage boom, it could potentially take cobalt to heights that may seem stratospheric even by today’s standards.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.