Castillo identifies six Himalaya-style cobalt targets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

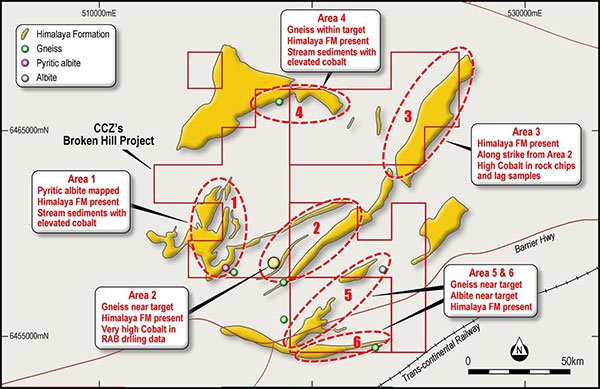

Castillo Copper Limited (ASX:CCZ) has this morning announced that the geology team on site at its Broken Hill Project is undertaking mapping reconnaissance and geochemistry work across six highly prospective target areas known to have the Himalaya Formation.

CCZ’s holdings are situated in close proximity to Cobalt Blue’s (ASX:COB) 60 square kilometre Thackaringa deposit, which hosts 61,000 tonnes of contained cobalt. The six identified sites have the same geological sequence, being the Himalaya Formation, as the Thackaringa deposit — making them prime targets for CCZ.

Further, this type of cobalt mineralisation is attractive because it is amenable to extraction, which could result in a more cost effective and fast-tracked operation.

The objective of this current program of work is to gather enough first-hand data to design the inaugural cobalt-focused drilling program at the Broken Hill Project.

CCZ’s project is situated 17 kilometres west of the historic Broken Hill mining centre, within a prolific region of NSW steadily emerging as a hub for battery metals. Broken Hill in particular is thought to contain one of the largest undeveloped cobalt reserves in the world, however previous exploration in the area has predominantly focused on zinc, lead and gold.

While CCZ’s key overall objective at present is to re-open the Cangai Copper Mine, the impetus to gather first-hand understanding of the geology at the Broken Hill project is now critical with the region’s growing profile as an emerging cobalt supply chain hub.

The company’s team reviewed legacy drilling/geochemistry data, geophysics, geological observations and regional maps to identify the priority target areas highly prospective for cobalt mineralisation.

The priority cobalt targets relative to the Himalaya Formation are mapped below:

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

The six targets were selected following the in-depth analysis of several data sets which were compared to peers’ deposits with known geology and confirmed cobalt mineralisation.

Once the initial field reconnaissance has been completed, CCZ will undertake a follow-up sampling program.

With the price of cobalt in the vicinity of US$85,000/t, CCZ is taking steps to expedite its exploration program in order to confirm the full extent of cobalt mineralisation across its landholdings as soon as possible.

A member of the geology team at CCZ’s Broken Hill Cobalt Project

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.