Brexit: its impact on Asia and EU

Published 23-JUN-2016 14:54 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Matt Simpson of Think Forex takes a closer look at Brexit and the relationship between the UK and EU with regard to the UK trade balance, and potential impact on growth and direction for the British Pound surrounding the EU referendum.

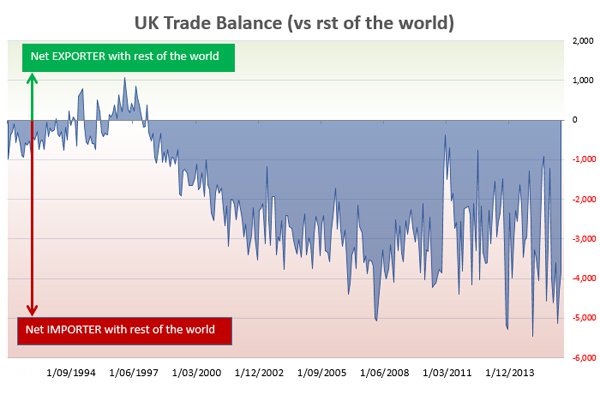

The UK has run a trade deficit since 1998, which simply means the economy imports more than it exports. A negative trade balance (referred to as a trade deficit) can hurt both economic growth and domestic currency.

Trade balance and growth

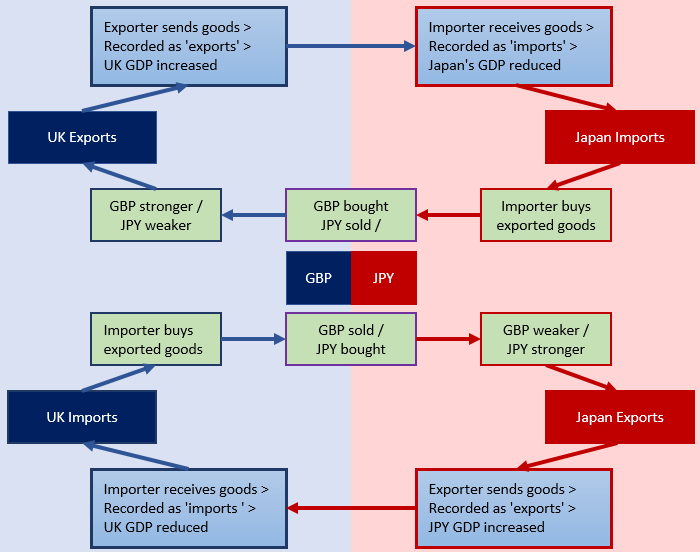

Gross domestic product (GDP) is a common way of assessing economic growth. The calculation of GDP effectively penalises imports by subtracting them from the total GDP figure. On the other hand, exports merit growth as they are included in the overall GDP number. This means that an economy with a trade deficit such as the UK would see lower growth than if it had a trade surplus (where exports outweigh imports).

Trade balance and currencies

The domestic currency is also negatively affected due to the debit and credit nature of international trade flows. An importer of a good needs to purchase the relevant currency of the exporter, meaning domestic currency is sold and foreign currency is bought. This effectively weakens the domestic currency and strengthens that of the exporter (supply and demand).

The following diagram shows how both growth and currency are affected during the exchange of goods between two countries. In theory, if the volume and value of goods exchanged were the same then it would have no impact on growth or currency value for either country.

Of course, when you consider the sheer scale and complexity of international trade, alongside additional factors such as monetary policy, trade tariffs, trade deals and moving exchange rates (to name just a few) the reality is far more complex than the chart above can encapsulate. But it serves to demonstrate how the debit and credit of international trade can affect both growth and exchange rates.

Trade deals and exchange rates

Whilst trade balance (also referred to as balance of trade) looks at an economy’s trade vs the rest of the world, we can take a closer look at the trade balance against individual countries or regions. One of the great unknowns surrounding the ‘Brexit’ referendum is what will happen to trade deals if Britain votes to leave the EU. What we do know is that any significant change in trading partners could have a huge impact on growth and exchange rates.

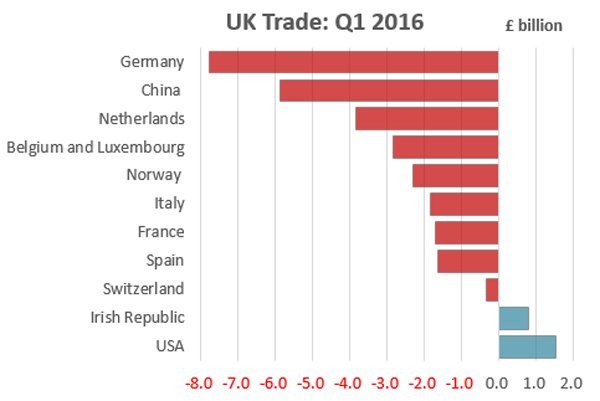

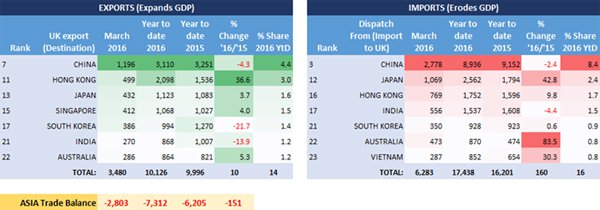

Below we can see that the UK was a net importer with 9 of its top 11 trade partners and 8 of those 9 are EU members. Therefore, changes in trade deals resulting from an EU withdrawal could have a disproportionately large impact on domestic GDP and the British Pound.

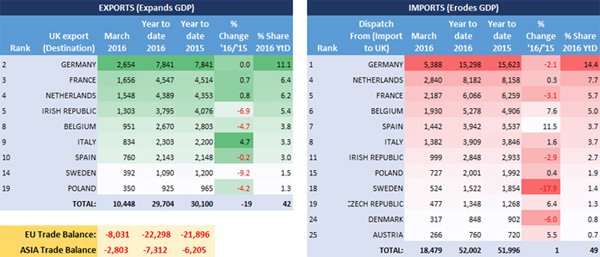

The tables below detail EU countries from the top 25 UK trading partners, for either exports (UK sends goods to) or imports (UK receives goods from). Focussing on Germany, the UK’s largest trading partner within the EU, we can see that imports outweigh exports by a factor of 2:1. So the UK has a trade deficit with Germany which negatively impacts UK growth, whilst helping to support German growth. If Germany still traded in the Deutschmark, this would have an appreciated effect on their currency. However, as they now trade in Euro’s the positive impact of German trade would be diluted with other Euro nations.

Not only does the UK run a trade deficit with each country, but there are also more countries which export to the UK than the UK exports to. By comparing the ‘total’ column of each table, you’ll see we have provided an ‘EU Trade Balance’ to show how the UK runs a deficit overall with the largest EU trade partners.

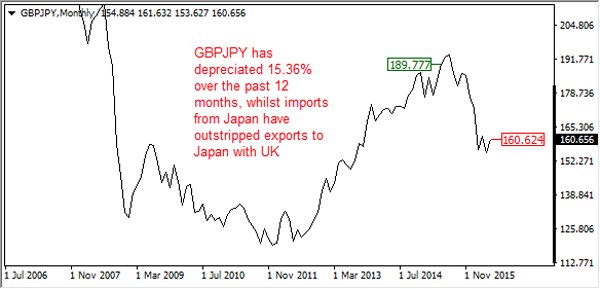

Taking Asia as an example, six of the UK’s top 25 importing trade partners are Asian (7 if we include Australia). Over the past year the UK has increased imports from Japan by 42.8% whilst exports to Japan have only risen 36.6%. In March 2016 alone, imports from Japan outstripped exports to Japan in nominal terms by a factor of 2:1, so trade balance between UK and Japan is in deficit. This places downwards pressure on the British Pound and helps support the Japanese Yen as the UK exchanges Sterling for Yen.

It is therefore no coincidence that GBPJPY has depreciated by -15.36% over the past year and by 10.7% in 2016. Of course, other factors will also be at play such as the interest rate differentials and whether the central banks involved are raising or lowering interest rates but hopefully you can appreciate the importance of trade data on domestic growth and currency.

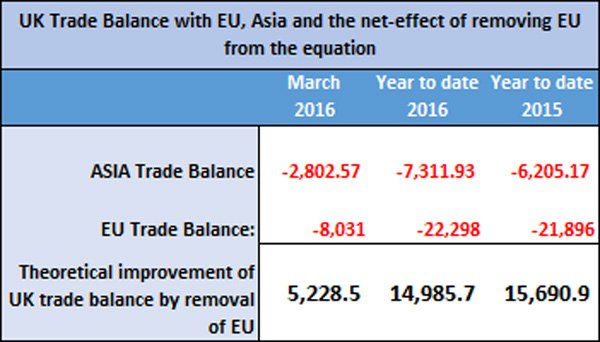

Brexit could result in higher growth for UK, without increasing exports

A great irony here is that, if the UK were to leave the EU and cut all ties with their EU trading partners, the UK should see a higher GDP as a result. This is because the negative effect of net imports would no longer weigh on UK GDP, thus sending their growth higher without having to export more goods.

We are not suggesting this outcome is likely, but want to use an extreme example to demonstrate how dramatic changes to trade deals can impact growth of the economies involved.

Whilst UK runs a trade deficit with Asia, removing EU from the equation would be a net positive for domestic growth as EU imports outstrip Asia exports by approximately 2 or 3:1, depending on which time horizon we choose above. However, for the UK to completely remove the negative effects from Asia imports, they would either need to become more productive at home (so less dependent on imports) or become a net exporter to Asia. However without the introduction of new Asia trade deals this seems very unlikely.

Tomorrow we will look at the aftermath of the referendum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.