BlackEarth locks in graphite exploration targets

Published 09-AUG-2018 12:01 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

BlackEarth Minerals NL (ASX:BEM) today provided an Exploration Target for the Maniry Graphite Project in Southern Madagascar.

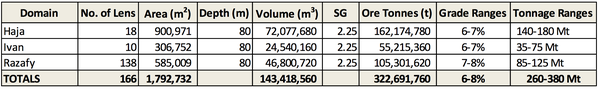

A review of all available data has highlighted the project to have an Exploration Target of 260-380Mt at 6-8% Total Graphitic Carbon (TGC).

The estimation was undertaken by extrapolating the recently defined resource at Razafy, utilising the information gathered by the historical mapping and rock chipping and observations from a historical VTEM survey flown in 2008.

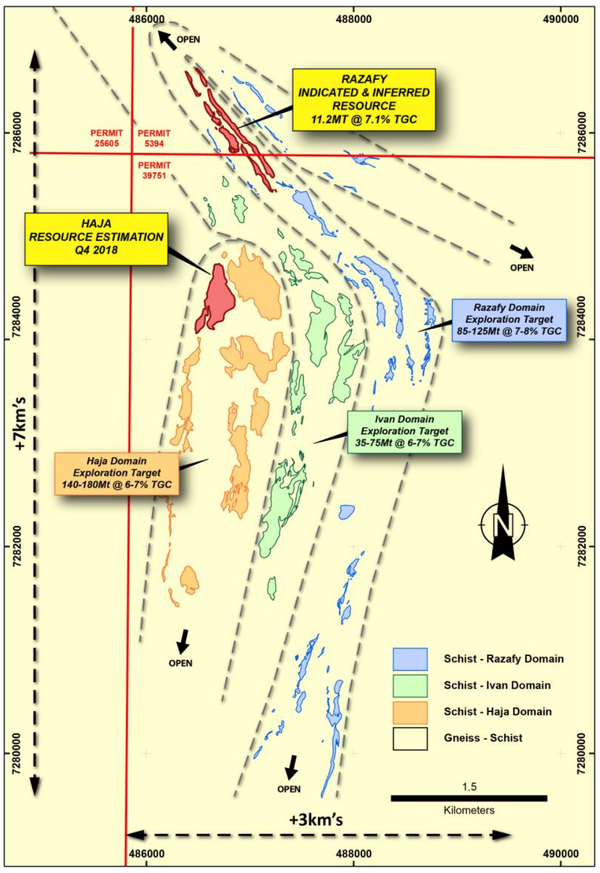

The Maniry Project has been broken down into three regional domains of graphite mineralisation — the Razafy Domain, the Ivan Domain, and the Haja Domain.

The three domains have a total Resource Target for the Maniry Project of 260 - 380Mt at 6-8% TGC.

BEM make note that these Exploration Targets are not JORC compliant Mineral Resources and that there is no certainty that further exploration work will result in the determination of a Mineral Resource.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.[J1]

The Razafy Domain

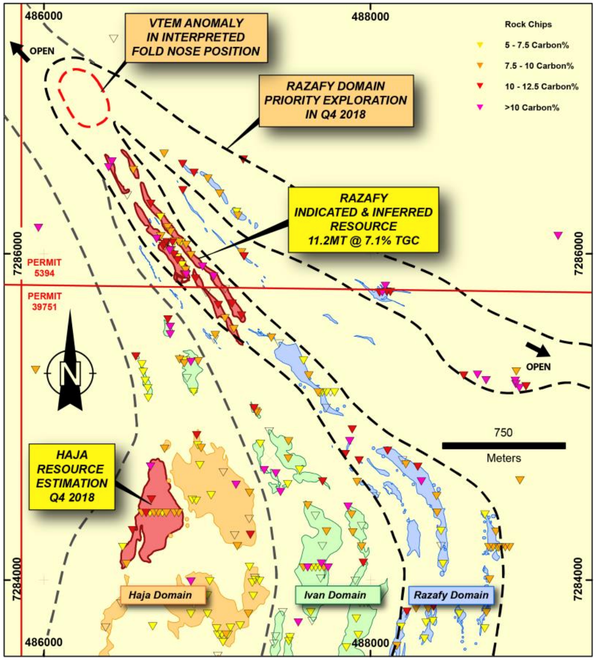

The Razafy Domain is a large-scale fold on the north and eastern margins of the Maniry area characterised by multiple high-grade lenses such as the recently defined Razafy and Razafy East Lenses.

The data review highlighted the Razafy Domain as a priority for exploration in the fourth quarter with the ultimate aim of defining further high-grade resources proximally to the high grade Razafy Deposit.

The Exploration Target for this domain, including the Razafy lens, is 85 - 125Mt at 7- 8% TGC. Upcoming exploration will attempt to delineate further high-grade mineralisation proximal to the Razafy Deposit.

Razafy exploration

A review of exploration data sets has further highlighted the Razafy Domain as a priority area for further exploration with the aim of delineating further high-grade resources proximally to Razafy Resource.

VTEM data, which was collected by the former project owner Malagasy Minerals Ltd in 2008 for nickel-copper sulphide exploration, along with mapping and rock chipping has been used to identify a large-scale fold that will provide the focus of a combined mapping, rock chipping and trenching program in the fourth quarter.

Of particular interest, a large, prevalent VTEM anomaly is situated in an interpreted fold nose position. Fold noses are well known structural positions for high grade graphite mineralisation, an example of this would be the Molo Graphite Deposit (Next Source Materials – 141Mt at 6.1% TGC) situated 65 kilometres north of the Maniry Project. BEM’s second graphite project in Madagascar, The Ianapera Project, is located along strike of Molo, exploration will also be undertaken here in Q4 2018.

The Haja Domain

The Haja Domain is characterised by a large-scale fold of the graphitic schist on the western side of the Maniry Project. The domain contains the Haja lens in the interpreted fold nose position, theoretically a position for higher grade mineralisation. This prospect is currently being systematically drill tested, with a JORC compliant resource estimation due in Q4 2018. The Exploration Target for this domain, including the Haja lens, is 140 -180Mt at 6-7% TGC.

Haja Drilling update

BEM also provided an update of the 2000m drilling program at the Haja Prospect where 23 of the 25 planned drill holes have been completed. Drilling is progressing well and is expected to be completed within the coming days with a maiden resource estimation in the fourth quarter of 2018.

Previous drilling at the Haja Prospect has identified extensive thicknesses of graphite mineralisation including intersections of 70m at 5.3% Total Graphitic Carbon.

The Ivan Domain

The Ivan Domain is located centrally at Maniry. The Domain is characterised by large scale, outcropping graphitic schist’s containing localised folding which appears to have provided localised areas of high grade mineralisation within the broader lens. The Exploration Target for this domain is 35-75Mt at 6-7% TGC.

Managing Director, Tom Revy commented: “This Exploration Target in the range of 260 – 380 million tonnes at 6-8% demonstrates the significant potential of the Maniry Graphite Project.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.