BlackEarth cranks up exploration at Maniry

Published 09-OCT-2018 12:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

BlackEarth Minerals NL (ASX:BEM) has provided a promising update on the recently received rock chip assays and mapping from the Maniry Graphite Project in southern Madagascar.

Mapping by the BlackEarth technical team has identified a number of outcropping graphitic schists within two kilometres of the Razafy Graphite Resource, with rock chipping returning exceptional assay results from all of the identified lenses.

In total, 56 rock chips were taken, the vast majority of which returned grades of more than 10% total graphitic carbon (TGC), with two results more than 40% TGC.

Commenting on this development, managing director Tom Revy said, “BlackEarth’s Razafy Graphite Prospect continues to deliver exceptional exploration results.

“We have to turn this advantage into a compelling business case, and reward for our shareholders should follow.

“BlackEarth’s next short-term hurdle is completion of the Scoping Study by the end of this year with the ultimate goal of delivering large flake graphite into the premium market.”

The zones of high-grade mineralisation will be systematically explored during the upcoming trenching program at Maniry that is due to commence during October, and the results of this program are expected to be reported towards the end of the year.

Consequently, the next few months should see consistent and potentially market moving news for the group.

Of course BEM remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Maniry growing in size

The confirmation of mineralisation in this area has further expanded the footprint of the Maniry Graphite Project and once again bolstered BlackEarth’s positive view of the project.

Critically, the identification of these exceptionally mineralised lenses towards the under-explored, north-west corner of the project area is suggestive of a previously unrecognized area of high grade mineralisation.

Much of this zone is covered by a relatively thin veneer of alluvial cover, prompting further investigation during the trenching program in October.

Results, from recent diamond drilling have confirmed that the Razafy Prospect consists of high grade, thick outcropping graphitic mineralisation contained within distinct lenses which remain not only open along strike but also at depth.

Recent identification of further lenses to the east also highlights the prospectivity of the immediate area which, based on mapping and previous exploration represents only 5% of the current Maniry Project area.

Maniry the near-term focus

BlackEarth’s Madagascan projects consist of two primary exploration areas, the Maniry project in the south, and the Ianapera project in the north.

The location of these projects is outlined below.

Maniry is highly prospective for large-scale, high-quality graphite deposits and is currently at an advanced evaluation stage.

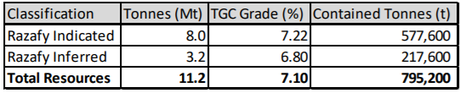

The Razafy indicated and inferred resource, comprising of 11.2 million tonnes at 7.1% Total Graphitic Carbon (TGC) is summarised in Table 1 below.

The vast majority of the resource has a high degree of confidence with an ‘Indicated’ classification, and the remainder is classified as ‘Inferred’.

The Mineral Resource is reported at a 6% TGC cut-off grade. The Mineral Resource was estimated within constraining wireframe solids defined at a nominal 3% TGC cut-off grade.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.