Is BCB the next Stanmore or Terracom?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Bowen Coking Coal Ltd (ASX:BCB) traded as high as 2.1 cents under comparatively high volumes on Monday morning in response to positive news regarding the group’s Stage I concept study at its Isaac River Coal Project.

If nearology counts, this is certainly prime territory as it is located immediately to the east of the BHP Mitsubishi Alliances’ Daunia Mine in the Bowen Basin, Central Queensland.

This area has taken on a new lease of life, proving to be a happy hunting ground, especially for emerging miners such as Stanmore Coal (ASX:SMR) and Terracom Ltd (ASX:TER).

In the last 12 months, Stanmore’s share price has more than doubled and Terracom’s has increased 300%.

Similarly, this development along with other positive recent news emerging from Bowen Coking Coal could be the early stages of a sustained run.

Interestingly, two highly experienced coal executives in Neville Sneddon and Nick Jorss joined the board in mid-December, and that in itself appeared to ignite interest in the stock.

Given Sneddon is the former managing director of Anglo Coal Australia and Jorss was the founder and former managing director of Stanmore Coal their appointments are significant in terms of bringing both industry and local knowledge to the company, as well as valuable business acumen.

Tip of the iceberg at Isaac River

Bowen Coking Coal has an impressive portfolio of top shelf coking coal assets at various stages of exploration and development.

The company fully owns the Isaac River, Cooroorah, Hillalong and Comet Ridge coking coal projects in the Bowen Basin, and it is a joint venture partner in the Lilyvale (15% interest) and Mackenzie (5% interest) coking coal projects with Stanmore Coal.

What lies ahead is an aggressive two-year exploration and development program, and the aforementioned board experience we referred to will be invaluable in terms of shaping the group’s exploration strategy and managing costs.

Looking specifically at yesterday’s news regarding the Isaac River Project, it was predominantly focused on an examination of mine planning, operating cost, capital expenditure and product options.

Such was the positive outcome of the study that it has encouraged management to advance the project into the next phase of project development, supporting additional drilling to obtain fresh coal samples to test the coking properties of all the seams.

The site is drill ready and the planned drilling and exploration activities are likely to be followed by a revised resource estimate, and subsequently the undertaking of Stage 2 of the study.

Consequently, there are catalysts on the horizon as the company releases drill results and the revised resource estimate.

Importantly, this phase of exploration activity will include modelling of the extraction of the lower seams, which are regionally known for their good coking properties.

The resource currently stands at 5.3 million tonnes with stage II expected to both increase the confidence level of the existing resource and potentially provide the business case for project development.

Given management expects to be drilling by the end of March, newsflow isn’t too far away.

Upgrading 154 million tonne Cooroorah resource

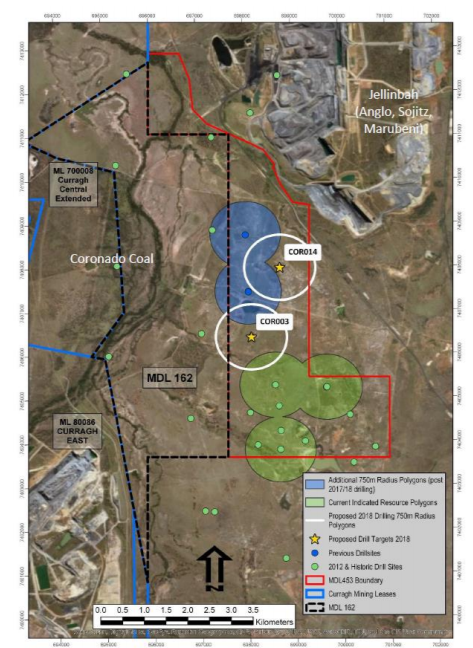

The Cooroorah Coking Coal Project is also shaping up as a good news story for 2019 as management looks to upgrade and increase the tonnage of the 154 million tonne resource which is surrounded by high quality producing mines as indicated below (bordered in red).

The December quarter drilling program successfully intersected all the target coal seams where expected, confirming the company’s confidence in the geological model and seam continuance predictions.

A key objective of the drilling program was to convert a percentage of Cooroorah’s Inferred JORC Resource for the Mammoth seam into the Indicated Resource category and to confirm the continuance between the two main resource areas in the north and south of the tenement.

Hole COR014 confirmed the extension of the Mammoth seam at a 4.5 metre thickness.

Management said that the seam appeared very clean and devoid of any stone bands, similar to those intersections observed in the 2017/18 exploration program.

COR014 is strategically located towards the east of the tenement (also the deepest part of the Mammoth resource area) to test the seam continuance closer to the interpreted Jellinbah fault.

Initial raw coal quality from COR014 confirmed the continuance of the high-quality coal.

Providing further potential upside was drillhole COR003 (see above, circled in white) which encountered all of the coal seams in line with the predictions from the geological model, adding further confidence in terms of delineating a continuation of the seam between previous exploration in the south (marked in green) and the latest drilling in the north of the tenement.

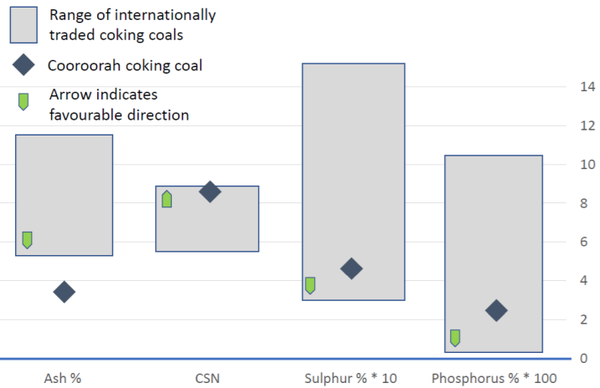

The high-quality of the Cooroorah coking coal will no doubt play an important role in the project valuation given it should fetch a premium price driven by high demand for coal that is low in ash, sulphur and phosphorus.

The following chart demonstrates how coal from the Cooroorah project stacks up against other internationally traded coking coal.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.