Anderson ready to launch exploration program at Woomera

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

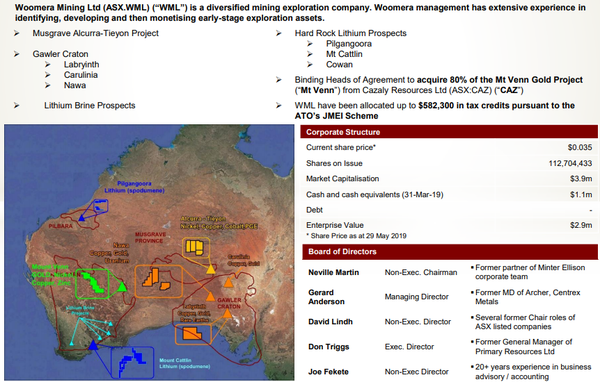

Woomera Mining Ltd (ASX:WML) has an extensive minerals tenement portfolio prospective for copper, lithium, gold, uranium, iron ore, nickel and cobalt.

Such a diversified asset base is difficult to find, particularly among emerging players.

What makes WML an even rarer commodity is the quality of its assets which are mainly located in areas where there are high profile projects being operated by leading mining groups.

Management has acquired proven territory and undertaken exploration that has identified a diversified range of metals in areas where they are traditionally found, and geological trends typically support the presence of such commodities.

I caught up with managing director Gerard Anderson at the Noosa Mining Conference, and we discussed the company’s strategy in terms of conducting a focused exploration campaign, as well as his approach in terms of prioritising the group’s various activities.

However, it is important to first gain an understanding of WML’s project portfolio, particularly in terms of appreciating management’s ability to extract optimum value from a high profile asset base.

Gawler Craton, Pilbara, Ravensthorpe..... and then Mt Venn

Woomera’s assets include tenements in the Musgrave Province of South Australia, and the company also has tenements in the Gawler Craton which are considered prospective for uranium rich iron oxide copper gold (IOCG), as well as copper, nickel, cobalt, precious metals and rare earths.

As one of the most prolific mining regions in Australia and host to major projects such as Olympic Dam, the inclusion of Gawler Craton assets in WML’s portfolio should come as no surprise given management’s proven ability to snare premium sites in highly prospective regions.

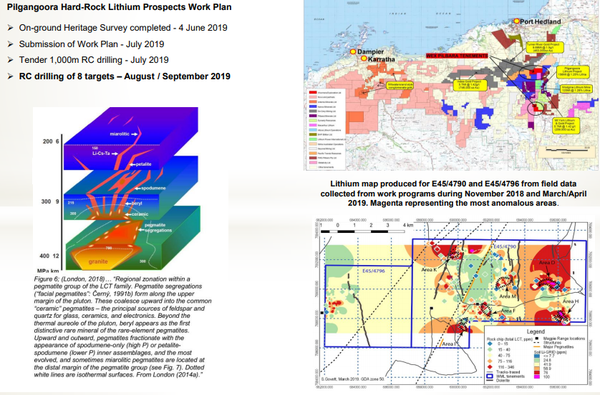

WML’s tenement portfolio also includes 9 granted tenements and 3 tenement applications in Western Australia including 2 tenements and 1 tenement application in the Pilbara region where the company is focused on hard rock lithium prospects.

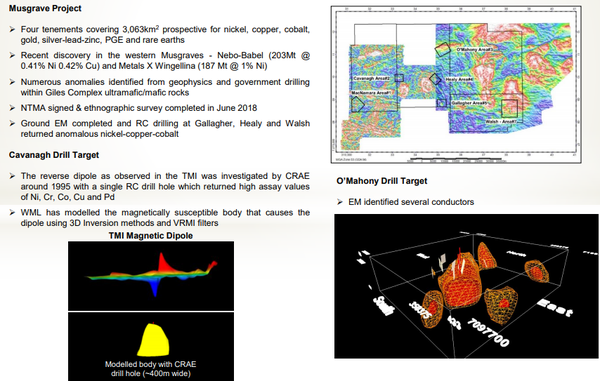

WML has four tenements covering approximately 3000 square kilometres in the Musgraves, an area that is prospective for nickel, copper, cobalt, gold silver-lead-zinc, platinum group elements and rare earths.

Traditional high grades identified at Mt Venn

However, it has been the recent acquisition of an 80% interest in the Mt Venn assets that has really caught the market’s attention.

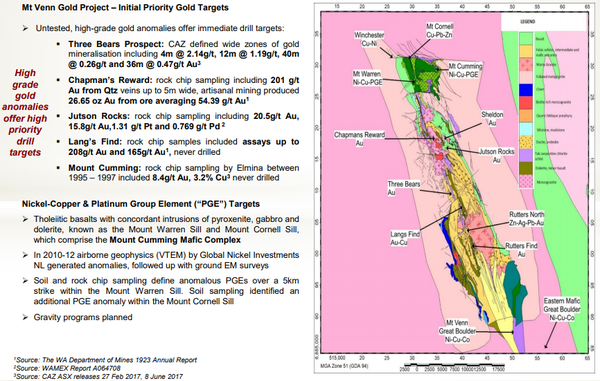

The Mt Venn gold and nickel project is 125 kilometres from the township of Laverton in the north eastern goldfields of Western Australia.

The high grade mineralisation delineated at Mount Venn in the course of historical exploration is well documented, but before going there it is worthwhile gaining an understanding of the process that led to WML gaining an 80% stake in the gold tenements.

On 23 May, WML signed a heads of agreement providing the framework to purchase an 80% interest in Cazaly Resources Ltd’s Mount Venn gold tenements.

Under the terms of the agreement which is expected to be finalised by September, WML will acquire 100% of the shares in Yamarna West, a wholly-owned subsidiary of Cazaly which held the tenements.

Yamarna would then transfer to Cazaly a 20% undivided interest in the tenements and Cazaly would enter into an agreement with Yamarna to establish an unincorporated joint venture under which Yamarna would have an 80% interest and Cazaly a 20% interest.

However, there has been another significant chapter added to this story with WML advising this week that according to the DMIRS register, the amalgamation applications have been granted and the areas the subject of P38/4149-4151 and P38/4195 are now part of E38/3111.

The two tenements E 38/3111 and E 38/3150 cover 50 kilometres of strike of the Mt Venn Greenstone Belt providing Woomera with a dominant land position that represents more than 90% of the belt.

The Mount Venn greenstone belt is associated with the Yamarna Shear and is close to Gold Road Resources’ (ASX: GOR) Gruyere gold deposit located in the neighbouring Dorothy Hills Greenstone Belt.

The Gruyere deposit has a resource of 6 million ounces, and as Gold Road has progressed the project in the last six months the company’s shares have more than doubled, spurred on by a buoyant gold price.

However, for an emerging company like WML it is worth taking a look at where Gold Road was trading when it discovered the Gruyere deposit in October 2013 the group was trading in the vicinity of 9 cents per share, not far from its 10 year low.

So if you fancy a 15 bagger, WML might be the stock to follow.

Significance of additional licences

In addition to the granted exploration licences, four Prospecting Licences over the historic Chapman’s Reward mine (P38/4149, 4150, 4151 and 4195) which had expired were pending amalgamation into E 38/3111.

With the four expired Prospecting Licences covering the Chapman’s Reward gold prospect at Mt Venn now having been amalgamated into E 38/3111, WML has brought further territory under its banner that has historically delivered near surface fine visible gold quartz veins up to 5 metres.

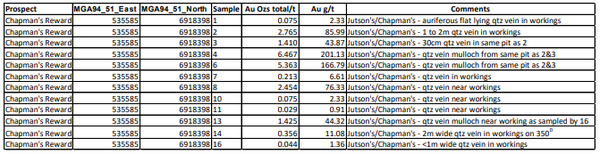

Coordinates and descriptions of State Prospecting Party’s 1923 rock chip sampling undertaken at Chapman’s Reward results converted are shown below.

Note that six of the 12 results featured grades between 44 g/t gold and 201 g/t gold.

Furthermore, Cazaly Resources conducted rock chip sampling in September 2018, delineating grades of approximately 32 ppm gold.

There are several gold targets that could be drilled once Heritage Clearances are completed.

Foremost among the gold targets are Chapman’s Reward, Lang’s Find, Mount Cumming and the Three Bears Prospect.

Aside from Chapman’s Reward, the latter is one of Anderson’s key targets as exploration has defined a major five kilometre corridor of coincident, soil, auger and historic drilling anomalism at Three Bears.

Cazaly completed two drilling programs in January and July 2017 intersecting wide gold zones up to 40 metres thick.

Mineralised zones included intercepts of 12 metres at 1.2 g/t gold and 36 metres at 0.5 g/t gold.

Anderson sees numerous similarities between Three Bears and Gruyere, and it will be one of the phase 1 high priority drilling targets in the group’s October/November exploration campaign.

Continued exploration at Gawler Craton, Musgraves and Pilbara

Anderson said that WML’s exploration campaign at Mount Venn wouldn’t alter the group’s commitment to continue its planned exploration of other key projects.

In addition to drilling at Mt Venn, the plan for fiscal 2020 is for drilling to be undertaken at the Alcurra-Tieyon Project in the Musgraves and drilling in the Gawler Craton at Labyrinth.

There is also the potential for drilling at Nawa and management intends to actively explore the Pilgangoora Lithium Project.

The company plans to also undertake soil sampling at Mt Cattlin following the calendar year 2019 harvest.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.