Analysts see 80% upside in Resolute Mining

Published 24-JUL-2017 15:57 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

John Welborn, Chief Executive of ASX 200 gold producer Resolute Mining (ASX: RSG), attended the Noosa Mining Conference last Friday and took the time to update FinFeed on the group’s multiple projects that should see it progress to a 500,000oz/annum producer by 2020.

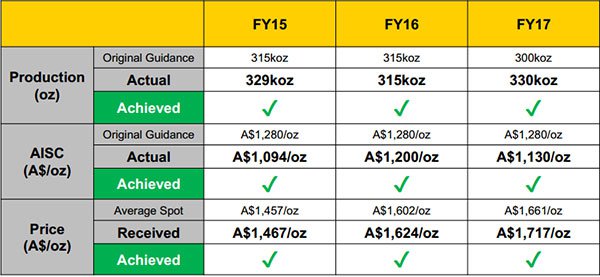

The company has strung together three stellar years between 2015 and 2017 inclusive, exceeding guidance and analysts’ expectations each year on every count, from production through to costs and the realised price per ounce of gold.

On July 12 the company released its results for fiscal 2017. Production of 330,000 ounces from its mines in Africa and Australia was 10% ahead of original guidance of 300,000 ounces. All in, Sustaining Costs (AISC) were AUD$1,130 per ounce, more than 10% lower than guidance of $1,280 per ounce.

The realised gold price was $1,717 per ounce, significantly better than spot of $1,661 per ounce. However, even at spot it is worth noting the healthy margin of circa $530 per ounce.

Yet commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

RSG benefits from Welborn’s business acumen and knowledge of Africa

Welborn has demonstrated his strong financial background and knowledge of the industry and its drivers in effectively managing the company’s exposure to commodity and currency price movements. His experience stems from many years in the industry from exploration through to construction and production.

Most will remember Papillion Resources’ transition from a mere minnow to the owner of the Fekola gold project in West Africa, which was eventually taken over by B2Gold for $670 million. Welborn was instrumental in identifying Fekola as a highly prospective deposit. Interestingly, he now has a ‘soundalike’ exploration target in Nafolo which is situated adjacent to the Syama mine, recently delivering some outstanding drill results.

However, despite the fact that he has established such a strong track record, and RSG has consistently outperformed, it doesn’t appear to be reflected in the share price. Trent Allen from Citi reviewed the company in mid-July after the release of its fiscal 2017 result.

Not only was the analyst praiseworthy of the result, but he expects RSG will beat fiscal 2018 guidance of 300,000 ounces. Indeed, the company has a track record of under-promising and outperforming, and it wouldn’t be surprising to see Allen’s estimate of 318,000 ounces being closer to the mark.

He has a ‘buy’ recommendation on the stock with a price target of $1.90, implying upside of 80% to Friday’s closing price of $1.06.

Welborn restores earnings, repairs balance sheet

Wellborn took over the reins of RSG in mid-2015 when its beaten down share price was tracking in the vicinity of 25 cents per share. Fifteen months later the company’s shares hit an eight year high of $2.35, handing shareholders a capital gain of more than 800%.

However, it should be noted that historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering stocks in these markets should seek independent financial advice.

Welborn’s industry experience, as well as his knowledge of doing business in overseas jurisdictions has been instrumental in driving efficiencies which have flowed through to improved production and a much healthier balance sheet. As at June 30, 2017 the company had $290 million in cash, bullion and listed investments and group net operating cash flow from its Ravenswood and Syama operations was $152 million.

This is in stark contrast to the position the company was in when he took over, and represents a $320 million turnaround in net debt over the past two years.

However, RSG’s shares have declined since last year’s peak, leaving Welborn somewhat perplexed. He highlighted the fact that on so many measures the company has outperformed its peers with a sector leading return on equity of 20%, and yet it continues to trade at a significant discount to its Net Asset Value.

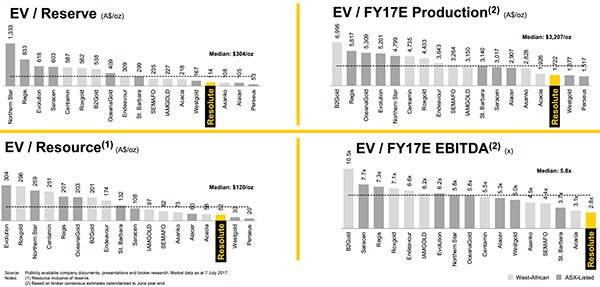

As the following table demonstrates, the company also trades at a significant discount to its peers based on gold reserves, resources, production, and EBITDA.

Notwithstanding the share price performance, he highlighted the group’s strong institutional shareholder support which includes large global funds such as Oppenheimer Funds, Baker Steel Capital Managers and IFM investors. With two projects in Africa and one in Australia RSG tends to be better understood by Northern Hemisphere investors.

When Welborn is away from the mine site he spends his time between Perth and London. Having witnessed the strong show of support he received at the previous year’s London Mines and Money conference there is no doubt that investors in Europe and North America not only ‘get’ the story, but they have a good deal of confidence in Welborn’s ability to achieve that 500,000 ounce per annum goal.

An overview of producing assets and growth prospects

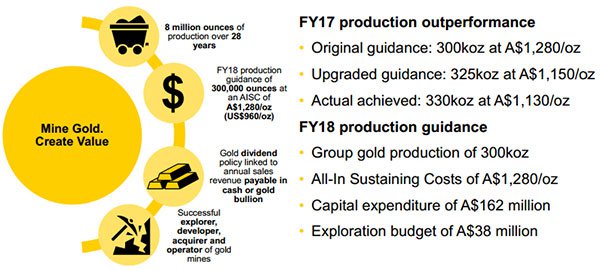

The following provides some background on RSG’s history and its current operations. The company is an experienced explorer, developer, and operator, having owned and managed nine gold mines across Australia and Africa which have produced circa 8 million ounces of gold.

RSG currently produces from two mines, the Syama Gold Mine in Africa and the Ravenswood Gold Mine in Australia, and is one of the largest gold producers listed on the ASX with FY18 guidance of 300,000 ounces of gold production at All-In Sustaining Costs of AUD$1,280/ounces (US$960/ounces).

Resolute’s flagship Syama Gold Mine in Mali is a robust long-life asset comprising parallel sulphide and oxide processing plants. The move to underground mining is expected to extend the mine life beyond 2028.

The Ravenswood Gold Mine in Queensland demonstrates Resolute’s significant underground expertise in successfully mining the Mt Wright ore body, where operations are expected to cease in FY18. The company’s next stage of development in Queensland is the return to large scale open pit mining at the Ravenswood Expansion Project which will extend the mine life for a further 13 years to at least 2029.

In Ghana, the company has completed a feasibility study on the Bibiani Gold Project focused on the development of an underground operation requiring modest capital and using existing plant infrastructure.

RSG is also exploring over 4,200 square kilometres of potential world class tenure in West Africa and Australia with active drilling programs in Mali, Ghana, Cote d’Ivoire and Queensland, Australia.

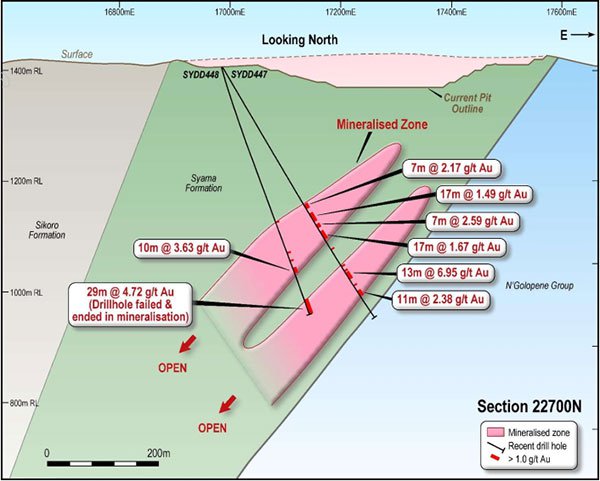

Welborn is particularly confident about the future of the Nafolo prospect. There was a potentially game changing development at the start of 2017 with outstanding drilling results being achieved at the Nafolo prospect, located adjacent to the 8 million ounce Syama deposit.

Results from drilling at Nafolo have identified high grade gold mineralisation across very wide intercepts, including 41 metres grading 4.9 grams per tonne gold and 37 metres grading 3.1 grams per tonne gold.

There were some high-grade hits across smaller, but still robust intersections such as 13 metres grading 6.9 grams per tonne gold. One interesting hit was 29 metres grading 4.7 grams per tonne gold from 446 metres with mineralisation continuing at depth, suggesting that this could be similar to Syama in terms of being a major discovery with underground potential.

Welborn noted that the proximity and the location of the Nafolo discovery shows potential for the mineralisation to be accessed early in the underground mine life at the Syama project. Given the mineralisation at Nafolo is similar in size and tenor to the mineralisation at the 8 million ounce Syama orebody, Welborn is eager to put his $38 million exploration budget to work in fiscal 2018.

This has the potential to transform the Syama operations, as all drill holes have intersected gold mineralisation, while there are substantial untested areas to the south and at depth. Furthermore, the deposit remains open in all directions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.