MAN sampling for uranium <5km from producing mine in the US.

Mandrake Resources (ASX: MAN) has just completed a uranium sampling program at its project in Utah, USA.

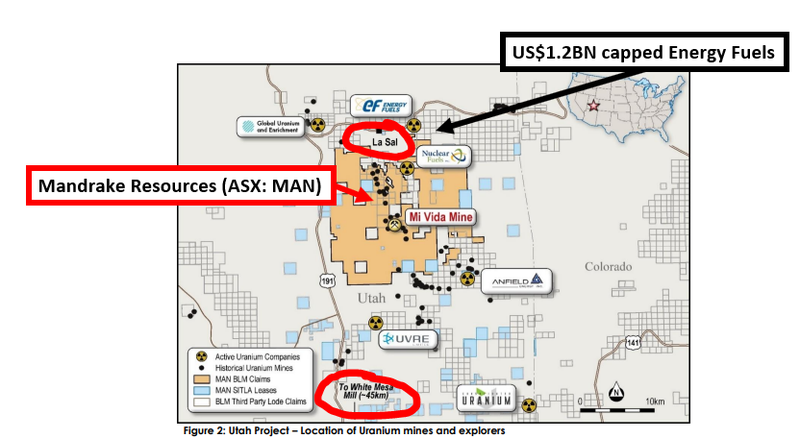

MAN’s project covers ~93,755 acres (~379km2) in Utah - previously the third biggest uranium mining state in the USA.

MAN’s project sits <5km away from the La Sal uranium mine which restarted production in December 2023 and ~100km away from the only operating conventional uranium mill in the US (White Mesa Mill).

Both La Sal and the White Mesa mill are owned by US$1.2BN capped Energy Fuels.

Since entering the US, MAN’s focus has been on lithium brines but today, MAN completed its first uranium targeted sampling program.

In today’s announcement, MAN confirmed several “radioactive outcrops” had been identified and six different rock chip samples had been taken for lab testing.

MAN now expects the results from the sampling program to come in before the end of Feb 2024.

US uranium - right place, right time?

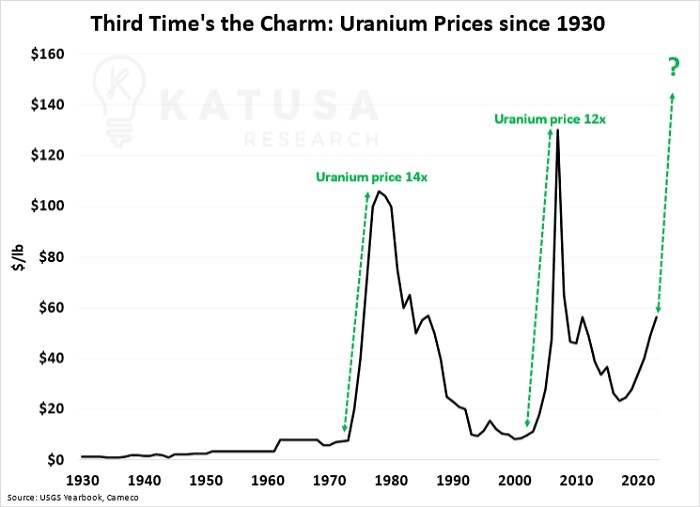

Earlier in the week uranium prices hit ~15 year highs at ~US$107/lb.

Uranium is now in a technical bull market - the third we have seen over the last ~50 years.

The first uranium bull market was in the 1970s-80s when the price increased by 14x.

The second was in 2007-2009, when the price increased by over 12x.

Now so far in this cycle the uranium price is up ~5x from the US$20/lb lows of the 2010’s.

One thing both of those bull markets had in common was that when spot prices started moving, they increased exponentially.

We think the uranium market is heading into a period of structural shortages, made worse by the Russia/Ukraine conflict which threatens to hit the enriched uranium supply chain.

For some context - ~20% of the USA’s enriched uranium capacity comes from Russia.

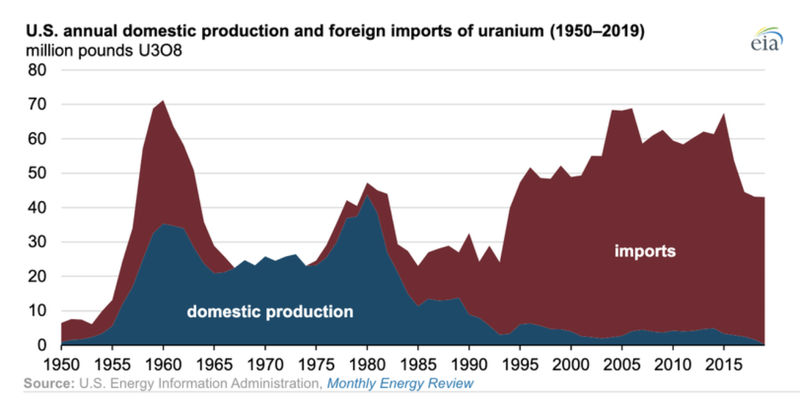

At the same time the US is almost solely reliant on imports for its uranium supply even though it has the world's largest nuclear reactor fleet.

Basically, the US finds itself in a position where it has almost no domestic uranium supply chain BUT generates ~30% of its electricity through nuclear power.

(Source)

Interestingly, the US was once the world’s biggest uranium producers in the 1960s.

We think the recent run in the uranium spot price is in part due to structural supply shortages after decades of underinvestment in new supply AND a combination of the fragility in the nuclear power supply chain.

The US government is looking to get ahead of it and has already introduced up to ~$10BN in funding support for the domestic uranium/nuclear industry:

- US$6BN to maintain and upgrade existing nuclear power plants

- US$4.3BN to wean itself off Russian uranium supplies.

Our view is that US based uranium projects will benefit the most from the current uranium bull market and so if MAN is able to make a uranium discovery it could have a positive impact on the company’s share price.