MAN receives drill permits for US Lithium project

Mandrake Resources (ASX: MAN) just received permits for its two well re-entry program at its US lithium project.

MAN’s project is prospective for lithium brines, similar in terms of geology to projects owned by Exxon Mobil and Albermale in other parts of the US.

MAN project covers ~93,755 acres (379km^2).

Today’s news means MAN can start exploration work on the project with a two well re-entry program on old oil and gas wells.

The objective of the re-entry program will be to go back into the old wells and isolate the lithium brine-bearing reservoirs.

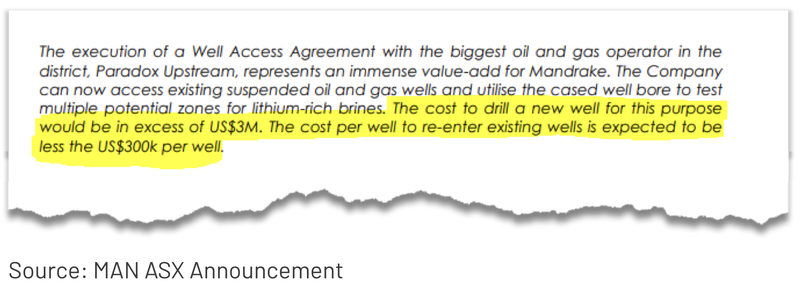

MAN doesn't need to drill new wells and so gets to do all of this work at a fraction of the cost a conventional drilling program would cost.

MAN already has a well access agreement signed, meaning the re-entry program will cost ~1/10th of what it would cost drilling a new well.

In today’s announcement, MAN confirmed the re-entry program would start as soon as a JORC lithium exploration target is announced and the results from Direct Lithium Extraction (DLE) testing is released.

MAN expects both those catalysts to be delivered “imminently”.

MAN progressing 3 major catalysts this quarter?

In the medium term we think MAN could put out 3 key announcements that could re-rate its share price:

- 🔄 Sampling results - MAN has seen grades of ~340mg/li in wells ~6km away from its ground. MAN’s neighbour Anson’s resource has an average grade of ~127mg/li. If the sampling program returns grades higher than these across multiple reservoir intervals, the market may start to take an interest in MAN’s project.

MAN’s re-entry program is now fully permitted and could start before the end of this quarter.

- 🔄 Maiden JORC resource - A maiden JORC resource estimate will give the market something to compare MAN’s project size/scale potential to other US lithium brine peers.

MAN expects to publish a JORC exploration target imminently.

- 🔄 Direct Lithium Extraction (DLE) partnership - This was a major catalyst for Anson and was a key reason that led to its market cap reaching ~$490M in mid 2022. This was also the peak of the last bull market. Even so, Anson is currently capped at a fairly impressive $186M.

MAN expects to put out two sets of DLE test results imminently.

Why does the DLE news matter?

Direct Lithium Extraction (DLE) matters because it is the key to unlocking the lithium potential of brine projects across the US.

DLE tech helps to speed up the process of taking lithium brines and producing battery grade products - especially in parts of the world where evaporation isnt feasible.

Its the same technology that Exxon Mobil is looking to apply to its projects over in Arkansas.

The video below is a great explainer of how DLE can change the game for US lithium brine projects:

(Source)

What’s next for MAN?

- Re-entry program to commence 🔄

- Direct Lithium Extraction (DLE) test results 🔄

- JORC lithium exploration target 🔄