Our Cannabis Portfolio

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| BOD | 1615899600 17-Mar-2021 | $0.500 | -66% | -95% |

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| BOD | 1615899600 17-Mar-2021 | $0.500 | -66% | -95% |

Macro Outlook Canabis - 2023

Unloved cannabis stocks have been sold down aggressively throughout 2022, but 2023 might prove to be a better year.

We think that with some further regulatory progress on recreational cannabis in key markets, particularly in the US and Europe, combined with more risk appetite in the market, cannabis stocks can deliver outsized returns in part because they are so currently unloved.

Here is where we think we are on the Gartner hype cycle:

Cannabis companies went through the early stage of the hype cycle back 2018, with the legalisation of recreational cannabis in California the key catalyst for the industry.

Other key positive developments/future developments:

- Google is relaxing its ban on CBD product advertising, with some caveats - a sign that CBD is slowly going mainstream and a potential source of sales growth.

- Despite getting shot down at the end of 2023, there is a chance the The SAFE Banking Act which would open up avenues for dispensaries to access banking services in the US will be included in a year end bill (2023), to further legitimise the industry and make it more investable for large institutional funds. In turn improving sentiment, perhaps even for ASX listed companies.

- Near-term FDA regulation of CBD industry to formalise CBD’s role in the market and again, make CBD companies more investable.

- New European cannabis liberalisation policies including recreational and/or medicalisation to unlock new sales growth for companies with established products.

All up, if the right things click into place, then we think 2023 could be the start of a decade long investment thematic, where only the best cannabis companies have survived the down turn and will thrive.

What the analysts say

US-based cannabis financial and strategic advisory firm Veridian Capital Advisors is naturally bullish on the prospects for cannabis stocks in 2023 with one of their equities analysts, Jonathan DeCourcey saying,

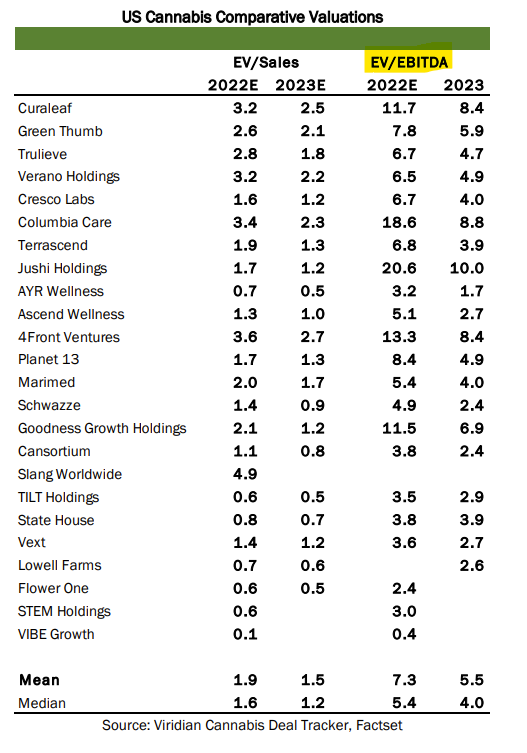

“As we look to 2023, the opportunity becomes even more favorable. Even omitting the share gains for large public players (both through execution and consolidation) and conservatively growing estimated 2022 revenues by the roughly 20% growth rate for broader US cannabis sales in 2023 and leaving adjusted EBITDA margin levels unchanged from 2022 estimates, US cannabis companies will be trading at a roughly 50% discount to the one year forward projections of this winter with 2023 multiples (’23EV/Sales at 2.1x and EV/EBITDA at 6.3x). These valuations levels are incommensurate with the high growth nature of US cannabis and look inexpensive even relative to slower growth more mature industries”

Short version: Cannabis stocks are cheap.

We also note this table of EV/EBITDA multiples of companies in Veridian’s coverage universe (generally if this number is less than 10, it indicates potential value):

More evidence that cannabis stocks could be cheap.

What is the bear case for Cannabis?

Cannabis stocks can broadly be classified as growth stocks as many are yet to become profitable in any sustained, meaningful way.

As a result, these companies are subject to the same vagaries as growth stocks with the added complications from regulatory uncertainty and the sell-offs that occur if legislation fails to pass.

Todd Sohn, an analyst at Strategas Securities was quoted by Bloomberg as saying “Pot stocks were part of the ‘speculative bubble’ that popped last year and that has continued throughout 2022…There’s no reprieve here yet, and the groups involved continue to suggest there’s no new liquidity cycle imminent - that is, the Fed isn’t coming to the rescue.”

Countries are also slow to adjust regulations, so stocks that are leveraged to changes in law may have progress held up if slow moving governments take their time to open up the industry.

Our Commentary on Cannabis

BPM drilling next door to $1.8BN Capricorn Metals

Next Investors

Feb 5, 2024

|ASX:BPM

|1 min

Today, BPM put out soil sampling results from targets further south of Louie and Chickie and confirmed that BPM would look to drill those targets as part of the current drill program.

Why are small caps going down and new lithium commentary

Weekender

May 20, 2023

|Next Investors

|15 min

In this weekender, we cover the old market saying - "sell in May and go away" - while also giving our spill on the lithium market right now.

Making sense of what's 'in' and what's 'out'

Weekender

Oct 31, 2022

|Next Investors

|13 min

In an increasingly chaotic world full of competing narratives and conflict it can be hard as an investor to identify which macro themes are “in” or “out.” Understanding where the tailwinds are coming from, or will come from in the future, is a big part of making good, long term investments.

BPM drilling next door to $1.8BN Capricorn Metals

ASX:BPM

|Feb 5, 2024

Why are small caps going down and new lithium commentary

Next Investors

|May 20, 2023

Making sense of what's 'in' and what's 'out'

Next Investors

|Oct 31, 2022