Why uranium stocks are soaring, one good movie recommendation

Published 18-SEP-2021 14:00 P.M.

|

13 minute read

Aside from VUL raising a whopping $200M and then trading $72M of volume on Friday before its entry to the ASX 300 next week... uranium continues to be the story of the moment.

The uranium price is up 60% in the last two weeks in what has been dubbed by many as the “uranium squeeze” led by the Sprott physical uranium trust, an investment fund that is buying up and holding physical uranium in anticipation of growing demand, driving up the price.

The uranium squeeze appears to be contagious with hedge funds and family offices said to be joining in buying physical uranium, and a lot of financial players are increasingly interested in uranium, from the Middle East to Singapore and Hong Kong.

As Bloomberg reported this morning, the world’s biggest uranium miner, Kazakhstan’s Kazatomprom, is in talks to directly supply the Sprott Physical Uranium Trust, according to its chief commercial officer, Askar Batyrbayev. He added that in addition to Sprott, there’s further competition for the Kazahk producer’s supplies, with Kazatomprom also in talks with China to help build the country’s strategic stockpiles -- designed to hold 23,000 tons by 2026.

(Side note: start doing some reading on the resources potential in Kazakhstan. We are working on a new investment in that country for later this year/early next year... is nice!)

We think the sudden interest to corner the physical uranium market is because uranium is starting to become widely accepted as a potential fuel for clean energy COMBINED with years of chronic under investment in exploration and development while nobody cared about uranium over the last 10 years.

Again a huge congratulations to those that were invested in and long term holding uranium stocks while they were out of favour - hats off to you and well done, especially to those out there sharing their research in their high conviction investments (CP, MC).

Our little uranium explorer GTR has been lifted in the uranium excitement like a kite in a hurricane. GTR expects to be drilling before Christmas so the next few months will be interesting to watch, especially if the uranium bull run has legs. GTR just released the prospectus for their rights issue - details here.

What we are investing in

The USA has a $1.5 billion strategic stockpile of uranium and China is rapidly building theirs.

COVID made all countries realise how flimsy global supply chains are in a crisis. Remember how hard it was for countries to get COVID medical supplies when there was a demand surge? We now also have critical shortages in semiconductors and chips which are stoking global tensions.

Uranium aside, we believe most countries are going to want to build and maintain their own stockpiles of all key commodities needed over the next decade, just in case there is another crisis that disrupts global supply chains again. Countries building their own stockpiles will further drive up commodity prices.

This new desire of countries to secure local stockpiles of key commodities, coming off the back of years of under investment, is why we believe the world is currently in a commodities super cycle.

Other investment themes that we believe in are cybersecurity, health tech, green energy (but also traditional energy which we don’t think will go away as quickly as expected). We also love early stage metals exploration which can be pretty “dynamic” in a hot commodity market (be careful with these they are very risky).

Here is a reminder of all our high conviction investment thematics and which stocks we are invested in for each theme: https://nextinvestors.com/articles/what-happened-week-sep-11th-2021/

The small cap market - so hot right now

The small cap market is definitely feeling good right now compared to May and June. Hot markets can go for weeks, months and even occasionally years, but they will always cycle up and down.

When markets are hot every investor is feeling like a genius and mentally spending their paper profits. If you are sitting on a huge paper win, it’s never a bad time to do a quick stop and think - would a 5% to 10% top slice be a smart move in case the market turns for the worse?

While we can’t offer investment advice, if you want to brush up on how WE think about investing in the small cap market it’s all here in our ebook.

Bored with the market closed on the weekend?

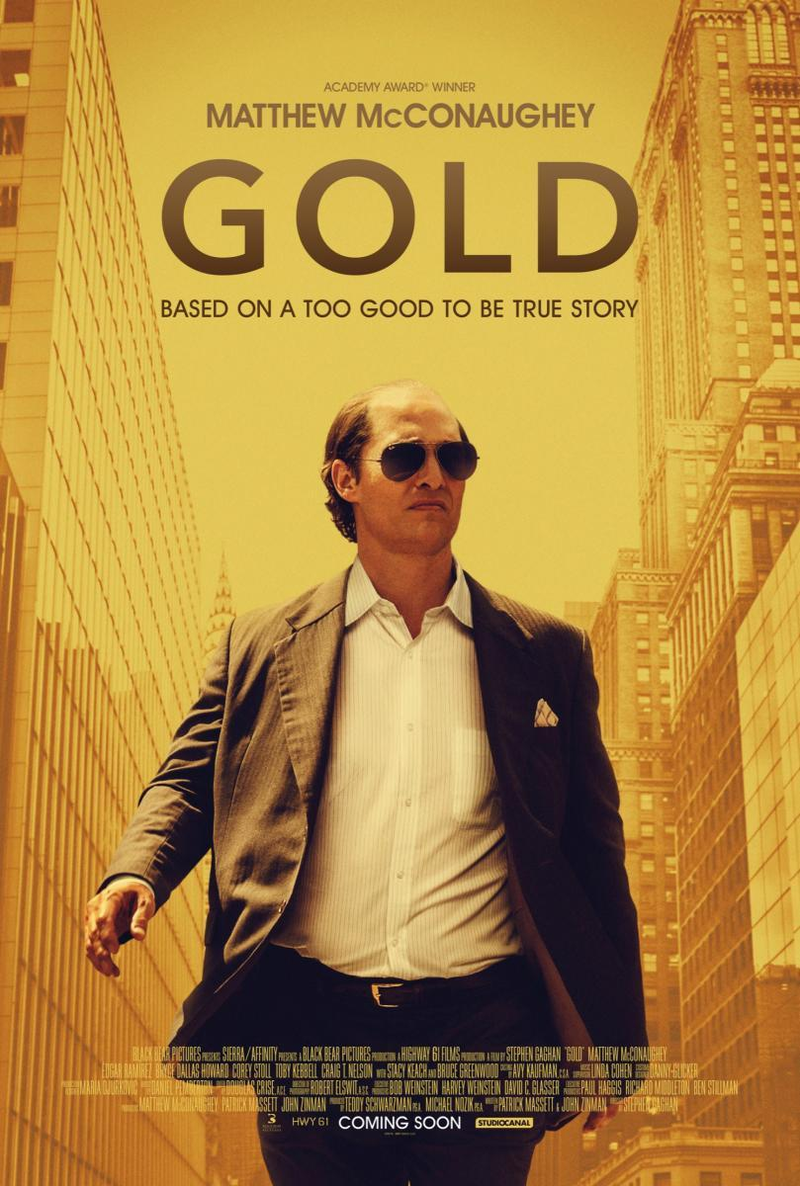

If you are like us and find weekends boring because the stock market is closed, instead of refreshing your trading platform just in case something moves... here is one of our favourite small cap market related movies that a couple of us rewatched last night:

It’s about a down-on-his-luck gold prospector trying to raise money to explore for gold in the Indonesian jungle - a great way to spend a couple of hours for anyone who loves early stage exploration.

It’s hard to find this movie on the main streaming services (we have our own copy on DVD) but we noticed it is currently streaming on SBS for free: https://www.sbs.com.au/ondemand/movie/gold/1938720835538

📰 This week on Next Investors

Kuniko (ASX:KNI) has been trading on the ASX now for over three weeks after its heavily oversubscribed 20¢ IPO and has since been busy progressing its exploration plans — applying modern exploration methods to its historical battery metals projects in Norway.

Since completing a soil and rock chip sampling program in August, KNI has commenced a significant program of airborne geophysics, comprising magnetics, electromagnetics (EM), and radiometric components, across three project areas.

KNI this week provided an update on its exploration progress and we’re now waiting to find out if the current EM surveys on any of their 3 projects reveal large EM conductors below or near any historically mined areas. We expect EM survey results in about a month.

We plan to release our deep dive analysis and have been waiting for the KNI share price to find a stable range before doing so. We thought that would happen a few days after the IPO, but it could be a few more weeks as it’s been a wild ride since opening at 80¢, rising as high as $3.60, and dropping back to as low as $1.65.

📰 KNI commences EM surveys - will they find EM conductors? Find out next month...

Long time readers will know we have been holding uranium explorer GTi Resources (ASX:GTR) for well over a year now. GTR’s performance is heavily leveraged to a strong uranium price.

Uranium looked like it was about to have a run back in early 2020 when we first invested in GTR... but it was a false start and didn’t eventuate. Hopefully this time it’s the start of a strong uranium market.

GTR is now finalising the acquisition of a set of uranium projects in the USA, including in Wyoming’s Great Divide Basin — the uranium capital of America. Uranium is back and so is GTR. So we thought now is a good time to take a deeper look at GTR and its new projects.

Here is our deep dive into GTR:

📰 Uranium is Back - and GTR is Finally Coming Good

🗣️ Quick takes on key portfolio company events this week:

Monday saw a number of announcements from portfolio companies — MNB, TMR, GAL, BPM, PUR, and CPH — which we summarised here: Quick fire commentary on the six stocks making progress today.

To recap briefly:

- Minbos (ASX:MNB) reported that it has completed a 14-tonne bulk sample from its Cabinda Phosphate Project in Angola to improve its fertiliser product. The phosphate-laden rocks will now undergo lab tests in the USA to optimise its conversion into fertiliser.

- Tempus Resources (ASX:TMR) has submitted a permit to reestablish and extend an existing adit at its Canadian gold project to make drilling faster and easier, and so it can continue through Canada’s winter.

- Galileo Mining (ASX:GAL) reported that assay results from the first round of RC drilling at the Delta Blues prospect at its Fraser Range Project confirmed prospective mineralised sulphides. Follow up diamond drilling will now be conducted to test the better parts of the EM conductor at depth. GAL also reported that it has completed a placement to raise $6.5M.

- BPM Minerals (ASX:BPM) has completed the maiden AC drilling program at its Santy Gold Project in WA and assay results are due in around one month. The Santy Project is one of BPM’s ‘side bets’ that it is working on alongside its main focus, the Hawkins lead-zinc project that it is aiming to drill before Christmas.

- Pursuit Minerals (ASX:PUR) reported results from DHEM surveys on the first two diamond drill holes at its Phil’s Hill Project in WA. The surveys confirmed the presence and refined the location of several highly conductive anomalies, some aligned with visible sulphide mineralisation. PUR also announced this week that it has completed the acquisition of the Warrior Project, and commenced a soil sampling program at its Combatant Project which should be completed in ~4 weeks.

- Creso Pharma (ASX:CPH) has secured two new purchase orders from Swiss based import/export partner MHG GmbH worth a combined value of over A$330k for its human health hemp and cannabis products. This was followed up with the announcement yesterday that it has launched a new e-commerce channel (www.cannadol.ch) that will host a range of its new human health products.

Advanced Human Imaging (ASX:AHI)

This week AHI launched their body scan technology into 10 of China’s largest app stores through Tinjoy’s “Health Cube” app.

Over 140,000 pre-registrations have been reported by AHI, and pre-registration payments are now being collected by Tinjoy.

140,000 is a big number so this week we are going to try and figure out what exactly this means for AHI and realistic time frames in which it might convert to revenue. We will report back with our findings.

Elixir Energy (ASX:EXR)

Yesterday EXR announced that the Richcairn-1S exploration well has discovered 16 metres of coal and 20 metres of highly carbonaceous mudstone. Being an exploration well, this opens up the possibility of another new and potentially very extensive coal-bearing basin.

After a rocky start to the 2021 exploration program all six of EXR’s last wells have intersected their coal targets, this has led EXR to accelerate their 2021 exploration program by adding a third drill rig to the mix.

We have been invested in EXR since 2019 and it’s one of our bigger positions so we are pleased to see the EXR share price finally look like it wants to lift out from below 25c over the last two days.

Dimerix (ASX:DXB)

DXB closed the week at 28c, its lowest point since we first announced it as our Biotech Pick of the Year. We think that slow drift down on very low volume may be due to impatient short term investors exiting the stock to chase the flavour of the month (lithium and uranium stocks) combined with loose placement stock that came in at 20c a month ago.

There is an old saying in investing, “the bulls make money, the bears make money, the pigs get slaughtered”. This saying counsels against excessive greed and impatience of the “pigs”.

As long term “bulls” we don’t worry about the week to week fluctuations of the market, but are more interested in the companies ability to execute on their business plan over time.

DXB’s Phase III clinical trials on FSGS (a rare kidney disease) will take 12-18 months (for which they are now fully funded) and we can look forward to their “COVID side bets” results before Christmas.

Like with exploration companies, our plan is to invest early into biotech stocks, be patient with our investment, and as the company progresses, look to take some profits in the lead up to a major catalyst. In the case of biotechs, the major catalyst is often clinical trial results.

Thompson Resources (ASX:TMZ)

TMZ announced the appointment of Stephen Nano to help advise the company with technical strategy and business development.

When Stephen was the CEO Mirasol Resources Limited (TSX:MRZ), from 2014 to 2019, he built a track record of consolidating district-scale opportunities and attracting exploration investment to the company.

His focus will be to support the consolidation of the fragmented silver projects in the New England Fold Belt and will bring his 30 years of experience to the team.

Alexium International Group (ASX:AJX)

AJX CEO Bob Brookins and CFO Jason Lewis provided a comprehensive investor update on Thursday to present the company’s full year results, which included a Q&A session.

You can watch it here: https://youtu.be/nGlSRewDA9w.

In our other portfolios 🧬 🦉 🏹

🦉 Wise-Owl

Vulcan Energy Resources (ASX:VUL) announced that it has raised $200M in a Placement to institutional investors including Hancock Prospecting and new ESG-focused institutions, and was led by Goldman Sachs and Canaccord at $13.50/share. VUL will now conduct a SPP for existing shareholders to raise another $20M, also at $13.50/share.

VUL will use the funds to accelerate and expand its dual renewable energy and lithium development strategy, including expanding its operations by acquiring existing brownfield energy and brine infrastructure. VUL will also look to apply its geothermal lithium expertise to grow the business in other parts of the world that have the right conditions for geothermal lithium production.

Following news of the planned cap raise, AlsterResearch published a new research report with a price target for VUL of $22 — 50% above Thursday’s closing share price.

After its stellar run over the past year, VUL will be added to the S&P/ASX 300 Index on Monday. This is a major milestone for listed companies as it makes them attractive to large institutional index investors. VUL’s share price jumped (from $14.88 to $15.17) last night in the closing market auction as buyers rushed in ahead of VUL’s addition to the ASX 300.

We also noted that a huge volume of shares traded in VUL on Friday, perhaps in anticipation of its addition to the ASX 300.

📰 Cashed up VUL Expands its Zero Carbon Lithium Ambitions

🧬 Finfeed

Finfeed is our newly launched small cap ASX biotech stock portfolio. We are currently scouring the biotech landscape for our next investment to sit alongside Dimerix (ASX:DXB) in the portfolio. This week we provided some educational material about investing in biotech companies, and the key risks and questions that investors should ask at every stage of the drug development process.

If you are a DXB investor, OR are interested in biotech stocks, take a look at this article about what to consider when investing in early stage biotech stocks.

📰 How we invest in early stage biotech companies

🌎 Mainstream Media:

Oil & Gas (EXR, 88E, IVZ)

AFR: Why oil and gas stocks are a bargain

Battery Metals (VUL, EMN, GAL, KNI)

Bloomberg: A Tesla Co-Founder Aims To Build an Entire U.S. Battery Industry

Lithium (VUL)

Bloomberg: CATL Said to Be Mystery Bidder for Canada’s Millennial Lithium

AFR: The lithium boom just went to another level

Hydrogen (PRL)

Sydney Morning Herald: Air NZ to work with Airbus on carbon-free hydrogen planes

Uranium (GTR)

Zero Hedge: As Sprott Goes "Hunt Brothers" On Uranium, A Copycat Joins The Squeeze To Force An Explosive Move Higher

Bloomberg:Uranium Giant in Talks to Supply Sprott as Investor Demand Soars

Yahoo Finance: Sprott’s New Uranium Trust Sees Hedge Funds Driving Metal Demand

Sprott: https://sprott.com/media/4161/sprott-uranium-infographic.pdf

Commodities / ESG

Bloomberg: $500 Million of SPAC Cash Vanishes Under the Sea

AFR: Explorers poised for ‘elongated commodities boom’

Bloomberg: Commodity Price Surge Spurs Australian Explorers to Get Digging

Have a great weekend,

Next Investors

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.