TTM’s primary asset (Dynasty) has an existing 3.1M ounce gold, 22M Ounce silver JORC resource. We think the resource at Dynasty underpins TTM’s valuation.

$0.970

Opened: 29-May-2024

Shares Held at Open: 12,152,769

What does TTM do?

Titan Minerals Ltd (ASX:TTM) is an exploration and development company on the hunt for world class gold, silver and copper assets in Ecuador.

What is the macro theme?

As of writing this memo gold, silver and copper price are moving upwards.

Gold and silver are both precious metals that are thought of as hedges against currency inflation.

Silver also has industrial use cases including in the manufacture of solar panels. Demand for silver from solar panels is forecast to go exponential and as such can be considered important to the energy transition.

Meanwhile copper is predominantly used for electricity transmission. Renewable energy projects require A LOT of copper to link them up to the grid from remote areas.

Copper is also used in data centres for AI and in electric vehicles (EVs) - there are roughly 80kgs of copper in an average EV.

Our Big Bet for TTM

We want to see TTM prove up a $1BN plus copper or gold discovery in Ecuador which is so attractive that a mining major acquires the company

Why did we invest in TTM?

Advanced stage asset with giant JORC resource

TTM’s primary asset (Dynasty) has an existing 3.1M ounce gold, 22M Ounce silver JORC resource. We think the resource at Dynasty underpins TTM’s valuation.

TTM has agreed to terms on a US$120M farm-in deal with Hancock Prospecting subsidiary

TTM has agreed to terms on a JV / earn in for its earlier stage copper project. Once binding, we think the deal validates the potential for a seriously big copper discovery, given the deal was signed at such an early stage and for such a large amount.

TTM essentially has a free carried option at giant copper porphyry discovery

We think the proposed deal with Hanrine (Gina’s subsidiary) gives TTM a free option at being a 20% holder in a giant copper porphyry discovery in a deal that is worth more than TTM’s current market cap on its own.

Right commodities at the right time

TTM gives us exposure to gold, silver and copper. All three commodities are currently running with gold and copper both trading at all-time highs and silver breaking out into decade highs.

Rare copper exposure with tier 1 discovery potential

We think it is hard to find small cap stocks on the ASX that have genuine tier 1 copper discovery potential. Especially not one with funding secured to drill out a potential discovery. TTM has both at its Linderos project.

TTM has institutional backing

For such a small company, TTM already has some impressive funds on its share register including Tribeca, Nero Resources Fund, Bacchus Capital, and Thorney.

Ecuador is a mining hot spot

All of TTM’s assets are in Ecuador. The country is well known for being home to big discoveries and blue chip mining companies like Anglo American, Newmont, BHP, Barrick, Lundin. Large cheques are being written for Ecuadorian mining projects. We think TTM’s assets could be of increased interest over the coming months.

What do we expect TTM to deliver?

Objective #1: Upgrade Mineral Resource Estimate at Dynasty

Milestones

![]() JORC resource upgrade #1

JORC resource upgrade #1

![]() Drilling Results 1

Drilling Results 1

![]() Drilling Results 2

Drilling Results 2

![]() JORC resource upgrade #2

JORC resource upgrade #2

Objective #2: Economic assessment of the Dynasty project

Milestones

![]() Metallurgical Testwork Results

Metallurgical Testwork Results

![]() Pre-Scoping Study results

Pre-Scoping Study results

Objective #3: Progress Linderos Project through to MRE

Milestones

![]() Complete JV deal with Hanrine (Gina Rinehart subsidiary)

Complete JV deal with Hanrine (Gina Rinehart subsidiary)

![]() Drill program #1

Drill program #1

![]() Drill program #2

Drill program #2

![]() Confirmation of copper Porphyry discovery

Confirmation of copper Porphyry discovery

![]() Maiden JORC resource estimateMineral Resource Estimate published

Maiden JORC resource estimateMineral Resource Estimate published

Objective #4: Sign JV/strategic partnership on earlier stage projects

Milestones

![]() Joint venture or farm-in partner announced

Joint venture or farm-in partner announced

![]() Drilling exploration program commences

Drilling exploration program commences

![]() Drilling exploration program results

Drilling exploration program results

What could go wrong?

Exploration / Drilling risk

There is no guarantee that TTM’s extensional drilling programs will be successful and TTM may fail to uncover enough economic mineralisation to justify the expense.

Funding risk/dilution risk

As a small cap company, TTM is reliant on capital markets to advance its projects if it cannot do strategic deals with partners.

If something negative happens at a macro or company level, TTM could struggle to access capital on favourable terms.

These capital raises may take place at a discount, and result in the issuance of new shares which incur dilution to existing shareholders.

Commodity price risk

At the time of writing this memo all three of the base metals that TTM’s projects are leveraged to are running hot.

Should the price of these commodities fall, it could hurt the TTM share price and the look-through value of its assets in any takeover scenario.

Deal risk

Specific for the Linderos Project, the deal with Hanrine is subject to conditions including a formal earn-in and JV agreement being signed.

It is possible that the deal falls through for whatever reason, in which case we think the market would react negatively and lead to a fall in TTM’s share price.

Sovereign risk.

TTM’s prospects are all located in the developing nation of Ecuador.

There is no guarantee that local authorities and/or communities will favour development of TTM’s prospects, and so could hinder advancement.

We also note a recent surge in violence could have a dampening effect on investments.

What is our investment plan?

We plan to hold the majority of our position in TTM for the next 12 months (and beyond) as it progresses through both its Dynasty project as well as completing its deal with Hanrine for the Linderos Project.

However we may de-risk a portion of our Investment if the share price appreciates materially in line with our standard de-risking plan.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 12,152,769 TTM shares at the time of publication. S3 Consortium Pty Ltd has been engaged by TTM to share our commentary and opinion on the progress of our investment in TTM over time.

Opened: 01-Mar-2022

Closed: 29-May-2024

Shares Held at Open: 4,249,250

Shares Held at Close: 12,152,769

Reason Memo Closed: New Material News

What does TTM do?

Titan Minerals Ltd (ASX:TTM) is an exploration and development company on the hunt for world class gold and copper assets in the emerging global minerals hotspot, Ecuador.

What is the macro theme?

Gold remains a safe haven investment and hedge against inflation, and has historically outperformed in times of volatility (e.g market bubble crash, armed conflicts…).

Bullish gold market conditions persist, particularly with the go-to response to the pandemic being unprecedented worldwide monetary and fiscal stimulus (i.e. ripe conditions for sustained inflation).

Copper demand is set to grow from its already robust position on the back of unprecedented stimulus spending on infrastructure and construction projects globally.

[Memo Assessment - 29-May-2024]: Sentiment = Strong

For a while market sentiment for gold, silver and copper was all relatively weak.

However, in recent months the price of gold, silver and copper have all started rallying and sentiment has started to pick up again.

We are marking the sentiment for TTM’s macro theme as “strong” but we are conscious of the sentiment having been low at points during our first Investment Memo

Our Big Bet for TTM

We want to see TTM prove up a $1BN plus copper or gold discovery in Ecuador which is so attractive that a mining major acquires the company

Why did we invest in TTM?

Prime gold/copper real estate

TTM is an early mover in securing prime real estate within one of the world’s latest exploration and mining hotspots - Ecuador. TTM owns several exploration and development assets in the country. Ecuador has only recently become an attractive exploration and mining jurisdiction through improved and stable legislation. With Ecuador mirroring the geology of several of its mining-rich neighbouring nations, there is a good opportunity for big discoveries still to be made here. TTM could appeal to larger mining groups now seeking to attain or grow a significant land position within this hotspot.

[Memo Assessment - 29-May-2024]: Grade = B

While the overall prospectivity of this part of Ecuador has only improved as TTM has gone about its exploration efforts - the current political situation in Ecuador is markedly more tense.

In a positive for TTM, we note that recently elected President Noboa attended PDAC in Toronto to re-emphasise Ecuador’s attractiveness as a home for mining investment.

Additionally, a number of mining majors have invested heavily in the region of Ecuador that TTM operates in.

However, since our initial TTM Investment Memo was published, we note that a surge in violence in Ecuador may have a dampening effect on potential investment.

Friction between the Ecuadorian federal government and local stakeholders could be a source of risk for TTM, along with the potentially volatile political environment in the country.

Flagship project already with a big resource base

TTM’s Dynasty gold project has a “foreign resource estimate” of 14.5Mt @ 4.53 g/gold + 36g/t silver for a total contained resource of 2.1Moz gold + 16.8Moz silver. TTM is drilling in order to re-classify the resource to JORC standards, with potential upside of further growing the deposit. This could form the basis of a possible local mining operation down the track.

[Memo Assessment - 29-May-2024]: Grade = B

Although TTM managed to deliver an upgrade to the Foreign Resource Estimate, it took much longer than expected.

This caused investor sentiment to wane in the project and the JORC upgrade wasn’t enough to offset the delays in the project.

Copper side bets

TTM has two highly prospective copper projects in their pipeline, not far from where several major copper discoveries have been made of late. These provide blue-sky potential upside, should a discovery be made.

[Memo Assessment - 29-May-2024]: Grade = A

TTM managed to sign a Joint Venture agreement for one of its copper side-bets “Linderos” with a subsidiary of Gina Rienhart’s Hancock Prospecting.

For TTM to extract some value from these “side-bets” is a big win in our eyes.

What do we expect TTM to deliver?

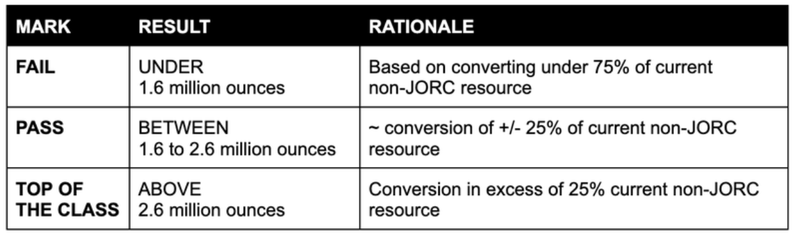

Objective #1: Resource conversion to JORC standards at Dynasty

Here is how we will rank the JORC resource estimate result (our opinion only):

[Memo Assessment - 29-May-2024]: Grade = A

TTM managed to publish an upgraded JORC resource of 3.1M ounces of gold and 22M ounces of silver. This beat our “Bull Case” scenario for the project.

Objective #2: Follow-up drilling at Linderos

[Memo Assessment - 29-May-2024]: Grade = B

Assays from TTM’s follow up drilling came back strong, with 308m at 0.4% copper equivalent. TTM did not follow up this program with more drilling but did conduct IP surveys for more target generation.

From this work, TTM was able to sign a Joint Venture worth up to US$120M to develop the project (in exchange for 80%).

Objective #3: Commence drilling at Copper Duke

[Memo Assessment - 29-May-2024]: Grade = D

TTM was able to define drill targets for Copper Duke but no drill program was done. This was due to financial constraints and resources allocated to the Dynasty project.

What could go wrong?

Capital requirements

TTM is not a producer, remaining an explorer, and so requires continuous funding as it continues to advance its assets. As such, the company will be required to raise capital for survival when the current cash at bank drains. However, there is no guarantee that capital markets will be conducive at that point. We note that they have a substantial cash balance at present, which minimises this risk for 2022.

[Memo Assessment - 29-May-2024]: Risk = Materialised

Through this TTM Investment Memo the company has raised $5.5M at 5 cents per share, $4.1M at 3.3 cents per share.

Each of TTM’s last four capital raises has been done at a lower and lower valuations, which has been painful for existing investors.

Underlying commodity risk

TTM is exposed to commodity price risk, which depends on macroeconomic factors and demand and supply dynamics of the underlying commodities, i.e. gold and copper. Market sentiment closely correlates with commodity prices, and hence TTM’s valuation will be impacted by commodity prices as well. There is no guarantee that gold and/or copper sentiment will trend positively this year.

[Memo Assessment - 29-May-2024]: Risk = Materialised

Although the sentiment for copper, gold and silver is strong, in 2023 when TTM was raising capital, the sentiment for these commodities was relatively weak.

This has meant that TTM has needed to raise capital at depressed valuations, diluting existing shareholders.

Geological risk

The resource for the flagship project is an estimate only, and there is no guarantee that the current “Foreign resource estimates” is substantially converted into JORC resources. Even if the JORC reclassification occurs, it could be at a much lower grade, size or level of confidence, which would impact its value.

[Memo Assessment - 29-May-2024]: Risk = Decreased

TTM was able to publish a JORC resource and de-risk the project from a geological perspective.

Sovereign risk

TTM’s prospects are all located in the developing nation of Ecuador. There is no guarantee that local authorities and/or communities will favour development of TTM’s prospects, and so could hinder advancement.

[Memo Assessment - 29-May-2024]: Risk = Unchanged

What is our investment plan?

We first invested in TTM at 6.67c and increased our position again at 10c in anticipation of the JORC resource estimate on its Dynasty gold project.

We intend to de-risk our investment keeping 80% of our position in the lead up to the JORC resource definition.

We plan to sell up to 50% of our investment in TTM if the share price increases 4-fold from our initial investment price in the lead up to the JORC resource.

Depending on the outcome of the JORC resource estimate, our investment strategy for TTM will change:

[Memo Assessment - 29-May-2024]: Grade = D

TTM’s share price did not materially appreciate during the life of the memo and we did sell down a portion of our holdings at a loss.

Although the “Top of class outcome” was beat by TTM’s results, the JORC resource was delayed and the commodity price risk materialised.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 4,249,250 TTM shares at the time of publication. S3 Consortium Pty Ltd has been engaged by TTM to share our commentary and opinion on the progress of our investment in TTM over time.

Time’s up: Is TTM about to get taken over? Good time to have released “spectacular” drill results with 38.5m @ ~3g/t gold

Jan 14, 2026

Jan 14, 2026 |

12 min

Titan Minerals (ASX: TTM) already has a 3.1M ounce gold and 22M ounce silver mineral resource estimate. And this morning TTM announced “spectacular” drill results, including a peak 38.5m, 3g/t gold hit.

US Fed Chair Powell subpoenaed - silver and gold both hit NEW all time highs. Index buying driving silver stocks? plus one new announcement…

Jan 13, 2026

Jan 13, 2026 |

16 min

We had to double check this video wasn’t AI when we first saw it... Basically, it’s the US Fed Chair Jerome Powell accusing the US government of putting forward a legal case for criminal charges against him… for refusing to lower interest rates.

TTM’s 3.1Moz gold 22Moz silver project: Chinese strategic investment of US $10M and 90 day exclusivity to get a deal done.

Oct 17, 2025

Oct 17, 2025 |

12 min

The gold price just isn’t stopping. Gold hit new all-time highs today of US ~$4,380 per ounce. Titan Minerals (ASX: TTM) has a 3.1 million ounce gold resource. Earlier in the week received a US$10M strategic investment from US$3.5BN Lingbao Gold International Company…

What’s lurking below the 3.1M oz. gold and 22M oz. silver? TTM going copper porphyry hunting to find the source

Jul 4, 2025

Jul 4, 2025 |

9 min

What’s below 3.1M oz gold and 22M oz silver? We might know pretty soon… Our Investment Titan Minerals (ASX: TTM) already has a 3.1M ounce gold and 22M ounce silver JORC resource (estimate) at its Dynasty project in Ecuador.

TTM now targeting a 5 million ounce gold resource? Plus first results from copper JV with Gina Rinehart…

May 8, 2025

May 8, 2025 |

9 min

Titan Minerals (ASX: TTM) is ... is now targeting a +5 million ounce gold resource. TTM also has a large copper porphyry project where a subsidiary of Gina Rinehart’s Hancock Prospecting is spending US$120M to earn-in 80% of the project. This morning, TTM announced the first drill assays back from Gina Rinehart's team.

TTM to upgrade 3.1M ounce gold, 22M ounce silver resource

Feb 5, 2026

Feb 5, 2026 |

3 min

Our gold and copper Investment Titan Minerals (ASX: TTM) just released further high grade results from its 3.1M ounce gold, 22M ounce silver Dynasty project in Ecuador.

TTM hits extensions at 3.1M oz gold, 22M oz silver project - discussions progress on a corporate deal

Jan 7, 2026

Jan 7, 2026 |

3 min

Our gold and copper Investment Titan Minerals (ASX: TTM) has just released more drill results from its 3.1M ounce gold, 22M ounce silver Dynasty project in Ecuador.

TTM’s major shareholder raises ~A$227M to pursue “mergers and acquisitions”.

Dec 5, 2025

Dec 5, 2025 |

3 min

Our copper-gold Investment Titan Minerals (ASX: TTM) has now been in an exclusivity period with Lingbao Gold for 52 days for its 3.1M ounce gold, 22M ounce silver project in Ecuador.

TTM results set to add to resource as Lingbao prepares for another visit

Nov 26, 2025

Nov 26, 2025 |

2 min

Our copper-gold Investment Titan Minerals (ASX: TTM) has just released more drill results from its project in Ecuador…

TTM confirms copper-gold porphyry in Ecuador

Nov 18, 2025

Nov 18, 2025 |

2 min

Our copper-gold Investment Titan Minerals (ASX: TTM) just hit porphyry-hosted gold-silver and copper at its 3.1M ounce gold, 22M ounce silver Dynasty Gold Project.

Sunday Edition: 8th February

Feb 8, 2026

Feb 8, 2026 |

19 min

Here you can find everything we wrote about in the past week, plus some interesting stuff we came across on our travels. A much bigger week for announcements this week, we did quite a few QuickTakes so it appears companies are now well and truly back into the swing of things. Plus check out our new Investment: BMG

Much mooted, more misunderstood: The case for "Real" assets

Feb 7, 2026

Feb 7, 2026 |

13 min

Much mooted by many as the “digital, gold alternative”, Bitcoin was sold off by as much as 40% during the week. Does that mean some of that released money will now find its way back into traditional “safe haven” assets, gold and silver? Back in 2022, we sat in a Melbourne Mining Club lunch presentation by the AngloGold Ashanti CEO, who had slides about bitcoin absorbing a lot of capital that would usually go into gold. (the fact that a major gold company CEO spoke about bitcoin diverting funds away from gold lives rent free in our heads)

Sunday Edition: 18th January

Jan 18, 2026

Jan 18, 2026 |

22 min

As 2026 kicks off, yesterday we wrote about what we got right in 2025 - turns out a fair bit. The only thing we didn’t manage to find and add was a countercyclical, beaten down, later stage battery metals project... We are adding a new Portfolio addition next week - stay tuned. This morning we watched this video from the Saudi Arabia hosted “Future Minerals Forum” where “Special Assistant to the US president, National Security Council” David Copley, talks about the USA’s intent on critical metals and mining ambitions.

Sunday Edition: 11th January

Jan 11, 2026

Jan 11, 2026 |

10 min

Yesterday we covered some of the Investment ideas we are thinking about as 2026 starts to kick into gear. What other new “macro investment themes” could attract attention and capital for the next few years? See here for a summary of everything else we published last week plus links to the full articles (and one email we sent in the week between Christmas and New Years).

Our 2026 outlook and catalysts we are watching for in the near term

Jan 3, 2026

Jan 3, 2026 |

13 min

Happy New Year! The last three of these “first few days of January” emails we have sent in recent years have been, frankly, pretty grim reading. Desperately trying to find hope for the year ahead - after trudging through a barren wasteland that was the year just gone. Not this time.