SGA’s graphite project has an inferred JORC Resource of 209Mt at a grade of 28.5% TGC (total graphite content) for 60Mt contained graphite. This makes it the highest grade graphite project on the ASX.

$0.062

Opened: 22-Jul-2022

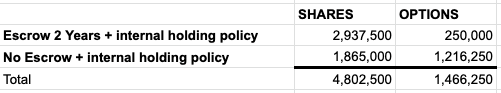

Shares Held at Open: 4,802,500

What does SGA do?

Sarytogan Graphite (ASX:SGA) holds 100% of a huge graphite project in Kazakhstan, strategically located between Europe and China.

SGA has the highest grade graphite resource of any ASX listed graphite company. It is also the second largest contained graphite resource on the ASX.

What is the macro theme?

Graphite is a critical raw material used in the manufacturing process for lithium-ion batteries - it cannot be substituted in battery anodes.

The battery market is rapidly growing, with graphite demand expected to be five times greater than current levels by 2050.

Consequently graphite is now listed as a “critical mineral” in the US, EU, India, Japan and Australia.

Our Big Bet for SGA

Given SGA's graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+

Why did we invest in SGA?

Highest grade graphite resource on the ASX

SGA’s graphite project has an inferred JORC Resource of 209Mt at a grade of 28.5% TGC (total graphite content) for 60Mt contained graphite. This makes it the highest grade graphite project on the ASX.

Second largest graphite resource on the ASX

The project’s 60Mt of contained graphite resource ranks second only to graphite producer Syrah Resources (capped at $880M).

Low market valuation relative to its graphite peers

Based on its inferred 60Mt contained graphite resource, SGA currently trades with an enterprise value/tonne of contained graphite resource of $0.74/tonne. This compares with graphite major Syrah Resources which trades at $5.19/tonne and graphite developer Renascor which trades at $48.37/tonne. We expect this gap to close as SGA’s market cap rises with upgrades to the classification of its resource and progresses to mine development studies. (Note: the EV/contained graphite (A$/tonne) calculations are based on closing prices as at 21 July 2022).

Project located in Kazakhstan - an established mining jurisdiction between EU and China

Kazakhstan’s mining legislation is based on Western Australia’s mining code. The country is the biggest producer of uranium in the world producing ~45% of global supply in 2021. Companies like Chevron and Exxon Mobil own and operate projects in-country. Kazakhstan’s unique location also presents itself as a future supplier of battery metals to downstream users in Europe and China.

Tight capital structure

There are only 132 million shares currently on issue. 54% of SGA’s shares are escrowed (mostly for two years from the IPO date). This includes the 39% held by founder and Technical Director Dr Waldemar Mueller. There is therefore a limited number of shares available in the event that there is increased demand - we think the SGA capital structure is leveraged to growth.

Extensive Kazakhstan experience and expertise

Technical Director and major shareholder (owning 39%) Dr Waldemar Mueller brings extensive in-country relationships to SGA. This is a big positive for an ASX listed company operating in Kazakhstan. We think Dr Mueller will be able to navigate doing business here, and given his large shareholding, is incentivised to deliver success for SGA shareholders.

What do we expect SGA to deliver?

Objective #1: Complete metallurgical testwork

Milestones

![]() Determine flake size distribution

Determine flake size distribution

![]() Metallurgical testwork results

Metallurgical testwork results

Objective #2: Increase confidence in the resource - upgrade JORC resource from inferred to indicated

Bull case = Total contained graphite >20mt in the “indicated” resource classification.

Base case = Total contained graphite 15-20mt in the “indicated” resource classification.

Bear case = Total contained graphite <15mt in the “indicated” resource classification.

Milestones

![]() Infill and extensional drilling program starts

Infill and extensional drilling program starts

![]() Drill results

Drill results

![]() JORC resource update/upgrade commissioned

JORC resource update/upgrade commissioned

![]() JORC resource update/upgrade completed

JORC resource update/upgrade completed

Objective #3: Commence Scoping Study on project economics and feasibility

Objective #4: Progress offtake discussions

Milestones

![]() Commence discussions with potential offtake partners

Commence discussions with potential offtake partners

What could go wrong?

Metallurgical testwork risk

With a massive JORC resource in place, SGA needs to work through the metallurgical testwork to determine whether its graphite can be produced into economically recoverable graphite. SGA is yet to determine the flake size distribution of its JORC resource, which could have implications on product suitability. Testwork could show that the graphite can not be produced economically or that the flake sizes are not suitable for its various use cases.

Exploration risk

SGA’s current JORC resource sits 100% in the “inferred” category — the lowest JORC resource confidence level. Drilling will increase the data available to upgrade the resource from inferred to indicated or measured and then to mineral reserves. As with all exploration, there is always risk that a drilling program fails to deliver the required intercepts for the resource to be upgraded.

Commodity price risk

The outlook for graphite pricing remains positive in the near term, but as with all commodities, the price is volatile. Graphite is an opaque early stage market. New graphite supply may come online and therefore demand may be lower than anticipated. A projected 74% of future graphite demand is forecast to come from EVs, presenting a high technology concentration risk that could impact on graphite pricing.

Funding risk

The funds raised in the IPO are expected to cover two years of operations. Given SGA has no revenue and is still progressing its project towards development, it is likely to be reliant on capital markets for future financing rounds. Once these funds are exhausted SGA may need to raise capital which would dilute existing holders.

Sovereign risk

Kazakhstan’s legal system is less developed than some more established jurisdictions, resulting in higher sovereign risk including in obtaining all required permits and approvals. Kazakhstan borders both Russia and China and so any geopolitical escalations in the region could have spillover effects on Kazakhstan. We also note the civil unrest in Kazakhstan earlier in the year which could reappear at any stage in the future.

What is our investment plan?

Our plan is to hold the majority of our position in SGA for 3 to 5 years in the hope of an acquisition by a major mining company after the project is de-risked (see “our long term bet” above).

Over the next 12 months we will apply our de-risking strategy for early stage companies. We may look to sell 20% of our holding if the company delivers on one or more of the above objectives and the share price materially re-rates.

Summary of our hold periods, See our internal holding policy here.

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,802,500 SGA shares and 1,466,250 SGA options, the Company’s staff own 50,000 SGA shares and 12,500 options at the time of publishing this article. The Company has been engaged by SGA to share our commentary on the progress of our Investment in SGA over time.

SGA seals $5M funding injection from EU bank - PFS “imminent”

Aug 9, 2024

Aug 9, 2024 |

9 min

An European bank just invested $5M into Sarytogan Graphite (ASX: SGA).

SGA’s Graphite for Nuclear Energy Production

Mar 11, 2024

Mar 11, 2024 |

9 min

Five Nines and now able to produce high purity graphite needed in nuclear reactors.

SGA’s graphite tested in batteries - consistently outperforming synthetic graphite

Feb 8, 2024

Feb 8, 2024 |

11 min

Our graphite Investment Sarytogan Graphite (ASX: SGA) ticked off its biggest milestone yet. SGA just showed that its graphite can be effectively used to make lithium-ion batteries.

CONFIRMED: SGA has produced battery grade product.

Dec 19, 2023

Dec 19, 2023 |

9 min

Today our Small Cap Pick of the Year Sarytogan Graphite (ASX: SGA) has announced that tests have confirmed that YES its graphite can be used in electric vehicle batteries.

Graphite is Back. SGA preps more samples to repeat 99.99% battery grade test success.

Nov 13, 2023

Nov 13, 2023 |

11 min

SGA is developing a giant (second largest on the ASX), high grade (highest on the ASX) graphite resource in Kazakhstan, a country in between Europe and China.

SGA Pre Feasibility Study released

Aug 12, 2024

Aug 12, 2024 |

2 min

Sarytogan Graphite (ASX: SGA) just put out its Pre Feasibility Study (PFS). Today’s news has been years in the making - for highest grade and second biggest contained graphite resource on the ASX.

SGA’s Graphite Suitable For Use In More High Value Markets

Apr 12, 2024

Apr 12, 2024 |

3 min

Our 2022 Small Cap pick of the Year Sarytogan Graphite (ASX: SGA) confirmed its graphite as suitable for yet another market.

SGA’s graphite now suitable for the Nuclear industry

Mar 5, 2024

Mar 5, 2024 |

2 min

Sarytogan Graphite (ASX: SGA) just showed the market its graphite is suitable for use in the nuclear industry.

SGA achieves graphite thermal purification scale up

Dec 7, 2023

Dec 7, 2023 |

3 min

Sarytogan Graphite (ASX: SGA) - the company has just announced the successful scale up of its thermal purification process in conjunction with the company’s US technology partner.

SGA to scale up its graphite processing flowsheet

Oct 30, 2023

Oct 30, 2023 |

1 min

Sarytogan Graphite (ASX: SGA) just hit another key milestone for its graphite project in Kazakhstan.

Is it Bull o’clock yet?

Aug 18, 2024

Aug 18, 2024 |

20 min

Markets move in cycles. Right now, in the ASX small cap market, it feels like we are still firmly in “bear” mode. Equities prices have collapsed, liquidity too… But there have been signs that the gears on the crash-boom clock are turning ever closer towards “bull” mode.

When will it get better?

Aug 10, 2024

Aug 10, 2024 |

16 min

It’s been a terrible two years in the small end of the market - surely it couldn’t get worse right? …right?

What Happened?

Apr 13, 2024

Apr 13, 2024 |

9 min

Is this (finally) the start of the precious metals run we have been predicting for a couple of years?

What Happened this Week?

Mar 16, 2024

Mar 16, 2024 |

9 min

Another week of the small market looking… pretty OK. Yet again we have seen a few of our portfolio companies rise off their 12 month lows.

Drill race is on and what is happening in the lithium market

Aug 26, 2023

Aug 26, 2023 |

7 min

In this weekender, we explore the race to initiate major drilling campaigns, the fluctuating landscape of lithium prices, and how cash-rich companies are strategically positioning themselves in the mining sector."