White Rock retains 100% interest in Red Mountain Project

Published 11-FEB-2020 11:08 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Limited (ASX:WRM) today announced that Sandfire Resources Limited (ASX:SFR) decided to forgo its right to earn-in to the Red Mountain Project, Alaska, effective today, although it remains a 11.3% shareholder of White Rock.

Sandfire’s withdrawal means that White Rock will retain 100% ownership of its flagship exploration project, the Red Mountain Project, a high-grade zinc and precious metals VMS project with significant gold potential at the newly defined Last Chance prospect.

The outstanding potential of the Red Mountain project is highlighted by the two high grade deposits, with an Inferred Mineral Resource of 9.1 million tonnes @ 12.9% ZnEq2 for 1.1 million tonnes of contained zinc equivalent at Dry Creek and WTF deposits.

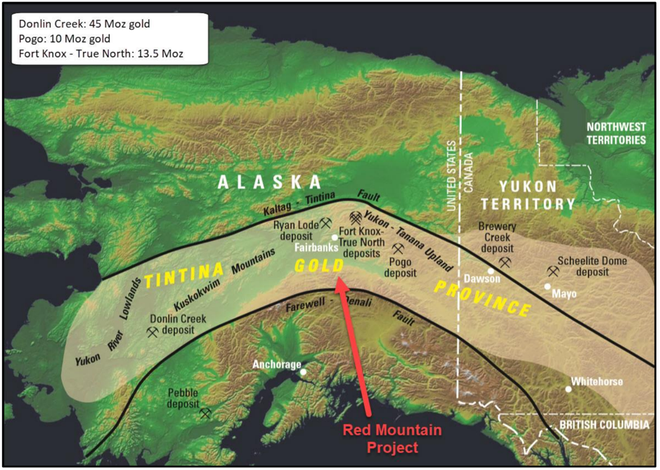

The newly defined Last Chance gold anomaly discovery is within the Tintina Gold Province, host to giant gold deposits including Donlin Creek (45Moz Au), Pogo (10Moz Au) and Fort Knox (13.5Moz Au), which are all of the Intrusion Related Gold System (IRGS) style of mineralisation.

The Last Chance Prospect is a large (15km2), strong (up to 418ppb (0.4g/t) gold) and robust gold anomaly defined by 27 stream sediment sample points.

It should be noted that the nearby Pogo gold mine, recently acquired by ASX-listed Northern Star (ASX:NST), was discovered on a similar stream sediment gold anomaly.

Sandfire spent A$8.5 million on the project in 2019 and will withdraw without earning any retained interest. White Rock were the beneficiary of some A$7.7 million spent on the ground in 2019 and earnt some $770,000 as manager in the process.

White Rock obtained a huge amount of exploration data from flying the first modern-day airborne EM over its 475km2 strategic tenement package, and conducted a significant amount of stream and rock chip sampling, etc.

White Rock will now initiate a process to secure funding to explore the exciting new gold anomaly at Last Chance during the 2020 field season. It still has many targets to test, including the VMS target at Cirque it discovered and follow-up work at Hunter.

White Rock’s 100% control of the Red Mountain VMS mineralisation and the newly defined IRGS target at Last Chance provides its shareholders with much greater upside leverage in value creation through discovery.

White Rock MD and CEO Matt Gill said “While White Rock understands that commercial decisions can be at odds with individual project pathways, the retention of 100% of the Red Mountain Project will allow White Rock to identify alternate funding to advance the zinc and precious metals-rich VMS deposits while also pursuing the exciting new gold prospect at Last Chance with 100% of the upside exposure provided to White Rock shareholders.

“Our aim is to create value for our shareholders through exploration success, a core strength of the White Rock Board and management team.”

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.