White Rock raises $2.5 million to advance the DFS

Published 05-DEC-2016 14:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The good news continues to flow at White Rock Minerals (ASX:WRM) with the company announcing on Monday morning that it had raised $2.5 million to progress its Definitive Feasibility Study (DFS), Environmental Impact Statement and associated approvals in relation to the group’s Mt Carrington project.

Management also indicated that the funds would assist in providing ongoing working capital. The placement price of 1.5 cents is broadly in line with where the company was trading a fortnight ago, and a 15% premium to its mid-November range.

Notably, in the first half hour of trading on Monday morning, WRM’s shares traded at a premium to the placement price, at one stage hitting 1.9 cents, representing a premium of more than 25%.

It should be noted here, that those considering this stock shouldn’t make assumptions regarding exploration outcomes only, nor should they base investment decisions on performances and share price movement to date. Investors considering this stock for their portfolio, should seek professional financial advice.

This represents strong support for a junior miner, in a sense not surprising given the Mt Carrington project has attractive financial metrics and is being shaped by some very experienced identities in the mining industry.

White Rock Mt Carrington

Chief executive, Matt Gill has a wealth of global experience, and he made the following comments in relation to both the October placement and recent raising, “These equity raisings represent a game changer for White Rock as it will now be able to advance the current Mt Carrington scoping study to Definitive Feasibility Study level, and progress the necessary permitting through completion of its Environmental Impact Statement”.

Clear line of sight to production

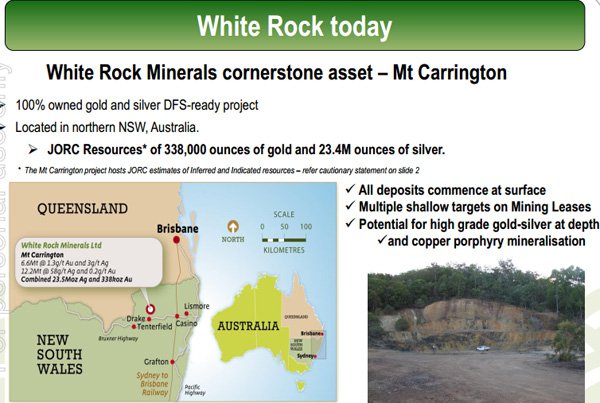

From an operational and strategic perspective, Gill highlighted the fact that once these were completed and subject to certain conditions precedent, the proposed US$19 million financing package offered by Cartesian Royalty Holdings would enable the group to build and commission the mine, unlocking the full potential of the Mt Carrington gold/silver project where a strong resource base of 338,000 ounces of gold and 23.4 million ounces of silver has the potential to support a mine life of more than seven years.

Also working in WRM’s favour is the fact that there is existing infrastructure in place, providing a clear sight to the construction and production phase.

WRM is well diversified with Mt Carrington offering leverage to precious metals, while its Alaskan based Red Mountain project provides exposure to zinc, copper and lead, as well as silver and gold.

It is also close to extensive mining infrastructure, and near surface high grade exploration results suggest there is scope to expand the project into a sizeable zinc silver operation.

Conservative commodity prices used in scoping study

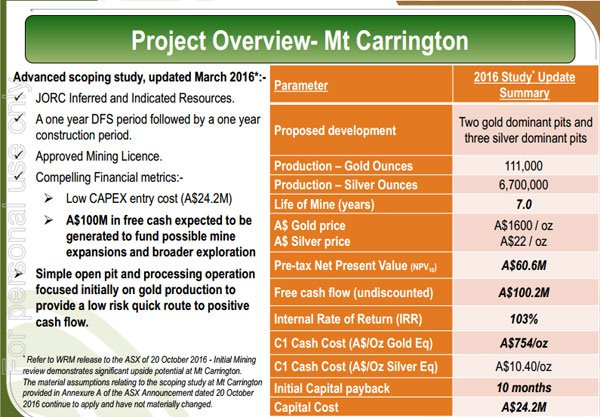

Harking back to Mt Carrington, the metrics certainly stack up well with the 2016 scoping study pointing to projected free cash flow of more than $100 million. Importantly, the Australian dollar gold price used in the scoping study was $1600 per ounce.

The current spot price is circa $1600 per ounce. For every AU$100 ounce movement, free cash flow over the mine life is impacted to the tune of $6 million.

Similarly, the Australian dollar silver price is currently in the order of $22.50 per ounce. The scoping study was based on a price of AU$22 per ounce, indicating that free cash flow over the life of mine is approximately $3 million higher than indicated in the scoping study.

The following provides a useful snapshot of the Mt Carrington project. Key metrics to consider are the short payback period (10 months) extremely high internal rate of return (103%) and the strong margins that exist taking into account the difference between commodity prices and C1 cash costs.

WRM will undergo a one year DFS period.

General Information Only

This material has been prepared by StocksDigital. StocksDigital is an authorised representative (CAR 000433913) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.