Vulcan inks lithium brine supply deal with German giant

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources Ltd (ASX:VUL) has signed a Memorandum of Understanding (MoU) with Pfalzwerke geofuture GmbH, part of the German utility and international energy provider Pfalzwerke Group.

The MoU constitutes an initial collaboration period, during which Pfalzwerke geofuture will supply live brine and well data from its operational geothermal power plant for Vulcan to use in its prefeasibility study (PFS).

The significance of this development, which is in effect an endorsement of Vulcan’s progress in terms of moving to a zero carbon lithium producer, can be fully appreciated by examining the background and highly profitable operations of the Pfalzwerke Group, details of which we will discuss later.

A legal Joint Venture (JV) will then be established, under which Vulcan will earn up to 80% of the lithium rights at Insheim by completing a DFS for lithium extraction.

The Insheim plant is currently pumping lithium-rich brine to the surface for energy generation, but not processing and extracting the lithium, before the brine is reinjected into the reservoir.

As part of this DFS, Vulcan will construct and implement a demonstration plant at Insheim.

Following completion of the DFS, Pfalzwerke geofuture can then choose to co-contribute to the construction of a commercial-scale lithium plant on site, or dilute interest to a royalty on lithium production.

Highlighting the significance of this development in terms of accelerating Vulcan’s aim of bringing a zero carbon lithium hydroxide product to market, managing director Francis Wedin said, “Partnering with the Pfalzwerke group, a well-respected German utility, is a transformational step for the company.

‘’It brings our goal of producing a Zero Carbon LithiumTM hydroxide product in Germany much closer to becoming a reality.

‘’We now have access to a lithium-rich producing geothermal brine operation, so that feasibility studies and potentially first lithium production can be achieved in a much shorter timescale without the immediate need to drill our own geothermal wells.’’

Europe and world’s first zero carbon lithium project

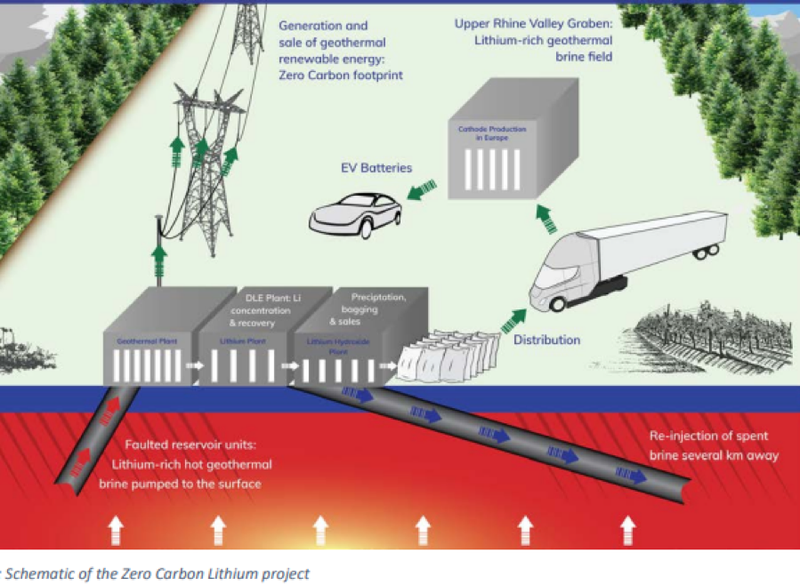

The Vulcan Zero Carbon LithiumTM Project is aiming to be Europe’s and the world’s first Zero Carbon LithiumTM project.

It aims to achieve this by producing battery-quality lithium hydroxide from hot, sub-surface geothermal brines pumped from wells, with a renewable energy by-product fulfilling all processing energy needs.

The Vulcan Zero Carbon LithiumTM Project is strategically located, within a region well-serviced by local industrial activity, at the heart of the European auto and lithium-ion battery manufacturing industry, just 50 kilometres from Stuttgart, the capital of south-west Germany’s Baden-Württemberg state, and a renowned manufacturing hub.

Mercedes-Benz and Porsche have headquarters and museums in the city which in keeping with the government’s expectations of a low environmental footprint is filled with greenspaces.

The burgeoning European battery manufacturing industry is forecast to be the world’s second largest, with currently zero domestic supply of battery grade lithium products.

Vulcan is concluding a scoping study at the project and is targeting a maiden JORC resource by the end of December.

Pfalzwerke Gruppe generates annual revenues of €1.5 billion

Pfalzwerke geofuture GmbH is the owner-operator of the Insheim geothermal plant, which has been operating successfully for seven years, providing Vulcan with predictability of supply.

The entity is 100%-owned by Pfalzwerke Gruppe which was founded in 1912.

The group has established itself as a German and international energy provider with annual revenue in excess of €1.5 billion.

Pfalzwerke Gruppe and its subsidiaries and partners offer solutions for all aspects of electricity and heating.

Importantly from Vulcan’s perspective, the company is increasing its share of renewable energy sources such as photovoltaic, biomass, geothermal and wind power.

With approximately 430,000 private and 20,000 business customers, as well as power supplies to 60 municipalities, Pfalzwerke Gruppe is one of the most important energy supply companies in Germany.

This is important for Vulcan as it should provide a ready end-market for the group’s product.

Both parties to potentially benefit from production at Insheim

The Insheim plant operates with a thermal water temperature of 1650C, producing a maximum of 4.8 MWel power and 10 MW thermal energy.

The plant receives a feed-in-tariff of €0.25/kWh under the EEG (German Renewable Energy Act).

The plant can supply around 8,000 households with electricity and 600 to 800 households with heat.

Currently, brine is pumped up, energy produced and the brine re-injected with no extraction of lithium from the lithium-rich fluids.

The agreement with Vulcan allows both parties to potentially extract value from the lithium contained within the brine.

The plant has a very small footprint and operates in harmony with its local surroundings.

This is a testament to the potential of geothermal wells to service Europe’s battery-quality lithium needs, with zero carbon footprint, without the requirement for environmentally and socially undesirable hard-rock mining.

With such a pronounced emphasis on environmentally friendly initiatives, one would expect strong government support for Vulcan’s zero carbon lithium project.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.