Vonex prepares for another big year in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In releasing its annual results for the 12 months to June 30, 2019, telecommunications innovator Vonex Ltd (ASX:VN8) revisited some of its achievements in recent months and provided a promising update on initiatives that are currently in the pipeline.

With regard to important imminent developments, it is the launch of the much anticipated Oper8tor app that has grabbed the attention of investors.

Oper8tor is a disruptive aggregated communications platform which targets the inclusion of conference, voice, message and video functionality, facilitating user communication across a broad number of channels.

The mobile app aims to seamlessly link all voice calls as well as messaging across multiple platforms and devices.

Vonex plans to complete development and testing work in the December quarter, after which the company will commence executing its planned marketing and commercialisation strategy for Oper8tor.

30,000 PBX user milestone a key achievement

Within its established businesses, the growth in the company’s Private Branch Exchange (PBX) users has been outstanding.

Vonex achieved a milestone in reaching 30,000 registered active Private Branch Exchange (PBX) users two weeks after the end of fiscal 2019.

This followed May 2019 being the largest month for new customer sales in the company’s history.

Management has driven strong consistent growth through a targeted marketing campaign and rising activity from its Channel Partners.

The growth rates of the group’s key metrics are moving in the right direction.

Vonex’s active user base has grown by 25% in the past 12 months and the company delivered 38% year-on-year growth in new customer sales value in the final quarter of fiscal 2019.

This came on the back of 20% year-on-year growth achieved in the March 2019 quarter, indicating that the company is building momentum.

In June, Vonex secured a partnership with Australia’s largest airline, Qantas Airways Ltd (ASX:QAN), gaining selection as the VoIP and Hosted Phone System telecommunications provider to the Qantas Business Rewards (QBR) program.

This program was officially launched to the group’s Channel Partners and to the wider community in mid-August, and it will no doubt provide significant growth momentum in fiscal 2020.

This should be complemented by the addition of a new revenue stream following the launch of Oper8tor.

Industry outlook

Vonex should continue to benefit from the National Broadband Network (NBN) rollout.

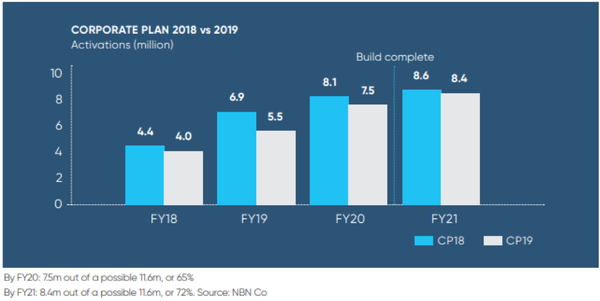

The latest updates from NBN Co report that the NBN construction phase is advancing well and remains on track for 100% of the initial build to 11.6 million premises before 2021.

This means for end customers, initial migrations to the NBN will continue to occur between now and 2022.

As illustrated below, this guidance should prove positive for Vonex over a longer duration than previously expected, in light of NBN Co downgrading its activation targets and now expecting only 70% of the Australian population to have made the switch from the old copper network by the end of fiscal 2021.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.