Volkswagen leads Zero Carbon EV push

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The raw material supply chains of electric vehicle manufacture have a major carbon footprint problem.

The existing practise of extracting lithium from hard rock sources, processing it, and then shipping it to European EV makers, generates significantly more CO2 emissions — 1.5X more, in fact — than manufacturing vehicles with internal combustion engines.

Car manufacturers are actively trying to reduce the carbon footprint of their battery supply chains in order to boost the green-credibility of their EVs to appeal to consumers and obtain premium pricing and to avoid financial emissions penalties.

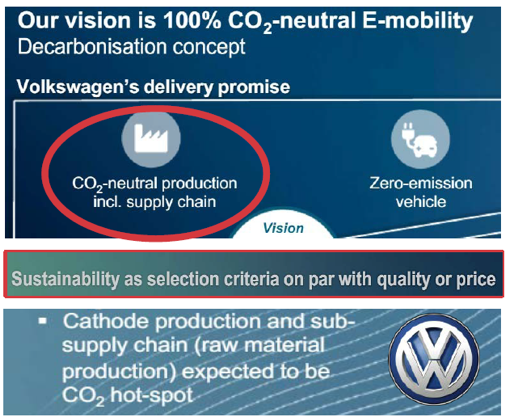

Volkswagen (FRA:VOW), which owns the Lamborghini, Porsche, Bugatti, Audi and Skoda brands, is leading the way in developing the first carbon neutral vehicles. The company has committed to 100% green power in battery cell production along with 100% green power all the way through a vehicle’s life.

The car maker is placing great importance on having a CO2-neutral production supply chain for its extensive new EV line-up. It has put sustainability on par with price, using a raw materials purchasing metric and has given its suppliers an ultimatum on carbon emissions.

Like the wider market for EVs, demand for the low, or ideally zero carbon emitting vehicles will only grow with more manufacturers demanding carbon neutral production supply chains.

EVs in Europe

Europe is on track to triple the number of electric vehicles on its roads by 2021 and will easily meet the EU's car CO2 emissions target by 2025.

Europe, and Germany specifically, is an emerging hub for battery and EV manufacturers as growth in the sector surges.

Just last week Elon Musk announced that Tesla will soon join the world’s largest automakers — including Volkswagen, BMW and Mercedes — in Germany, seeking to tap into Europe’s EV market.

Tesla has settled on a location outside of Berlin to build a “gigafactory”, where it will produce batteries, powertrains and electric vehicles, starting with the Model Y. The factory is expected to go into operation at the end of 2021. This is just one of many gigafactories being built in Europe in the early 2020s.

There are hurdles.

The industry is growing so fast that by the mid-2020s demand from the EU alone for battery-quality lithium hydroxide is forecast to equal the entire current global demand.

Vulcan’s zero carbon solution

Located at the heart of the European auto and lithium-ion battery industry, ASX listed Vulcan Energy Resources (ASX:VUL) formerly Koppar Resources, is working to bring “Zero Carbon” lithium to Europe’s EV supply chain in a move that could transform the industry.

Vulcan is on track to develop Europe’s — and the world’s — first Zero Carbon lithium project, while generating a renewable energy by-product.

This comes at an opportune time, with demand from the EU for battery-quality lithium hydroxide forecast to equal the entire current global demand by the early 2020s.

Working in its favour is it has by far the largest lithium project in Europe — a globally significant Exploration Target of 10.73 - 36.20Mt of contained Lithium Carbonate Equivalent (LCE), at its project in the Upper Rhine Valley of Germany.

Europe, being a densely populated region, has few locations where producing lithium is possible from traditional hard-rock sources even if lithium is present, so given Vulcan’s project’s location, its low impact extraction method and its potential scale, it’s in a perfect position to serve the growing German and European EV industry.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.