Vango to receive $70 million project financing for Marymia

Published 21-NOV-2019 12:43 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

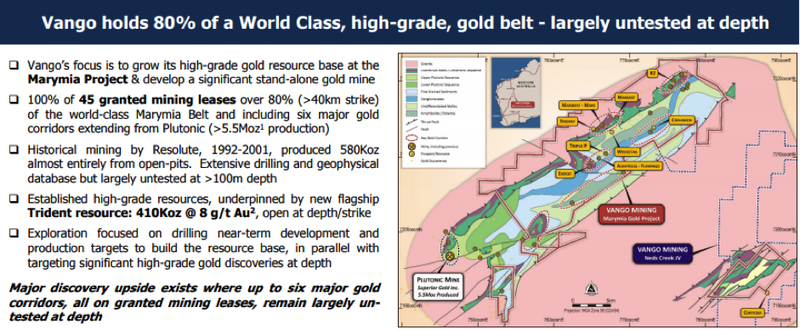

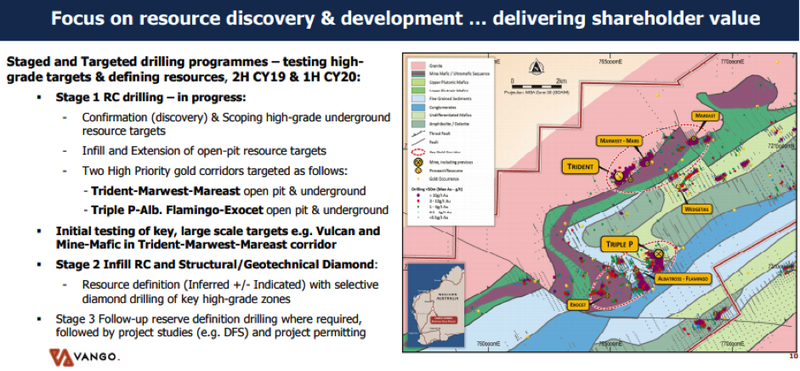

Just two days after announcing impressive drilling results at its Mars gold prospect in Western Australia, Vango Mining Ltd (ASX:VAN) has informed the market that the group has entered into a Strategic Partnership Framework Agreement with a Chinese entity that will assist in the financing and development of the company’s 100%‐owned Marymia Gold Project.

The Mars prospect which this week delivered outstanding drill results including 15 metres at 4.1 g/t gold is part of the Marymia Gold Project.

The agreement announced today represents a non-binding Term Sheet which outlines the framework under which China Nonferrous Metal Industry’s Foreign Engineering and Construction Co Ltd (NFC) proposes to provide project financing currently estimated at $70 million.

NFC is listed on the Shenzhen Stock Exchange and is based in Beijing.

The group is one of China’s leading construction and engineering groups and builds, owns and operates base metal mines, processing plants and smelters around the world.

NFC to provide EPC services and expertise

As well as project financing, the two parties have entered into a conditional agreement regarding the engineering, procurement and construction (EPC) required to develop the Marymia Project into a significant, high-grade, standalone gold mining operation.

The agreement is a significant milestone in the development pathway of the Marymia Project, and represents the formal starting point in Vango’s relationship with NFC for the financing and development of the project.

In effect, it is also an endorsement of the value that can be attributed to the project, suggesting that the group’s market capitalisation of approximately $100 million may be conservative.

Consequently, this development could provide share price momentum, at least returning the company to its 12 month high of about 22 cents.

On the share price front, the company traded strongly between March and September with its shares increasing from 12 cents to 22 cents and it would appear that a slight retracement in the gold price could account for some profit-taking, whereby it now presents a buying opportunity.

Site inspection paves the way for EPC contract

Under the terms of the agreement, NFC will assign a work team to the Marymia Project site within 30 days of signing the agreement to carry-out a site inspection and to assess the scope of work to be undertaken.

Vango will provide NFC with detailed information in relation to the Marymia Project, which includes, but is not limited to, any geological, location and resource data, and other detailed deliverables required for the project to reach its future operational objectives.

Subject to the successful completion of the site inspection, and a positive assessment of its outcomes, NFC proposes to undertake engineering design, equipment purchase and project construction, and delivery of the Marymia Project by way of an EPC contract model.

The formal EPC contract would be executed separately, subject to the mutual agreement of material terms and conditions by both parties.

Vango share issue valued at 35 cents per share

In support of the development of the Marymia Project, NFC proposes to provide financing currently estimated at $70 million for the project.

After executing formal binding EPC and financing contracts, Vango shares to the value of AUD$13 million would be issued to NFC at a share price 35 cents per share.

NFC would agree not to trade these shares before such time that the Marymia Project commenced production, an important provision in terms of maintaining share price stability.

Subject to ASX and ASIC regulations, in the event that Vango’s 20-day VWAP (volume weighted average share price) immediately prior to the commencement of production falls below 35 cents per share, Vango would issue additional shares to ensure that NFC’s holding value is AUD$13 million.

SARCO transfer simplifies business model

Vango also holds the SARCO Bauxite Project in Laos within its project portfolio.

NFC and Vango currently have a long-standing Memorandum of Understanding (MoU) in relation to the potential financing and development of the SARCO Project.

Vango and NFC have agreed that after the execution of a formal binding EPC contract in relation to the Marymia Project, NFC would transfer its remaining interests in the SARCO project to Vango and waive any loan obligation that SARCO and/or Vango might have to NFC, subject to final documentation in a formal SARCO share transfer agreement.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.