US FDA grants coveted Orphan Drug Designation for NTI’s Rett Syndrome Treatment

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 6,845,000 NTI shares and 350,000 NTI Options at the time of publishing this article. The Company has been engaged by NTI to share our commentary on the progress of our Investment in NTI over time.

A terrible childhood neurological disease.

Treatments that offer help to patients and caregivers are worth $2BN annually.

One ASX company re-rated over ~1,300% on a treatment for this disease.

And now, our Investment has a pathway to offering an alternative and (potentially) better treatment for this disease.

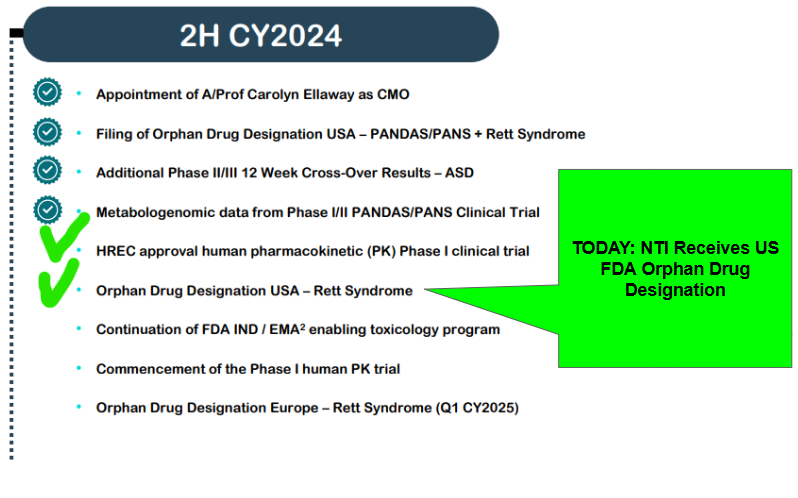

Today, our biotech Investment, Neurotech International (ASX:NTI) announced it has received US FDA Orphan Drug Designation for its treatment for Rett Syndrome.

NTI has completed a successful Phase I/II clinical trial on Rett Syndrome, and released the positive results in May of this year.

Orphan Drug Designation is very important to incentivise and support companies developing new treatments for rare diseases because it allows for:

- Fast tracked approvals

- Market exclusivity for 7 years

- Higher pricing (paid for by govt/insurance to incentivise treatment research for rare diseases)

Learn more about Orphan Drugs here: 🎓Orphan Drugs Explained

Orphan drugs are treatments developed for rare diseases that affect a small number of people.

Governments provide incentives to pharmaceutical companies to encourage the development of orphan drugs, as these diseases would otherwise be neglected due to the small potential market size.

Rett Syndrome fits the bill - it affects ~15,000 girls and women in the US and ~350,000 globally.

With the US FDA Orphan Drug Designation in hand, NTI can now look ahead to more material progress on licensing or commercialising its Rett Syndrome treatment with partners who can help bring NTI’s treatment to market.

Next we are hoping to see the European regulator also confer Orphan Drug Designation to NTI’s treatment for Rett Syndrome.

And (maybe) early progress on a potential licensing deal, after today’s news.

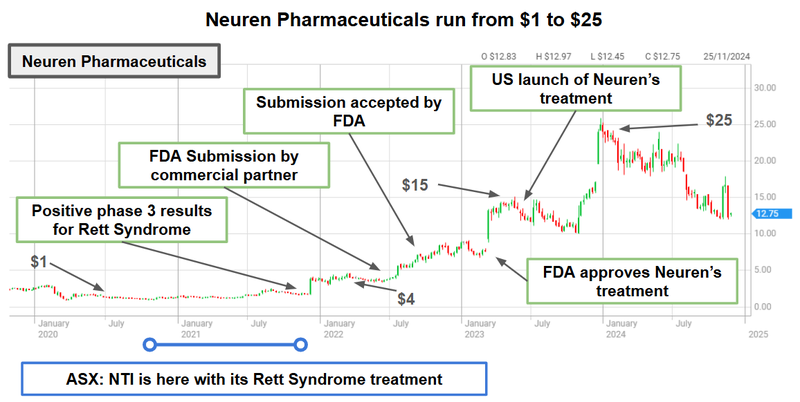

What success looks like for a biotech tackling Rett Syndrome -

There is an existing benchmark for ‘success’ when it comes to biotechs tackling Rett Syndrome.

We have written about it in just about every NTI note - it's the story of Neuren Pharmaceuticals.

Neuren successfully developed and commercialised a Rett Syndrome treatment over the past ~4-5 years.

In that period, Neuren’s share price went from ~$1 per share to a peak of over $25 per share...

Neuren now has a market cap of $1.6BN and was offered a market pathway to drug development success through the treatment of orphan diseases.

(Neuren received its Orphan Drug Designation for Rett in early 2015)

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

We think today’s news is a big milestone for NTI, looking to replicate Neuren's success.

At a fundamental level - NTI’s trial results met its primary endpoints AND was considered safer (relative to Neuren’s product).

Now it has Orphan Drug Designation approved by the FDA which we see as validation of all the work NTI has managed to do up to now.

Read our full take on the clinical trial results here: NTI’s Phase I/II Rett Syndrome clinical trial results improve upon $2.4BN capped Neuren’s results...

We see today’s news as a big step for NTI toward achieving our Big Bet which is as follows:

Our NTI Big Bet:

“NTI re-rates to a +$500M market cap by successfully advancing one or more of its clinical trial programs through to regulatory approval, partnership/licensing and/or is acquired by a large pharmaceutical company”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our NTI Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

We see today’s US FDA orphan drug designation step forward for the company.

Rett Syndrome is a genetic neurological disorder which primarily impacts females between the ages of 6-18 months, and causes severe cognitive and physical impairments.

- Causes: Rett Syndrome is the result of mutations in the MECP2 gene (located in the X chromosome - hence more prevalent in females). The gene mutation is often sporadic, meaning it is not usually inherited from parents.

- Symptoms: Initial symptoms usually include loss of purposeful hand skills, reduced social engagement and slow growth of limbs. As the syndrome progresses, symptoms can include seizures, repetitive hand movements and intellectual disability.

- Prevalence: Rett syndrome is rare, usually impacting 1 in 10,000 live female births.

- Treatments: There is no cure for Rett Syndrome, but the core focus is to manage symptoms. Symptom management can include medications for anxiety, physical therapy and sometimes devices like limb braces. The recent drug pioneered by Neuren (NEU) targets treatment of Rett Syndrome.

With such a difficult to treat disease, we were very pleased when NTI released positive clinical trial results for Rett Syndrome, showing it was safer than Neuren’s treatment:

NTI’s Phase I/II Rett Syndrome clinical trial results improve upon $2.4BN capped Neuren’s results...

These positive results were profiled in the news too - our Investment NTI made an appearance in a story on Channel 7 a couple weeks ago:

(Click here to watch the full story)

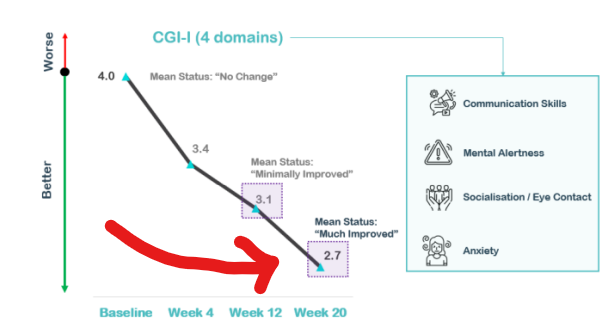

Part of why we think the results are so promising comes down to the long-term incremental improvements the treatment imbues over time...

Below are the results from NTI’s clinical trial on Rett Syndrome which show sustained benefits out to a 20 week timeframe:

(Source)

Orphan Drug Designation makes NTI more attractive for potential partners?

We see today’s news as a big positive from a deal making perspective.

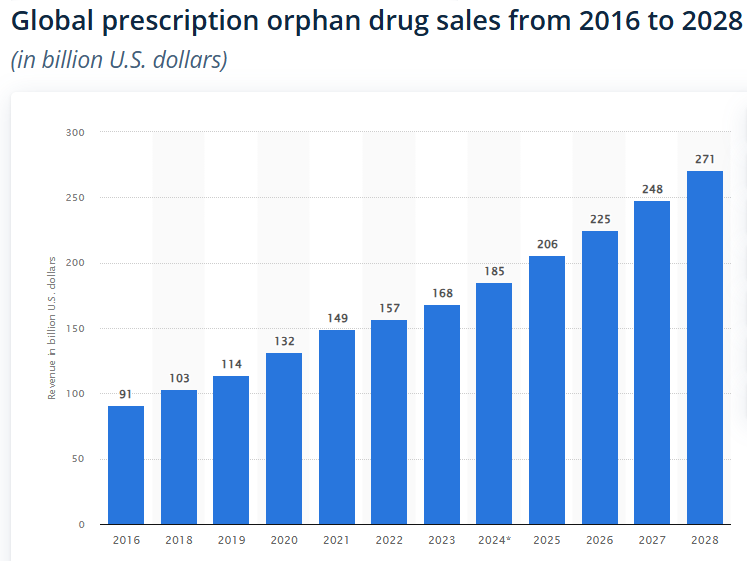

Orphan Drug Designations mean the rewards on offer for a successfully developed drug/treatment can be enormous.

It all comes down to the three key factors we mentioned earlier today:

- Fast tracked approvals: Companies may not need to complete a full Phase III clinical trial to get the product to market. Getting a drug/treatment to market quicker means faster payback on R&D investment. Sometimes the trials process’ can take over a decade, so this is a big positive for Orphan Drugs.

- Market exclusivity: Once approved, an orphan drug gets 7 years of market exclusivity in the US and 10 years in Europe. Exclusivity means there is less competition for that drug/treatment meaning the pharma company can target a larger part of the addressable market.

- Orphan drug pricing: Orphan drugs can be priced at higher levels to incentivise development, with the average price around $32,000 per patient per year in the US (paid by governments/insurers - NOT the patients).

A combination of the above factors makes drugs/treatments with orphan drug designation a lot more attractive to big pharmaceutical companies which we see as a big benefit for NTI given where the company is at right now.

Orphan drug sales have been steadily climbing and are projected to climb further:

(Source)

As a result, we expect some of the deal values ascribed to orphan drugs to continue to grow - and potentially benefit NTI.

A few months back, we mentioned that NTI was entering “Deal Making Mode” now that it has positive clinical trial results from its three clinical trials on PANDAS/PANS, Autism Spectrum Disorder and Rett Syndrome:

Check out that note here: NTI clinical data in hand - now entering “deal making” mode

(Source)

Next we have the following pieces of NTI newsflow to look forward to:

🔄Toxicology program and PK trials:

These will study how NTI’s treatment interacts with the human body - and hopefully firm up its method of action and improve the scientific validity for it as a promising treatment for a range of disorders.

🔄EU Orphan Drug Designation result (Q1 2025)

This would expand the commercial appeal of NTI’s treatment much as it has done with today’s US FDA Orphan Drug Designation.

Beyond that, we look forward to licensing and commercialisation initiatives from NTI:

Objective #2: Secure a global partner for NTI164

We want to see NTI advance commercialisation initiatives and, ideally, accelerate them. This could be a source of additional capital for the business to fund offshore trials and advance regulatory requirements.

Milestones

🔲Licensing/partnership agreement

🔲Partnership on global clinical strategy

🔲Potential M&A deal (Strategic equity investment?)

What could go wrong?

With NTI’s two clinical trials meeting their primary endpoints, and a $10M raise tucked away we now see three different risks, which are - “Regulatory risk” and “Market risk” and "Partnership risk":

What could go wrong - Market risk

Broader market sentiment for small pre-revenue biotechs could get worse and the sector as a whole trades lower, taking NTI’s share price with it. Alternatively, the entire market could sell down as well.

Source: “What could go wrong” section - NTI Investment Memo 18 September 2023

Regulatory risk:

We see the upcoming discussions with EU and US regulators about Orphan Drug Designation for PANDAS/PANS as key catalysts - regulators could decide that NTI’s drug does not qualify.

If NTI doesn’t get these designations, then it could hurt the NTI share price.

Source: “What could go wrong” section - NTI Investment Memo 18 September 2023

This risk was outside our NTI Investment Memo, and while NTI received Orphan Drug Designation from the US FDA, it is possible the EU regulator doesn’t grant it to NTI, hurting the ability of NTI to commercialise its treatment.

Partnership risk

NTI is looking to bring on a partner to help fund its clinical trial work globally. These deals can take a long time and delays do happen. There is no guarantee that NTI finds a suitable partner, or if the deal that NTI ends up securing meets market expectations in terms of value.

Source: “What could go wrong” section - NTI Investment Memo 18 September 2023

This risk is now more pertinent, now that NTI has Orphan Drug Designation in the US.

Our NTI Investment Memo

Our Investment Memo provides a short, high-level summary of our reasons for Investing. We use this memo to track the progress of all our Investments over time.

In our NTI Investment Memo, you can find the following:

- What does NTI do?

- The macro theme for NTI

- Our NTI Big Bet

- What we want to see NTI achieve

- Why we are Invested in NTI

- The key risks to our Investment Thesis

- Our Investment Plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.